The Federal Reserve has a dual mandate: to keep inflation low and to maximize employment. But sometimes, these two goals conflict with each other. For example, if the Fed raises interest rates to combat inflation, it can also lead to job losses.

SourceMoneyGuru-https://www.mgkx.com/5104.html

SourceMoneyGuru-https://www.mgkx.com/5104.html

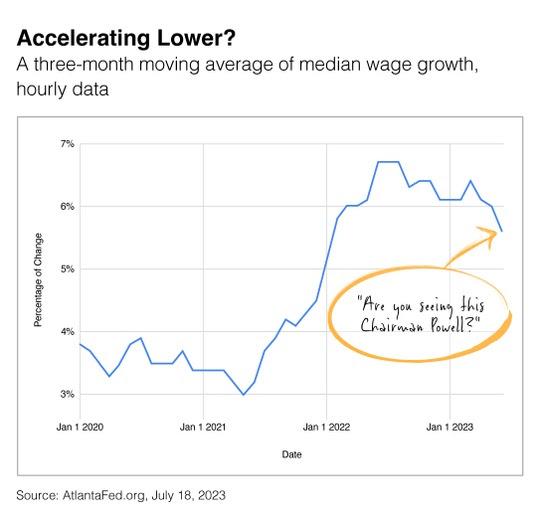

In recent months, the Fed has been focused on your paycheck. That's because the wages of American workers are a key driver of inflation. When wages go up, people have more money to spend, which can drive up prices.SourceMoneyGuru-https://www.mgkx.com/5104.html

In 2022, labor shortages pressured businesses to lift wages. This led to a sharp increase in median wage growth. However, as the economy has cooled off in 2023, wage growth has slowed. This is good news for the Fed, because it means that inflation is less likely to spiral out of control.SourceMoneyGuru-https://www.mgkx.com/5104.html

In his July press conference, Fed Chair Jerome Powell said that the Fed is "closely monitoring" wage growth. He also said that the Fed is "prepared to raise rates more aggressively" if necessary to bring inflation under control.SourceMoneyGuru-https://www.mgkx.com/5104.html

So, what does all of this mean for your paycheck? It means that the Fed is likely to continue raising interest rates in the coming months. This will likely lead to slower economic growth and some job losses. However, it will also help to bring inflation down.SourceMoneyGuru-https://www.mgkx.com/5104.html

In the long run, higher interest rates will help to make your paycheck worth more. That's because higher interest rates will make it more expensive to borrow money, which will slow down the economy and help to bring down prices.SourceMoneyGuru-https://www.mgkx.com/5104.html

Of course, the Fed's focus on your paycheck is not without its risks. If the Fed raises interest rates too quickly, it could lead to a recession. A recession would mean job losses and economic hardship for many Americans.SourceMoneyGuru-https://www.mgkx.com/5104.html

However, the Fed is walking a fine line. It needs to raise interest rates enough to bring inflation under control, but not so much that it causes a recession. It will be a delicate balancing act, and it remains to be seen whether the Fed will be successful.SourceMoneyGuru-https://www.mgkx.com/5104.html

In the meantime, it's important to understand the Fed's focus on your paycheck. The Fed's decisions about interest rates will have a big impact on your finances. So, it's important to stay informed and to make informed decisions about your money.SourceMoneyGuru-https://www.mgkx.com/5104.html

Here are some things you can do to prepare for higher interest rates:SourceMoneyGuru-https://www.mgkx.com/5104.html

- Pay down debt. This will free up more money in your budget and make it easier to handle higher interest rates.

- Save more money. This will give you a cushion in case of job losses or other financial setbacks.

- Invest in assets that are not sensitive to interest rates, such as stocks or real estate.

By taking these steps, you can protect yourself from the financial impact of higher interest rates.SourceMoneyGuru-https://www.mgkx.com/5104.html SourceMoneyGuru-https://www.mgkx.com/5104.html