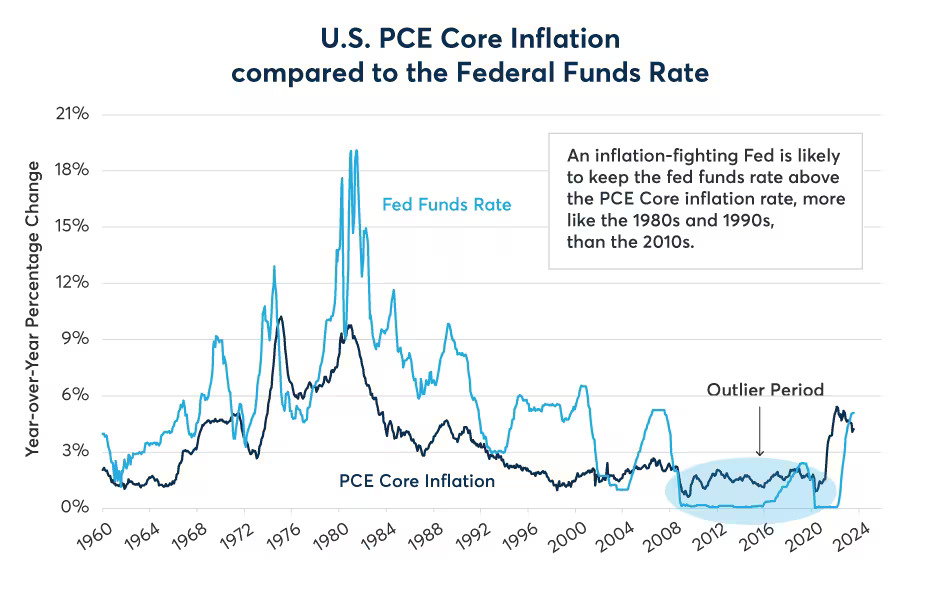

The past decade has seen an unprecedented suppression of risk management in financial markets. Ultra-low and even negative interest rates from central banks like the Federal Reserve and ECB created an environment where taking on risk was incentivized and managing risk was disincentivized. This era appears to be coming to an end as central banks pivot to fighting inflation through higher interest rates.

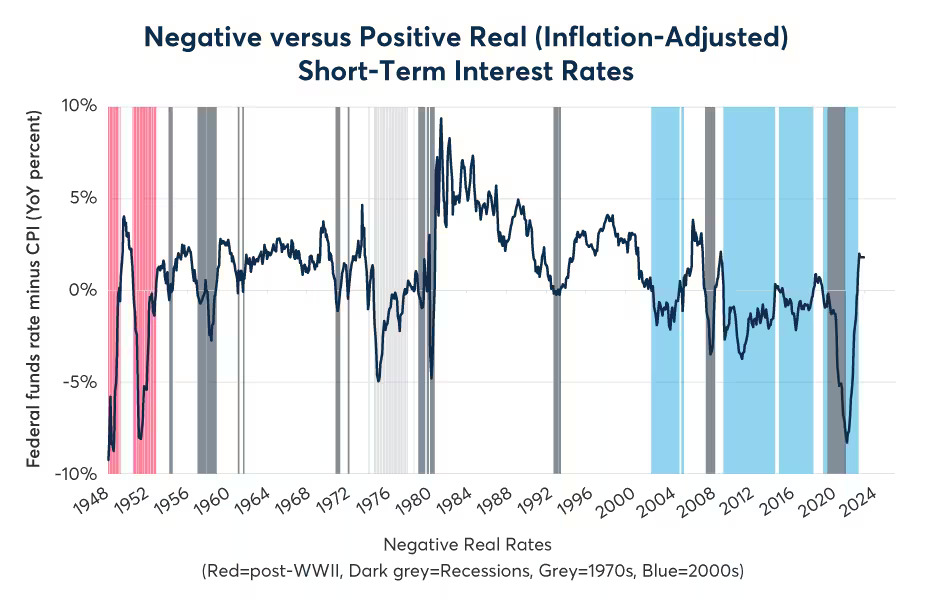

The shift in policy focus means we are entering a new regime of positive real interest rates after over a decade of negative real rates. During 2003-2021, the Federal Funds rate was below inflation 83% of the time. Prior to the 2000s, rates were above inflation 97% of the time. Persistently low and negative real rates suppressed the appetite for risk management through many channels.SourceMoneyGuru-https://www.mgkx.com/5240.html

SourceMoneyGuru-https://www.mgkx.com/5240.html

SourceMoneyGuru-https://www.mgkx.com/5240.html

The "Fed put" and maxims like "buy the dips" reflected a market psychology that downside risks would be backstopped by monetary policy. With the Fed now committed to bringing down inflation even at the cost of growth, this psychology needs to shift. We can no longer expect easing at the first signs of market turmoil.SourceMoneyGuru-https://www.mgkx.com/5240.html

Quantitative easing also distorted price discovery and risk premia for years. Removing this distortion through quantitative tightening further necessitates reviving risk management capabilities after a long atrophy.SourceMoneyGuru-https://www.mgkx.com/5240.html

The Fed's reluctance to reverse course means this regime shift should prove durable. Short rates are likely to remain above inflation for the foreseeable future barring recessions. The Fed's newly hardened stance on its 2% inflation target reinforces the positive real rate regime despite structural forces that kept inflation low before.SourceMoneyGuru-https://www.mgkx.com/5240.html

Consequently, economic agents from investors to financial institutions to companies need to devote much more focus to risk management going forward. There is tremendous unrealized potential in risk management that suppressed incentives have kept dormant. With the Fed now allowing more systemic risk, the onus is on market participants to step up.SourceMoneyGuru-https://www.mgkx.com/5240.html

Interestingly, this may ultimately benefit the economy's performance. Suppressing risk in one area likely just displaces it elsewhere given the inherent risks in a complex system. Price distortions from policymakers may worsen capital allocation. Allowing agents to manage risks efficiently with proper price signals could improve long-run growth.SourceMoneyGuru-https://www.mgkx.com/5240.html

In summary, the era of risk management suppression is ending. The shift promises to be difficult after an unprecedented period of distortion. But it also offers opportunities for those positioned to adapt. The economic landscape ahead will reward effective risk management and punish complacency. Market participants need to review their capabilities and commitment to risk management for the new regime.SourceMoneyGuru-https://www.mgkx.com/5240.html SourceMoneyGuru-https://www.mgkx.com/5240.html