Inflation may be cooling off from last year's 40-year high, but many Americans are still feeling squeezed by the cost of living. Recent research shows most people are living paycheck to paycheck, even those earning six-figures. Where is inflation headed from here? Experts say inflation is likely to settle around 2.5-3% in the coming years, higher than the past couple decades. That means the pressure of rising prices is here to stay.

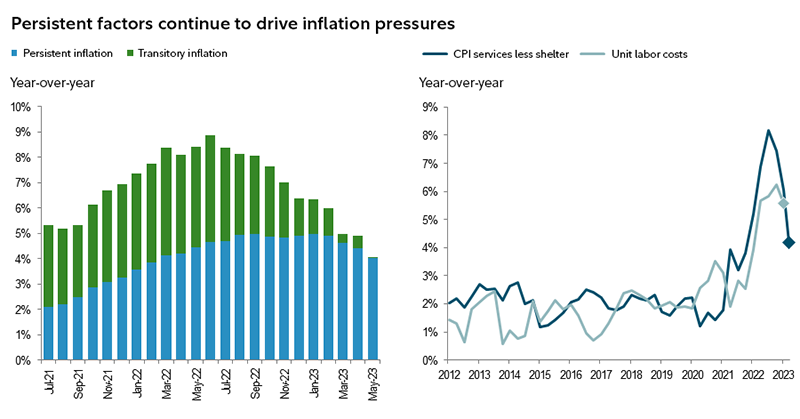

CPI: Consumer Price Index. LEFT: Indicates the contribution to year-over-year CPI over the past 12 months. Persistent Categories include areas where, historically, inflation has taken longer to dissipate, such as housing and food & beverages. Source: Bureau of Labor Statistics, Haver Analytics, Fidelity Investments (AART), as of 5/31/23. RIGHT: Unit Labor Costs measured as 4-quarter moving average. Diamonds depict the last chart points (as of 6/30/23). Source: Bureau of Labor Statistics, Haver Analytics, Bloomberg, Fidelity Investments (AART), as of 5/31/23.

Between volatile commodity prices and rising wages, progress on lowering inflation could slow. But you can take control of your finances with these 5 steps:SourceMoneyGuru-https://www.mgkx.com/5252.html

- Trim Spending - Review your monthly expenses and look for areas to cut back, like subscriptions you don't use often. Shop around for the best deals on necessities.

- Boost Income - Consider picking up a side gig for extra cash. Is there a hobby or skill you can monetize?

- Bulk Up Savings - Aim to have 3-6 months' worth of essential expenses in an emergency fund. Even starting with $1,000 can help create a buffer.

- Make Cash Earn - With interest rates rising, you can earn more income on cash holdings. Look at high-yield savings accounts, CDs and short-term bonds.

- Invest for Growth - Don't let inflation erode long-term savings. Include stocks and other assets with growth potential in your portfolio. Work with a financial advisor to create a diversified plan.

The key is focusing on what you can control. Trimming expenses, earning extra income, and putting your money to work can help offset the impact of inflation. Pair that with smart long-term investing and you can still make progress towards your financial goals, even in a high-inflation environment. Stay disciplined and be proactive - you've got this!SourceMoneyGuru-https://www.mgkx.com/5252.html SourceMoneyGuru-https://www.mgkx.com/5252.html