As we approach the one-year anniversary of the S&P 500's bottom in 2022, the stock market has seen impressive returns across sectors and styles. However, underneath the surface, corporate executives still have a great deal of unease about the economy and their businesses.

One concerning trend reflective of this is the sharp rise in reverse stock splits this year. In a reverse split, a company reduces its number of outstanding shares and increases its stock price to avoid being delisted for low valuation.SourceMoneyGuru-https://www.mgkx.com/5149.html

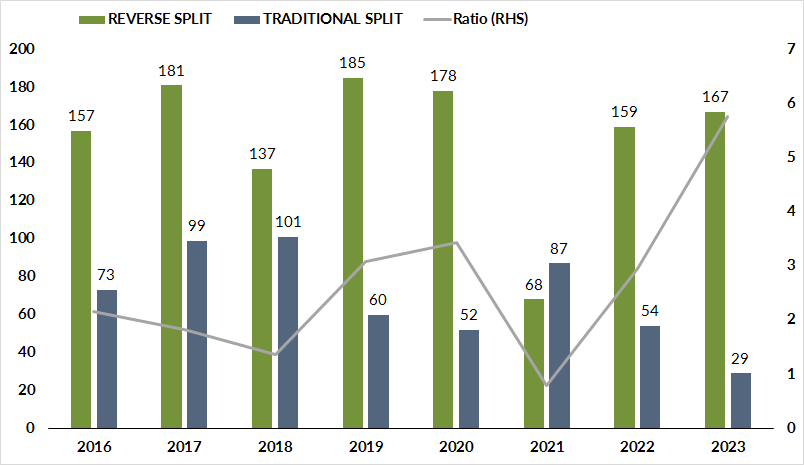

2021 saw just 68 reverse splits globally, as rock-bottom interest rates and low volatility created a speculative environment. In 2022, a more normal 159 reverse splits occurred. But in 2023 so far, we are on pace for over 200 reverse splits, the highest count in years.SourceMoneyGuru-https://www.mgkx.com/5149.html

Annual Split Count & Ratio Line: Euphoria in 2021, Desperation in 2023

To put this in perspective, since 2016 the ratio of reverse splits to traditional splits has averaged 2.22. In the frenzied 2021 market, that ratio was just 0.78. But in 2022 it rose to 2.94, and so far in 2023 it stands at a sky-high 5.76.SourceMoneyGuru-https://www.mgkx.com/5149.html

Many of the companies engaging in reverse splits this year are former pandemic-era darlings, including SPAC deals gone awry. For example, WeWork (WE) went public via a SPAC merger in late 2021 but has seen its valuation crater from $47 billion to under $300 million today. It just announced a 1-for-40 reverse split to avoid being delisted.SourceMoneyGuru-https://www.mgkx.com/5149.html

Similarly, Express Inc (EXPR), a retailer popular with meme stock traders in early 2021, hopes a 1-for-20 reverse split will reboot its flagging share price. With fickle consumer preferences and ongoing competition, EXPR’s outlook is bleak.SourceMoneyGuru-https://www.mgkx.com/5149.html

Of course, some pandemic winners are still thriving, like Copart (CPRT). The auto auction company recently enacted a 2-for-1 traditional split after hitting all-time highs. But companies like CPRT are the exception in 2023's uneasy stock market.SourceMoneyGuru-https://www.mgkx.com/5149.html

Until we see a return of bullish spirits and traditional splits from more high-quality companies like Nvidia and Eli Lilly, reverse splits will remain a sign of the struggling health of many businesses on Wall Street. Executives seem to be battening down the hatches for a potential recession rather than looking for growth.SourceMoneyGuru-https://www.mgkx.com/5149.html SourceMoneyGuru-https://www.mgkx.com/5149.html