The latest inflation reading may be down from last year's 40-year high, but many Americans aren't feeling much relief. Recent surveys show over 60% are living paycheck to paycheck, with nearly half of households earning over $100,000 also just scraping by.

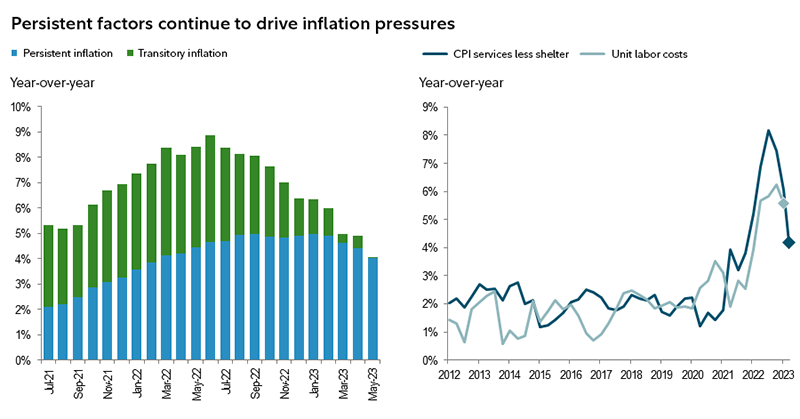

The reality is that while supply chain issues contributed to the initial price spikes, inflation is now driven more by ongoing labor shortages and wage growth. This means persistently higher prices may be here to stay.SourceMoneyGuru-https://www.mgkx.com/5226.html

SourceMoneyGuru-https://www.mgkx.com/5226.html

SourceMoneyGuru-https://www.mgkx.com/5226.html

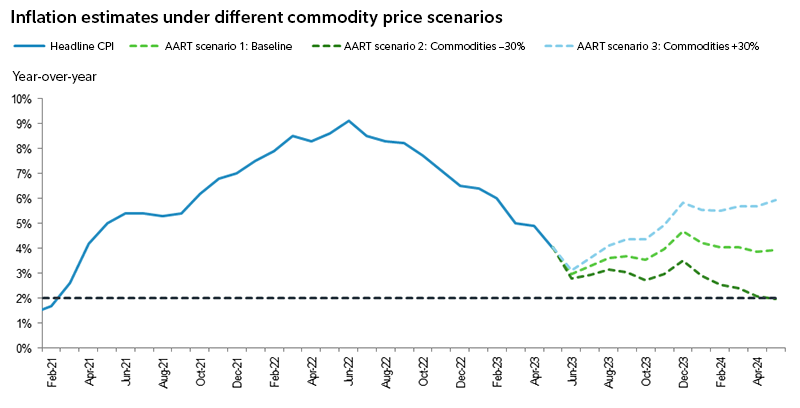

"I think the dynamics of the economy have shifted over the past decade," says economist Collin Crownover. "Inflation could run closer to 2.5-3% for years versus the under 2% we saw before."SourceMoneyGuru-https://www.mgkx.com/5226.html

This isn't just a temporary blip—it's a new normal. So what can you do to protect yourself financially if inflation persists at moderately high levels? Here are 5 steps:SourceMoneyGuru-https://www.mgkx.com/5226.html

- Review spending and trim fat. Analyze credit card statements to identify potential cutbacks on subscriptions, dining out, etc. Shop sales and buy generics to save.

- Explore raising income. Consider a side gig in addition to your regular job to bring in extra cash.

- Build emergency savings. Aim to stockpile 3-6 months' worth of essential expenses. This gives you a cushion against unexpected costs.

- Make cash work harder through safe investments. Money market funds, CDs, and bonds now offer far better yields than a year ago. Parking excess cash can earn extra income.

- Invest for growth above inflation. Stocks historically outpace inflation over time. Being too conservative risks erosion of purchasing power.

Inflation may feel daunting and out of your control. But by spending selectively, adding income streams, saving aggressively, optimizing cash, and investing wisely, you can take steps to protect yourself financially in the years ahead. The key is adjusting your money habits to make the most of what you have.SourceMoneyGuru-https://www.mgkx.com/5226.html SourceMoneyGuru-https://www.mgkx.com/5226.html