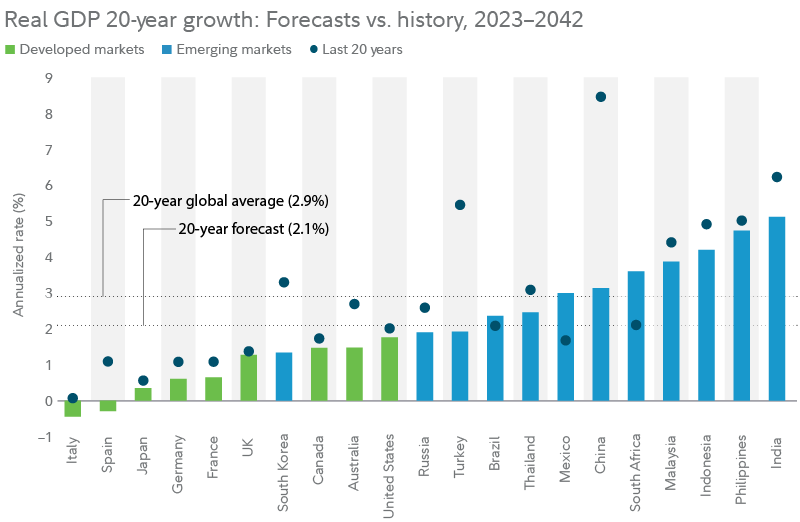

The favorable economic trends of the past 40 years may be shifting as we look ahead. Slower growth in developed nations could change return assumptions. Investors may need to take a more global approach to find returns.

Demographic Changes Suggest Slower Growth

Key drivers of growth like population and productivity gains may be moderating in developed economies. Aging populations with declining birth rates point to shrinking labor forces. This backdrop implies slower GDP growth, affecting markets.SourceMoneyGuru-https://www.mgkx.com/5236.html

SourceMoneyGuru-https://www.mgkx.com/5236.html

SourceMoneyGuru-https://www.mgkx.com/5236.html

While the US has inherent dynamism, its growth could still downshift. Other nations faceeven greater demographic challenges. Immigration policies will also influence labor force growth.SourceMoneyGuru-https://www.mgkx.com/5236.html

Seeking Out Global Growth and Productivity

With slower growth expected in mature economies, investors may want to diversify globally. Emerging nations have more room for catch-up growth and productivity gains through industrialization and technology adoption.SourceMoneyGuru-https://www.mgkx.com/5236.html

Countries like India and Indonesia still have considerable potential. Meanwhile, China and Malaysia face middle-income challenges but possess sophisticated human capital. Their complexity supports further development.SourceMoneyGuru-https://www.mgkx.com/5236.html

Expanding into Alternatives

In addition to global stocks and bonds, alternatives like private equity, hedge funds, real assets, and digital assets may unlock new return streams. Historically limited to institutions, many alternatives are accessible to individuals through funds.SourceMoneyGuru-https://www.mgkx.com/5236.html

Consider diversified alternative exposures based on your goals. Or target specific assets like real estate. The future may require exploring beyond traditional investments.SourceMoneyGuru-https://www.mgkx.com/5236.html

The Road Ahead

Forecasting long-term growth is challenging. But prudent investors consider a range of scenarios and build resilience into portfolios. Blending developed and emerging assets, and including differentiated alternatives, could help manage risks and find returns in a shifting landscape.SourceMoneyGuru-https://www.mgkx.com/5236.html SourceMoneyGuru-https://www.mgkx.com/5236.html