The global economy and financial markets are constantly evolving, and the past few years have seen a number of major shifts that are likely to have a lasting impact. Here are five megatrends that are reshaping markets and what investors can do to prepare for them:

- A new dynamic for corporate profits

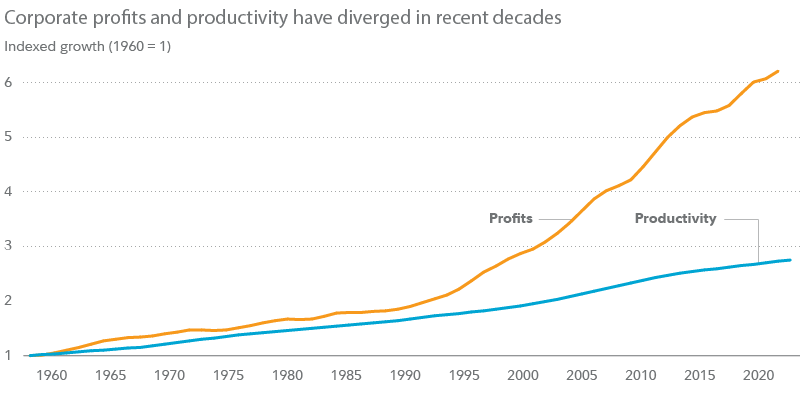

The past two decades have seen unprecedented levels of corporate profit growth, particularly compared with longer-term historical average relationships. Over the very long term, profit growth has been closely tied to gains in productivity, which is technically defined as the output per worker per hour worked. (Productivity can also be thought of as improvements due to technological innovations, like the advent of the internet, or due to having a better-trained, better-educated workforce.) But in recent decades, this relationship has taken a sharp divergence, with corporate profits surging as productivity gains lagged.SourceMoneyGuru-https://www.mgkx.com/5160.html

SourceMoneyGuru-https://www.mgkx.com/5160.html

SourceMoneyGuru-https://www.mgkx.com/5160.html

There are a number of factors that have contributed to this divergence, including globalization, industry concentration, and low interest rates. But ultimately, the sustainability of this trend is questionable. The key drivers that supported it—including globalization, industry concentration, and low interest rates—seem to be retreating or peaking. Going forward, productivity may once again become the fundamental, sustainable driver of corporate profitability.SourceMoneyGuru-https://www.mgkx.com/5160.html

What does this mean for investors? It means that they need to be more discerning about which companies they invest in. Companies that are able to consistently grow their productivity will be the ones that are most likely to deliver sustainable profits and returns for shareholders.SourceMoneyGuru-https://www.mgkx.com/5160.html

- A retreat from “peak globalization”

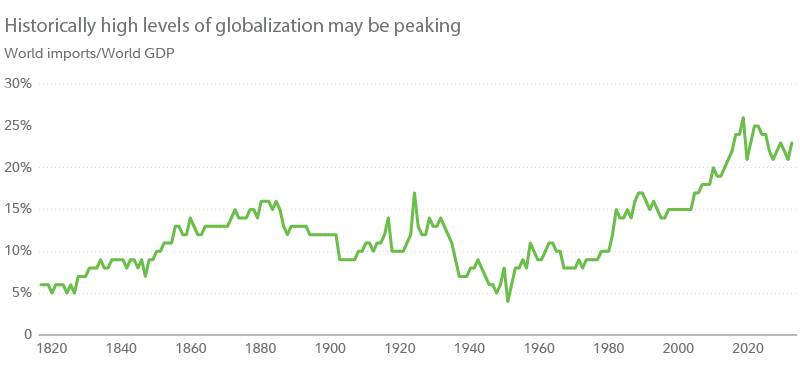

Globalization—the increasing interconnectedness and interdependence of the economies of individual nations—has been a powerful force in recent decades. Today, the overall level of global integration is high, as any shopper can tell by looking at where the goods they buy or the produce they eat has originated. But the world has perhaps already reached and passed the point of “peak globalization,” and global integration may be unlikely to advance further from here.SourceMoneyGuru-https://www.mgkx.com/5160.html

There are a number of factors that are contributing to this retreat from globalization, including rising nationalism, political instability, and the COVID-19 pandemic. As a result, we are likely to see a trend towards more regionalization and localization in the years to come.SourceMoneyGuru-https://www.mgkx.com/5160.html

SourceMoneyGuru-https://www.mgkx.com/5160.html

SourceMoneyGuru-https://www.mgkx.com/5160.html

This shift will have a number of implications for investors. For example, it will make it more important to invest in companies that are well-positioned to benefit from the growth of regional markets. It will also make it more important to understand the risks associated with investing in countries that are becoming more protectionist.SourceMoneyGuru-https://www.mgkx.com/5160.html

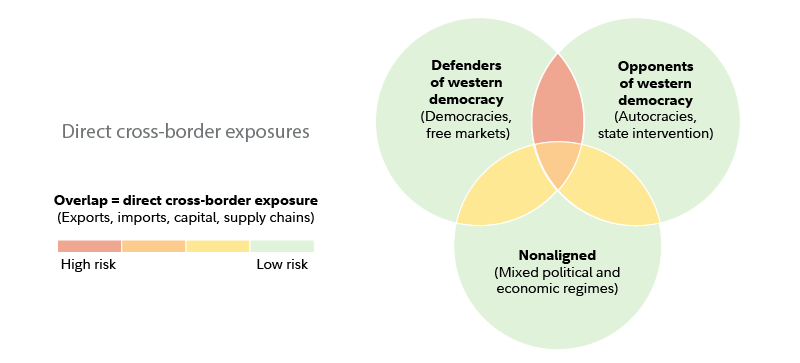

- A new, less stable, balance of global power

The United States has been the dominant global power for the past few decades. However, the rise of China and other emerging economies is challenging this status quo. As a result, we are likely to see a more multipolar world order in the years to come.SourceMoneyGuru-https://www.mgkx.com/5160.html

This shift will have a number of implications for investors. For example, it will make it more important to diversify their portfolios across different regions and countries. It will also make it more important to understand the risks associated with investing in countries that are experiencing political or economic instability.SourceMoneyGuru-https://www.mgkx.com/5160.html

SourceMoneyGuru-https://www.mgkx.com/5160.html

SourceMoneyGuru-https://www.mgkx.com/5160.html

- A long road toward decarbonization

Climate change is one of the most pressing challenges facing the world today. In order to address this challenge, we need to transition to a low-carbon economy. This will require a significant investment in clean energy technologies and infrastructure.SourceMoneyGuru-https://www.mgkx.com/5160.html

The decarbonization of the global economy will have a number of implications for investors. For example, it will make it more important to invest in companies that are involved in the clean energy sector. It will also make it more important to understand the risks associated with investing in companies that are reliant on fossil fuels.SourceMoneyGuru-https://www.mgkx.com/5160.html

SourceMoneyGuru-https://www.mgkx.com/5160.html

SourceMoneyGuru-https://www.mgkx.com/5160.html

- A changing landscape for portfolio management

The five megatrends discussed above are just some of the ways that the global economy and financial markets are evolving. As a result, investors need to be prepared to adapt their investment strategies accordingly.SourceMoneyGuru-https://www.mgkx.com/5160.html

This means being more flexible and nimble in their approach to investing. It also means being willing to invest in new and innovative technologies and sectors. By staying ahead of the curve, investors can position themselves to capture the opportunities that these megatrends present.SourceMoneyGuru-https://www.mgkx.com/5160.html

I hope this blog post has given you a better understanding of the five megatrends that are reshaping markets. By understanding these trends, you can make more informed investment decisions and position yourself for success in the years to come.SourceMoneyGuru-https://www.mgkx.com/5160.html SourceMoneyGuru-https://www.mgkx.com/5160.html