In the early days of the pandemic, many borrowers were able to save money and pay down debt. They received stimulus checks, unemployment benefits, and had fewer expenses because they were not commuting or traveling. As a result, their credit scores went up.SourceMoneyGuru-https://www.mgkx.com/4939.html

SourceMoneyGuru-https://www.mgkx.com/4939.html

SourceMoneyGuru-https://www.mgkx.com/4939.html

However, as the economy has recovered, many of these borrowers are starting to struggle. They are facing higher costs for housing, cars, and other goods. They are also carrying over balances on their credit cards and other loans.SourceMoneyGuru-https://www.mgkx.com/4939.html

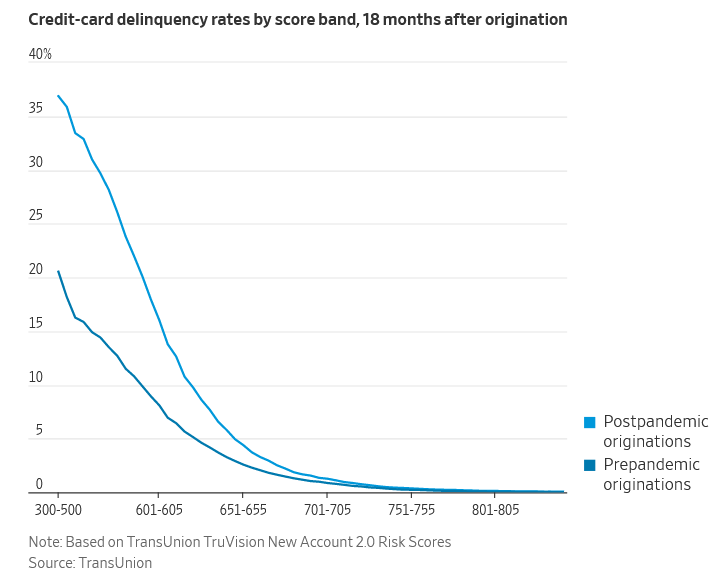

As a result, delinquency rates are starting to rise. For example, the delinquency rate for credit cards opened in mid-2021 is now more similar to the delinquency rate for borrowers with credit scores 25 points lower.SourceMoneyGuru-https://www.mgkx.com/4939.html

This is a warning sign for lenders. They need to be more careful when evaluating borrowers who have seen their credit scores improve during the pandemic. They should look beyond credit scores and consider other factors, such as income, debt-to-income ratio, and employment history.SourceMoneyGuru-https://www.mgkx.com/4939.html

Borrowers should also be aware of the risks. If you have seen your credit score improve during the pandemic, do not assume that you are now immune to financial problems. Make sure you are managing your debt responsibly and that you have a plan for unexpected expenses.SourceMoneyGuru-https://www.mgkx.com/4939.html

Here are some tips for borrowers:

- Track your spending and create a budget. This will help you stay on top of your finances and make sure you are not overspending.

- Pay down debt as quickly as possible. The less debt you have, the lower your risk of defaulting on a loan.

- Build up your emergency fund. This will give you a cushion in case of unexpected expenses.

- Be aware of the risks of credit cards. Credit cards can be a convenient way to pay for things, but they can also be a trap. Use credit cards responsibly and pay off your balance in full each month.

If you are struggling to make your payments, contact your lender as soon as possible. They may be able to work with you to create a payment plan.SourceMoneyGuru-https://www.mgkx.com/4939.html

The pandemic has caused a lot of financial uncertainty. However, by taking steps to manage your debt and stay on top of your finances, you can protect your credit score and your financial future.SourceMoneyGuru-https://www.mgkx.com/4939.html

What lenders are doing to address the issue

Lenders are aware of the issue and are taking steps to address it. Some lenders are using more sophisticated credit scoring models that take into account factors other than credit scores. Others are requiring borrowers to provide more information about their financial situation, such as income and debt-to-income ratio.SourceMoneyGuru-https://www.mgkx.com/4939.html

It is important to note that there is no perfect solution to this problem. Credit scores are still a valuable tool for lenders, but they need to be used in conjunction with other factors. By taking a more holistic approach to lending, lenders can better assess the risk of borrowers and make more informed decisions.SourceMoneyGuru-https://www.mgkx.com/4939.html SourceMoneyGuru-https://www.mgkx.com/4939.html