The stock market can be a daunting place, especially for new investors. While cash and other short-term investments offer a sense of security and predictability, they might not be the best choice for your long-term financial goals.

Here at mgkx, we understand that navigating the world of investing can be challenging. That's why we're here to help you make informed decisions about your financial future. In this blog post, we'll explore three key reasons why investing in stocks might be the right move for you, along with strategies to approach the stock market with confidence.SourceMoneyGuru-https://www.mgkx.com/5264.html

Reason #1: Stocks Offer the Potential for Higher GrowthSourceMoneyGuru-https://www.mgkx.com/5264.html

SourceMoneyGuru-https://www.mgkx.com/5264.html

SourceMoneyGuru-https://www.mgkx.com/5264.html

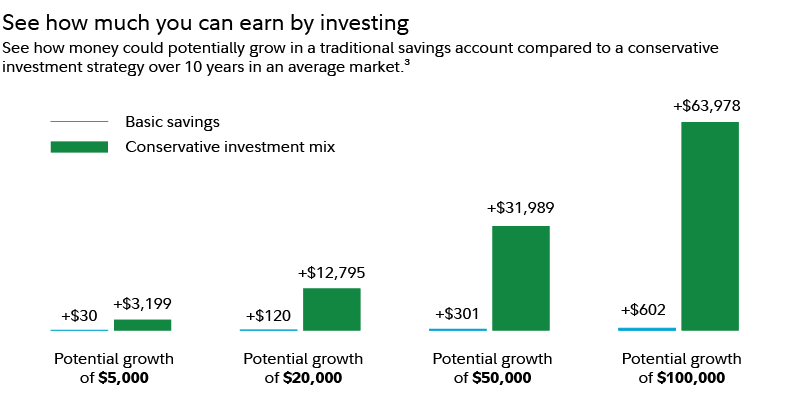

High-yield savings accounts and other safe investments play a valuable role in any financial plan. However, their stability often comes at the cost of growth potential. The value of your investment might remain stagnant over time, failing to keep pace with inflation.SourceMoneyGuru-https://www.mgkx.com/5264.html

"Historically, investing in stocks has led to stronger returns for investors compared to cash or bonds alone," says Naveen Malwal, CFA, institutional portfolio manager with Fidelity's Strategic Advisers. "This means investors who incorporate stocks into their portfolio are more likely to reach their financial goals."SourceMoneyGuru-https://www.mgkx.com/5264.html

Reason #2: Fight Inflation and Maintain Purchasing PowerSourceMoneyGuru-https://www.mgkx.com/5264.html

Inflation is a reality we all face. Over time, the same amount of money buys you less. A gallon of milk that cost $3 a decade ago might now cost $4. This erosion of purchasing power can significantly impact your long-term financial security.SourceMoneyGuru-https://www.mgkx.com/5264.html

Investing in stocks offers the potential to outpace inflation. While there are periods of short-term volatility, stocks have historically delivered higher returns than cash or short-term investments. This allows you to maintain your purchasing power and continue affording the things that matter most.SourceMoneyGuru-https://www.mgkx.com/5264.html

Reason #3: Increase Your Chances of Reaching Your GoalsSourceMoneyGuru-https://www.mgkx.com/5264.html

Many of us have financial goals, from dream vacations and home improvements to funding a comfortable retirement. Investing in stocks with a long-term perspective can significantly increase your chances of achieving these goals.SourceMoneyGuru-https://www.mgkx.com/5264.html

"By incorporating stocks into a diversified portfolio alongside bonds and cash, you give yourself a better shot at reaching your goals," explains Malwal. "The potential for higher returns can not only help you reach your goals faster, but also leave you with more money to enjoy them."SourceMoneyGuru-https://www.mgkx.com/5264.html

Diversification is Key to Managing RiskSourceMoneyGuru-https://www.mgkx.com/5264.html

SourceMoneyGuru-https://www.mgkx.com/5264.html

SourceMoneyGuru-https://www.mgkx.com/5264.html

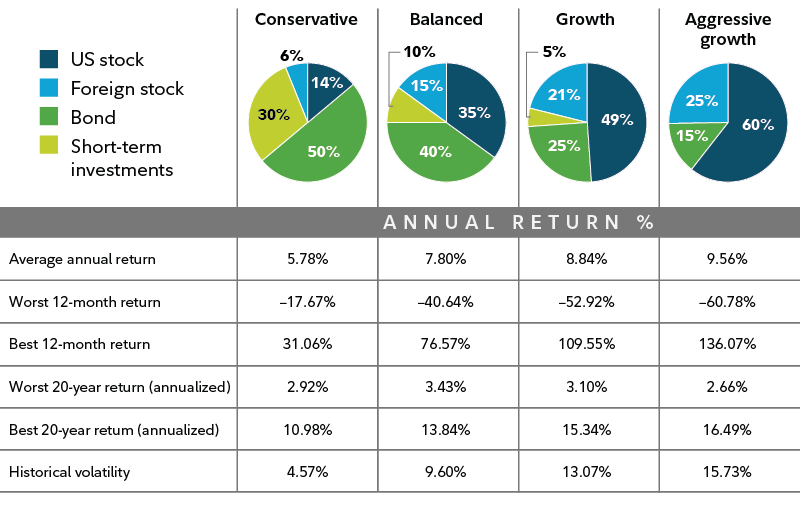

There's no magic formula for investment success. No single asset class guarantees high returns with low risk. However, diversification can be a powerful tool for managing risk and maximizing returns.SourceMoneyGuru-https://www.mgkx.com/5264.html

Diversification involves spreading your investments across different asset classes, such as stocks, bonds, and cash. Each asset class has its own risk and return profile. By diversifying, you can potentially smooth out the ups and downs of the market and reduce your overall risk exposure.SourceMoneyGuru-https://www.mgkx.com/5264.html

For example, a risk-averse investor might choose a portfolio that includes a mix of money market funds, CDs, and Treasuries, along with a smaller allocation to bonds and stocks. This approach can offer some growth potential while still prioritizing capital preservation.SourceMoneyGuru-https://www.mgkx.com/5264.html

How to Get Started with ConfidenceSourceMoneyGuru-https://www.mgkx.com/5264.html

If you're unsure about how to incorporate stocks into your investment strategy, you're not alone. Financial professionals like myself can help you navigate the complexities of the stock market and develop a personalized investment plan that aligns with your risk tolerance, financial goals, and time horizon.SourceMoneyGuru-https://www.mgkx.com/5264.html

We can work with you to:SourceMoneyGuru-https://www.mgkx.com/5264.html

- Determine an appropriate target rate of return: This will consider your financial situation, time horizon, and risk tolerance, all while factoring in inflation.

- Choose the right investments: We can help you select a diversified portfolio of stocks, bonds, and cash that aligns with your goals and risk profile.

- Develop a long-term investment strategy: We can help you develop a disciplined approach to investing and navigate market fluctuations with confidence.

Remember, investing is a marathon, not a sprint. By taking a long-term perspective, diversifying your portfolio, and seeking professional guidance, you can increase your chances of achieving your financial goals and building a secure future.SourceMoneyGuru-https://www.mgkx.com/5264.html

Ready to Take Control of Your Financial Future?

If you're interested in learning more about how investing in stocks can benefit you, contact us today for a free consultation. We're here to help you make informed decisions and take control of your financial future.