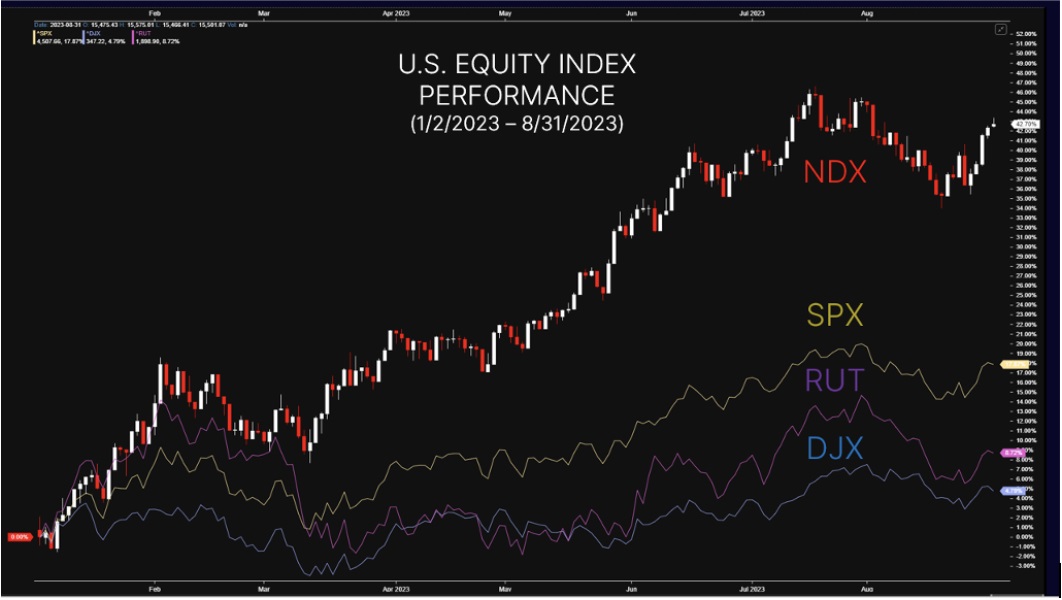

The performance of major U.S. stock indexes so far in 2023 has been eye-catching, but is it sustainable or an anomaly? The tech-heavy Nasdaq 100 is up over 40% year-to-date through August. The S&P 500 has climbed around 18%. At first glance, gains of this magnitude make 2023 seem like an outlier. But looking back over history, that may not be the case.

SourceMoneyGuru-https://www.mgkx.com/5244.html

SourceMoneyGuru-https://www.mgkx.com/5244.html

The Nasdaq's 40%+ return would rank it as the 9th time since 1985 that the index has seen such a gain over the first 8 months of a year. Impressive yes, but not unprecedented. The index saw even larger full-year gains of 85% and 102% during the tech bubble of the late 1990s. An 18% gain for the S&P 500 is also well within historical norms. The index has finished between +10% and +20% eleven prior times over the past 38 years.SourceMoneyGuru-https://www.mgkx.com/5244.html

The source of 2023's upside is no mystery - it's been driven by mega-cap tech leaders like Apple, Microsoft, Amazon and others. These stocks make up an outsized portion of the Nasdaq 100 and have vastly outperformed the average stock. Their future prospects, especially in AI, remain a key sentiment driver. Still, the top-heaviness explains why the S&P 500's advance seems more "average" even though it contains most of the same names.SourceMoneyGuru-https://www.mgkx.com/5244.html

Looking at downside risk, the Nasdaq has seen even worse years than 2023's upside. It fell 31% or more in 5 different years, with a 42% drop during the Great Financial Crisis. So even if tech stocks stall or see a correction, 2023 performance is unlikely to be a historical outlier on the downside either.SourceMoneyGuru-https://www.mgkx.com/5244.html

In conclusion, while 2023's market gains look impressive in raw terms, they are not necessarily outliers in a historical context. For the Nasdaq 100, 40%+ years have occurred several times before. The S&P 500's rise is squarely average. With over 4 months still remaining, investors should study past drawdowns and continue to manage risk. But so far, 2023 is more "impressive" than "outlier" by the standards of history.SourceMoneyGuru-https://www.mgkx.com/5244.html SourceMoneyGuru-https://www.mgkx.com/5244.html