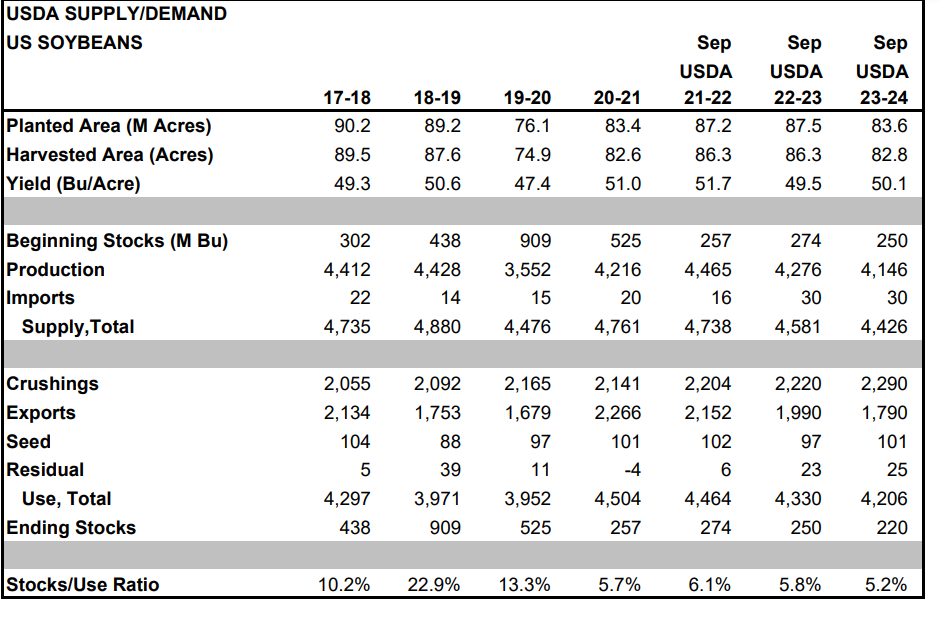

The latest USDA supply and demand report provided important updates on the soybean market. While there were no major surprises, the report offered useful insight into how late-season weather affected the soybean crop. The 2023/2024 soybean yield was reduced slightly to 50.1 bushels per acre, close to expectations. Pod counts were up 9% year-over-year, a promising sign. Higher projected ending stocks of 220 million bushels, versus expectations of 207 million, were driven by cuts to export and crush demand.

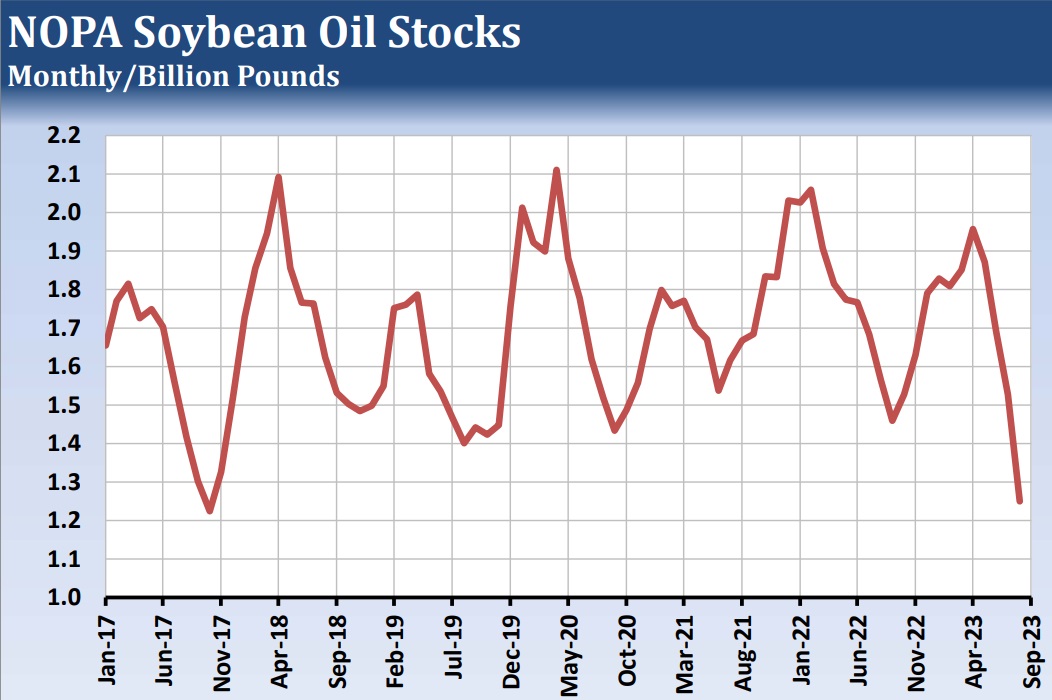

Many analysts now see 200 million bushels as the minimum "pipeline supply" for soybeans. So it's likely the USDA cushioned demand estimates to avoid releasing a report below that level. August soybean crush was disappointingly low at 161.5 million bushels, missing expectations and hitting an 11-month low. August 31 soybean oil stocks also undershot forecasts, dropping to 6-year lows. The weak crush is typical for August when maintenance downtime is common.SourceMoneyGuru-https://www.mgkx.com/5247.html

SourceMoneyGuru-https://www.mgkx.com/5247.html

SourceMoneyGuru-https://www.mgkx.com/5247.html

Looking ahead, new crush capacity and robust demand should bring crush rates to fresh highs this fall and winter. We anticipate the USDA will boost its crush forecasts in upcoming reports. Strong diesel and crude oil prices are supportive for soybean oil. If energy prices remain elevated, it could provide a bullish lift to the vegetable oil market.SourceMoneyGuru-https://www.mgkx.com/5247.html

The South American planting window is now open. Planting conditions are favorable across most of the region so far. One exception is northern and central Brazil which need more rain. River logistics on the Mississippi remain problematic but forecasts suggest some rain relief next week. This could give river levels a boost if realized.SourceMoneyGuru-https://www.mgkx.com/5247.html

On the trade policy front, China raised maximum moisture specs for US and Brazilian soybean imports. The change allows for more flexible shipping options but raises questions about how China will handle cargoes over the limits. We'll monitor for additional details as they emerge.SourceMoneyGuru-https://www.mgkx.com/5247.html

SourceMoneyGuru-https://www.mgkx.com/5247.html

SourceMoneyGuru-https://www.mgkx.com/5247.html

Overall, soybean fundamentals appear solid despite some expected yield pressure. South American production looks promising so far while Chinese demand remains strong. Soybean oil markets are supported by high energy prices for now. We'll watch weather and logistics closely in the weeks ahead as soybean harvest ramps up.SourceMoneyGuru-https://www.mgkx.com/5247.html

SourceMoneyGuru-https://www.mgkx.com/5247.html

SourceMoneyGuru-https://www.mgkx.com/5247.html

SourceMoneyGuru-https://www.mgkx.com/5247.html

SourceMoneyGuru-https://www.mgkx.com/5247.html