SourceMoneyGuru-https://www.mgkx.com/4936.html

SourceMoneyGuru-https://www.mgkx.com/4936.html

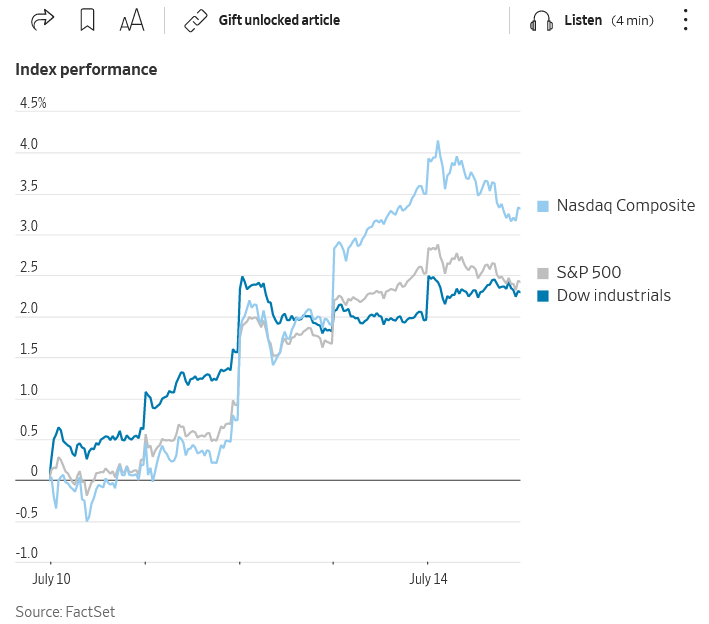

The Dow Jones Industrial Average and the tech-heavy Nasdaq Composite also recorded their best weeks since March, rising 2.3% and 3.3%, respectively. The S&P 500 gained 2.4% in a broad-based advance, with all 11 sectors moving higher for the week.SourceMoneyGuru-https://www.mgkx.com/4936.html

Investors welcomed the price figures as evidence that the Federal Reserve may succeed in taming the red-hot inflation of recent months without plunging the economy into a recession. The central bank is expected to raise interest rates by a quarter-percentage-point later this month, but the signs of slowing inflation could lower the chances of yet more rate increases later in the year.SourceMoneyGuru-https://www.mgkx.com/4936.html

“It might be that we achieve that elusive soft landing,” said Ellen Hazen, chief market strategist and portfolio manager at F.L.Putnam Investment Management Co.SourceMoneyGuru-https://www.mgkx.com/4936.html

Ms. Hazen said she has been positioned for the stock rally to broaden beyond the big tech stocks that have supported the market this year.SourceMoneyGuru-https://www.mgkx.com/4936.html

On Friday investors turned their focus to corporate earnings as banks began to share their results. JPMorgan Chase, Wells Fargo and Citigroup beat analysts’ forecasts for profit and revenue, with JPMorgan’s profit jumping 67% and Wells Fargo’s rising 57%. But there were signs of potential challenges ahead. Higher interest rates meant the banks had to pay more to depositors, and customers still withdrew some of their money.SourceMoneyGuru-https://www.mgkx.com/4936.html

JPMorgan shares rose 0.6%, while Wells Fargo shares slipped 0.3% and Citi shares fell 4%.SourceMoneyGuru-https://www.mgkx.com/4936.html

Investors said they are waiting for reports from smaller lenders before drawing broad conclusions about the health of the sector, which just months ago saw the failures of Silicon Valley Bank, Signature Bank and First Republic Bank.SourceMoneyGuru-https://www.mgkx.com/4936.html

“Hopefully we’re out of the woods when it comes to a lot of the regional bank problems that we had earlier this year,” said Brian Price, head of investment management at Commonwealth Financial Network.SourceMoneyGuru-https://www.mgkx.com/4936.html

Shares of UnitedHealth Group gained 7.2%, leading the S&P 500, after the healthcare and insurance company lifted its earnings guidance.SourceMoneyGuru-https://www.mgkx.com/4936.html

The S&P 500 fell 0.1% for the day, while the Dow industrials added 0.3%, or about 114 points. The Nasdaq Composite edged down 0.2%.SourceMoneyGuru-https://www.mgkx.com/4936.html

In bond markets, the yield on the benchmark 10-year U.S. Treasury note ticked up to 3.818% from 3.759% Thursday. Yields rise as bond prices fall.SourceMoneyGuru-https://www.mgkx.com/4936.html

Oil prices rose for a third consecutive week, with Brent crude, the global benchmark, gaining 1.8% to $79.87 per barrel.SourceMoneyGuru-https://www.mgkx.com/4936.html

Overseas stock markets were mixed Friday. The pan-continental Stoxx Europe 600 fell 0.1%, while in Asia, Hong Kong’s Hang Seng rose 0.3% and Japan’s Nikkei 225 edged down 0.1%.SourceMoneyGuru-https://www.mgkx.com/4936.html

Analyst Take:SourceMoneyGuru-https://www.mgkx.com/4936.html

The stock market rally this week was driven by the positive news on inflation, but it is important to remember that the Fed is still expected to raise interest rates in the coming months. This could weigh on economic growth and corporate profits, so investors should remain cautious.SourceMoneyGuru-https://www.mgkx.com/4936.html

Overall, the stock market is still in a bull market, but there are some risks on the horizon. Investors should carefully monitor the economic data and corporate earnings reports in the coming weeks to gauge the health of the economy and the direction of the stock market.SourceMoneyGuru-https://www.mgkx.com/4936.html SourceMoneyGuru-https://www.mgkx.com/4936.html