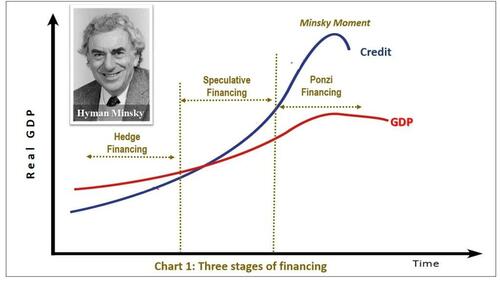

The global economy is facing a number of headwinds, including rising inflation, slowing growth, and over-indebted real estate markets. These factors are creating a "Minsky Moment" powder keg, which could lead to a financial crisis.

A "Minsky Moment" is a term coined by economist Hyman Minsky to describe a situation where an economy is in a state of financial fragility. This occurs when there is a build-up of debt, which is then followed by a sudden collapse.SourceMoneyGuru-https://www.mgkx.com/4949.html

SourceMoneyGuru-https://www.mgkx.com/4949.html

SourceMoneyGuru-https://www.mgkx.com/4949.html

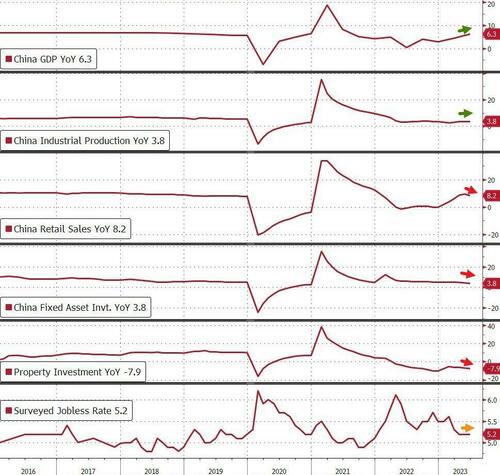

The global economy is currently experiencing a number of factors that could lead to a "Minsky Moment." These include:SourceMoneyGuru-https://www.mgkx.com/4949.html

- Rising inflation: Inflation is rising around the world, which is putting pressure on household budgets and businesses. This could lead to a decline in economic growth, which would further increase financial stress.

- Slowing growth: Growth is slowing in many countries, which is also putting pressure on financial markets. This is because a slowdown in growth usually leads to lower corporate profits and higher unemployment, which can lead to defaults on loans.

- Over-indebted real estate markets: Real estate markets are over-indebted in many countries, which is a major source of financial risk. If house prices were to fall, this could lead to a wave of defaults on mortgages, which would further destabilize the financial system.

The combination of these factors is creating a "Minsky Moment" powder keg. If one of these factors were to trigger a financial crisis, it could have a cascading effect on the global economy.SourceMoneyGuru-https://www.mgkx.com/4949.html

The good news is that there are a number of things that can be done to mitigate the risk of a "Minsky Moment." These include:SourceMoneyGuru-https://www.mgkx.com/4949.html

- Central banks should raise interest rates to cool inflation. This would help to reduce the amount of debt in the system and make it more difficult for borrowers to default on their loans.

- Governments should implement fiscal stimulus measures to support economic growth. This would help to offset the negative effects of rising inflation and slowing growth.

- Banks should strengthen their balance sheets and reduce their exposure to risky assets. This would make the financial system more resilient to a shock.

If these measures are taken, it will help to reduce the risk of a "Minsky Moment" and protect the global economy from a financial crisis.SourceMoneyGuru-https://www.mgkx.com/4949.html

However, it is important to remember that the global economy is still in a fragile state. If one of these factors were to trigger a financial crisis, it could have a cascading effect on the global economy. It is therefore important to monitor the situation closely and take action to mitigate the risk of a "Minsky Moment."SourceMoneyGuru-https://www.mgkx.com/4949.html SourceMoneyGuru-https://www.mgkx.com/4949.html