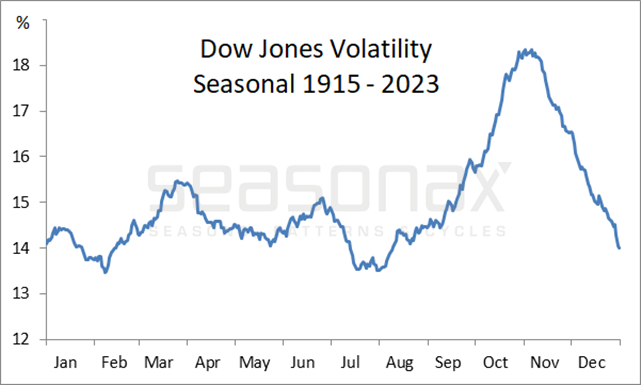

With the stock market at near record highs, volatility has been remarkably low in recent months. However, history suggests volatility may be poised for a seasonal breakout in the coming months.

Looking at over 100 years of stock market data, there is a clear seasonal pattern to volatility. Volatility typically hits a summer lull in late July and early August, bottoming out around 14%. But then volatility steadily increases into November, historically peaking around 18%.SourceMoneyGuru-https://www.mgkx.com/5153.html

Dow Jones Volatility, Seasonal Pattern, 1915 to 2023

We are currently in that summer lull period of muted volatility. However, if historical trends hold, we should expect volatility to start ticking up as we head into fall. By November, volatility could spike to levels not seen in many months.SourceMoneyGuru-https://www.mgkx.com/5153.html

What drives this seasonal surge in volatility? There are a few potential explanations:SourceMoneyGuru-https://www.mgkx.com/5153.html

- Uncertainty around elections - Midterm elections in the US occur in November, which can stir up uncertainty.

- Holiday spending worries - Heading into the critical holiday shopping season, concerns over consumer spending tend to emerge.

- Portfolio rebalancing - Many investors rebalance portfolios at year end, which can cause spikes in trading volume and volatility.

- Weather/energy shocks - Colder weather leads to higher energy usage, which can send oil and natural gas prices surging.

So while volatility remains subdued for now, investors should be prepared for a potential seasonal pop. That doesn't necessarily mean a market crash, but it could lead to increased market swings.SourceMoneyGuru-https://www.mgkx.com/5153.html

Now may be a good time to review your portfolio risk and hedge against volatility. Options strategies designed to profit from rising volatility could provide useful protection. Sticking to quality stocks, maintaining dry powder, and resisting the urge to overtrade during volatile markets are other sound strategies.SourceMoneyGuru-https://www.mgkx.com/5153.html

While volatility feels low at the moment, historical trends suggest we could see fireworks in the months ahead. By anticipating the risks, investors can try to avoid being caught off guard. Stay vigilant out there as we head into the volatile fall season.SourceMoneyGuru-https://www.mgkx.com/5153.html SourceMoneyGuru-https://www.mgkx.com/5153.html