With income tax rates ranging from zero to 13.3% depending on your state of residence, where you call home can significantly impact your bottom line. High earners, especially those in high-tax states like California and New York, are constantly seeking out ways to curb their tax bills. One appealing option is tax-free municipal bonds, which offer a steady income stream exempt from federal and often state taxes. Let's take a closer look at why these bonds are so alluring for investors.

The Tax Landscape Across The U.S.

The income tax system varies widely across states. In progressive tax states like California, New York, and Hawaii, rates rise along with income, maxing out above 10% for top earners. By contrast, states like North Carolina and Illinois use a flat tax rate regardless of income. Most eye-catching are the nine states with no income tax at all: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming, and New Hampshire (which taxes only dividends and interest). While tax-free living sounds enticing, these states often levy higher property or sales taxes.SourceMoneyGuru-https://www.mgkx.com/5223.html

The Benefits of Tax-Free Munis

SourceMoneyGuru-https://www.mgkx.com/5223.html

SourceMoneyGuru-https://www.mgkx.com/5223.html

Municipal bonds are debt securities issued by local governments to fund public projects. In addition to providing a steady semi-annual interest payment, their biggest perk is being exempt from federal and sometimes state income taxes. For investors in high tax brackets, this tax-free status puts more money back in their pockets. California's top rate is 13.3%, so a tax-free muni keeps significantly more of your investment earnings compared to a taxable bond.SourceMoneyGuru-https://www.mgkx.com/5223.html

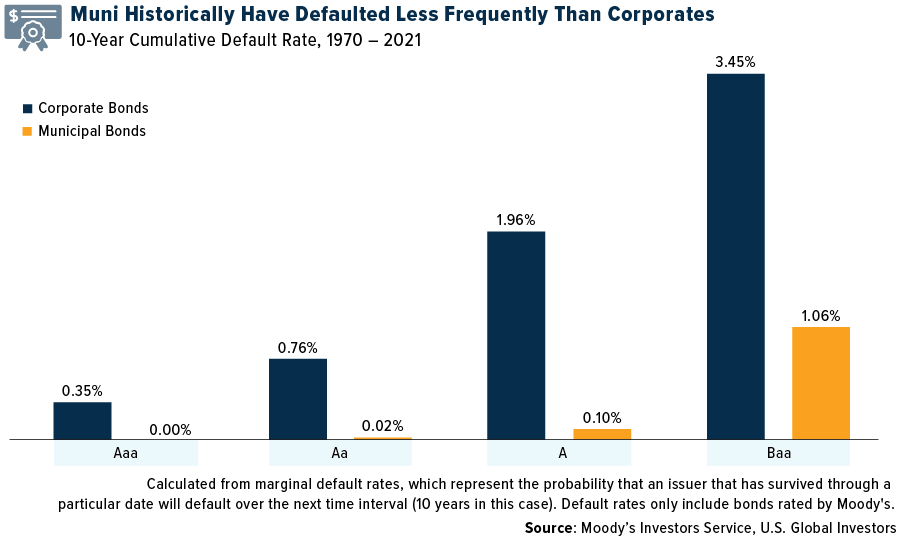

Beyond the tax advantages, munis offer relatively low risk compared to stocks and corporate bonds. Historically, munis have had extremely low default rates, especially among higher rated issues. Conservative investors with shorter time horizons often find munis attractive for their stability.SourceMoneyGuru-https://www.mgkx.com/5223.html

The Bottom Line

For high earners in high-tax states, tax-free municipal bonds can be an appealing investment to curb taxes and generate a steady income stream. Their tax-exempt status allows investors to keep more of their investment earnings. When considering the pros and cons, munis stand out for their tax perks and historically low risk of default. For the right investor, the allure of tax-free munis is simply too powerful to ignore.SourceMoneyGuru-https://www.mgkx.com/5223.html SourceMoneyGuru-https://www.mgkx.com/5223.html