Planning for retirement can seem daunting with so many unknowns. When will you retire? How much will you spend? How long will you live? While there are no definite answers, guidelines based on your age can help you stay on track.

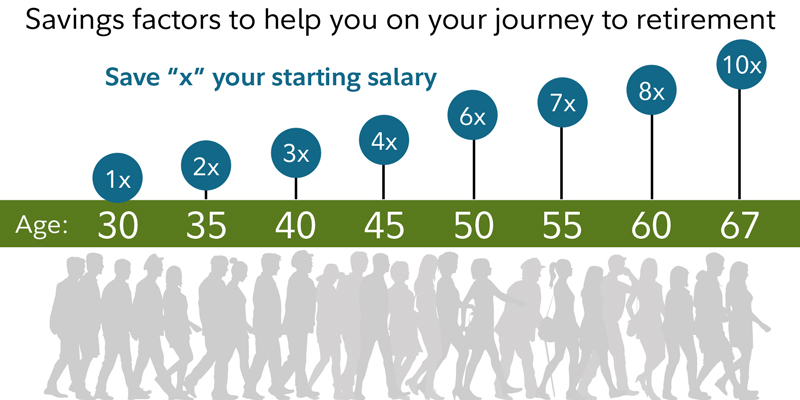

Our analysis shows that ideally, you should aim to have 10 times your annual pre-retirement income saved by age 67. This assumes you start saving 15% of your income at 25, invest more than half in stocks, retire at 67, and want to maintain your standard of living.SourceMoneyGuru-https://www.mgkx.com/5167.html

SourceMoneyGuru-https://www.mgkx.com/5167.html

SourceMoneyGuru-https://www.mgkx.com/5167.html

To stay on track, here are some age-based milestones:SourceMoneyGuru-https://www.mgkx.com/5167.html

- By 30: Save 1x your income

- By 40: Save 3x your income

- By 50: Save 6x your income

- By 60: Save 8x your income

Two big factors impact your target:SourceMoneyGuru-https://www.mgkx.com/5167.html

Retirement Age: The later you retire, the lower your savings goal. Delaying retirement gives your money more time to grow. For example:SourceMoneyGuru-https://www.mgkx.com/5167.html

- Retire at 70: Save 8x income

- Retire at 67: Save 10x income

- Retire at 65: Save 12x income

Working longer lowers how much you need to save. But you may not always control when you retire.SourceMoneyGuru-https://www.mgkx.com/5167.html

SourceMoneyGuru-https://www.mgkx.com/5167.html

SourceMoneyGuru-https://www.mgkx.com/5167.html

Retirement Lifestyle: Your spending also matters. Below are savings factors based on planned spending:SourceMoneyGuru-https://www.mgkx.com/5167.html

- Below average: 8x income

- Average: 10x income

- Above average: 12x income

If you're behind, there are solutions. Under 40? Save aggressively and invest for growth. Over 40? Save more, spend less, and work longer if possible.SourceMoneyGuru-https://www.mgkx.com/5167.html

The key is to make a plan and take action - it's never too late to get on track. With smart savings and planning, you can retire with confidence. The milestones serve as guideposts, not absolutes. Focus on consistent progress, not perfection. Small steps today put you closer to your dreams tomorrow.SourceMoneyGuru-https://www.mgkx.com/5167.html

You've got this! With some dedication and savvy planning, you can make retirement a reality.SourceMoneyGuru-https://www.mgkx.com/5167.html SourceMoneyGuru-https://www.mgkx.com/5167.html