SourceMoneyGuru-https://www.mgkx.com/5023.html

SourceMoneyGuru-https://www.mgkx.com/5023.html

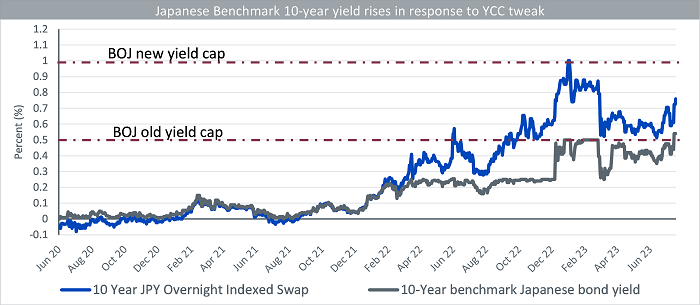

Under the new YCC framework, the BOJ will now allow some deviation above the long-term rate cap of 0.5%. This means that the 10-year Japanese Government Bond (JGB) yield could rise above 0.5%, but only temporarily. The BOJ has said that it will continue to intervene in the market to keep yields in check.SourceMoneyGuru-https://www.mgkx.com/5023.html

SourceMoneyGuru-https://www.mgkx.com/5023.html

SourceMoneyGuru-https://www.mgkx.com/5023.html

The BOJ's decision to tweak its YCC framework has been met with mixed reactions. Some analysts have welcomed the move, arguing that it will give the BOJ more flexibility to manage monetary policy. Others have criticized the move, arguing that it will only serve to prolong Japan's deflationary problems.SourceMoneyGuru-https://www.mgkx.com/5023.html

It is still too early to say what the long-term impact of the BOJ's decision will be. However, it is clear that the BOJ is sitting on the fence on easy policy exit. The central bank is not yet ready to tighten monetary policy, but it is also not willing to let inflation run out of control.SourceMoneyGuru-https://www.mgkx.com/5023.html

What does this mean for investors?

The BOJ's decision to tweak its YCC framework is likely to lead to increased volatility in the Japanese bond market. Investors should be prepared for sharp swings in yields in the coming months.SourceMoneyGuru-https://www.mgkx.com/5023.html

The BOJ's decision could also have implications for the Japanese yen. If yields rise too high, the yen could come under pressure. However, if the BOJ intervenes in the market to keep yields in check, the yen could appreciate.SourceMoneyGuru-https://www.mgkx.com/5023.html

Overall, the BOJ's decision to tweak its YCC framework is a sign that the central bank is still undecided about the future direction of monetary policy. Investors should be prepared for continued volatility in the Japanese bond and currency markets.SourceMoneyGuru-https://www.mgkx.com/5023.html

Conclusion

The BOJ's decision to tweak its YCC framework is a significant development that will have implications for the Japanese economy and financial markets. It remains to be seen how the BOJ will manage monetary policy in the coming months, but investors should be prepared for increased volatility.SourceMoneyGuru-https://www.mgkx.com/5023.html SourceMoneyGuru-https://www.mgkx.com/5023.html