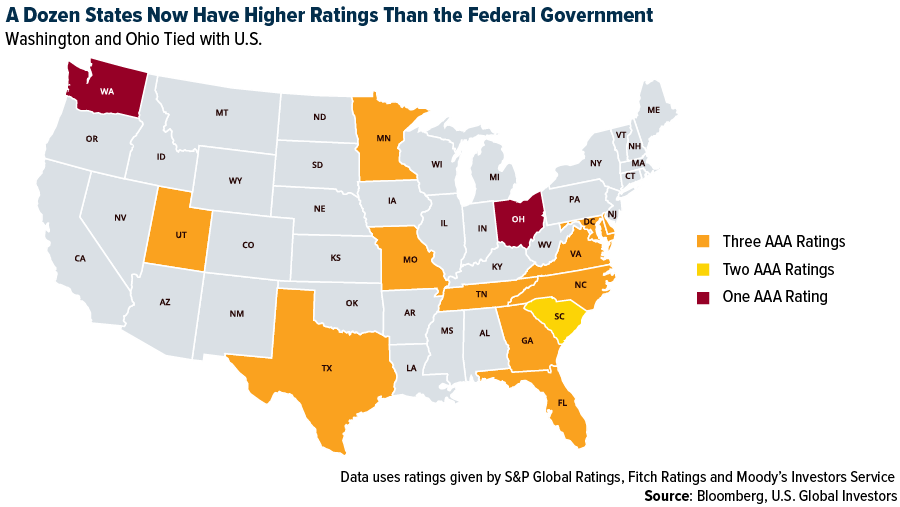

The recent downgrade of the United States’ credit rating from AAA to AA+ by Fitch Ratings has sent shockwaves through the financial world. This is only the second time in U.S. history that a ratings agency has taken this action, and it is a major blow to the country’s reputation as a safe and stable investment.

SourceMoneyGuru-https://www.mgkx.com/5072.html

SourceMoneyGuru-https://www.mgkx.com/5072.html

The downgrade is likely to have a number of ripple effects, both domestically and internationally. Here are a few of the most immediate consequences:SourceMoneyGuru-https://www.mgkx.com/5072.html

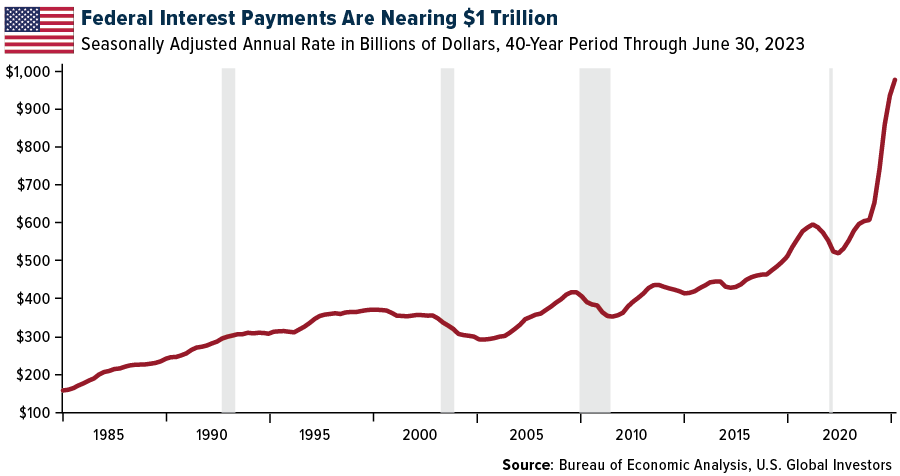

- Higher borrowing costs: The U.S. government will now have to pay more interest on its debt, which will add to the country’s already massive debt burden. This could lead to higher taxes or cuts to government spending.

- Devalued currency: The downgrade could also lead to a devaluation of the U.S. dollar, which would make it more expensive for Americans to buy imports and could hurt the economy.

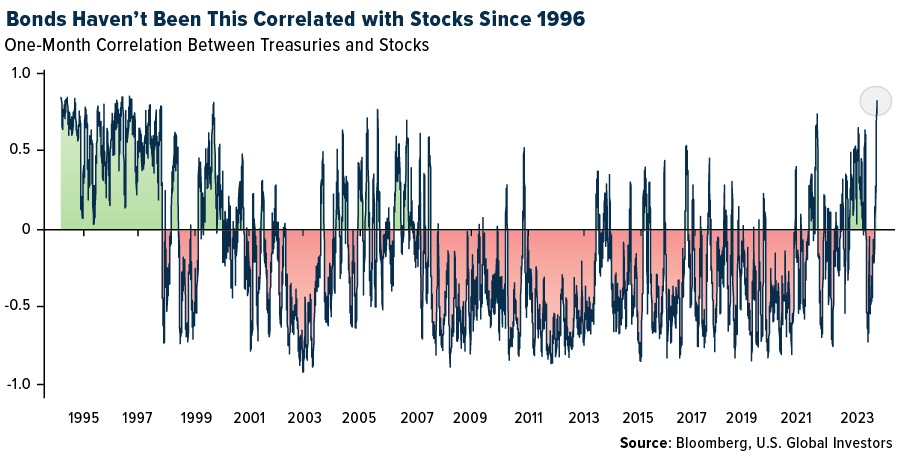

- Volatile stock market: The downgrade could lead to short-term volatility in the stock market, as investors worry about the impact of higher borrowing costs and a devalued currency on corporate profits.

- Changes in investment strategies: Investors may need to adjust their investment strategies in light of the downgrade. For example, they may need to increase their allocation to assets that are less sensitive to changes in interest rates, such as gold and silver.

The long-term impact of the downgrade is still uncertain, but it is clear that it will have a significant impact on the U.S. economy and financial markets. Investors should stay informed about the latest developments and adjust their portfolios accordingly.SourceMoneyGuru-https://www.mgkx.com/5072.html

SourceMoneyGuru-https://www.mgkx.com/5072.html

SourceMoneyGuru-https://www.mgkx.com/5072.html

In addition to the immediate consequences listed above, the credit downgrade could also have a number of longer-term implications. For example:SourceMoneyGuru-https://www.mgkx.com/5072.html

- It could make it more difficult for the U.S. government to borrow money in the future. This could lead to a credit crunch, which could further slow economic growth.

- It could weaken the U.S. dollar as the world’s reserve currency. This could make it more expensive for Americans to travel abroad and could lead to job losses in export-oriented industries.

- It could damage the U.S. reputation as a safe and stable investment. This could make it more difficult for U.S. companies to raise capital and could lead to a decline in foreign investment.

The credit downgrade is a serious development that could have a significant impact on the U.S. economy and financial markets. Investors should stay informed about the latest developments and adjust their portfolios accordingly.SourceMoneyGuru-https://www.mgkx.com/5072.html SourceMoneyGuru-https://www.mgkx.com/5072.html