Cattle prices have been on a wild ride over the past few years, reaching record highs in 2023 amid tightening supplies. This volatility is part of the ongoing cattle cycle that producers have contended with for over a century. As the current cycle approaches its contraction phase bottom, what should cattle industry participants expect next?

The cattle cycle refers to the elastic supply of cows and calves over time. It averages 8-12 years from peak to trough inventory, influenced by factors like weather, profitability, genetics, and demand. We are currently in the contraction phase, with US beef cow inventory down 4% year-over-year as of January 2023 - the lowest level since 1962.SourceMoneyGuru-https://www.mgkx.com/5157.html

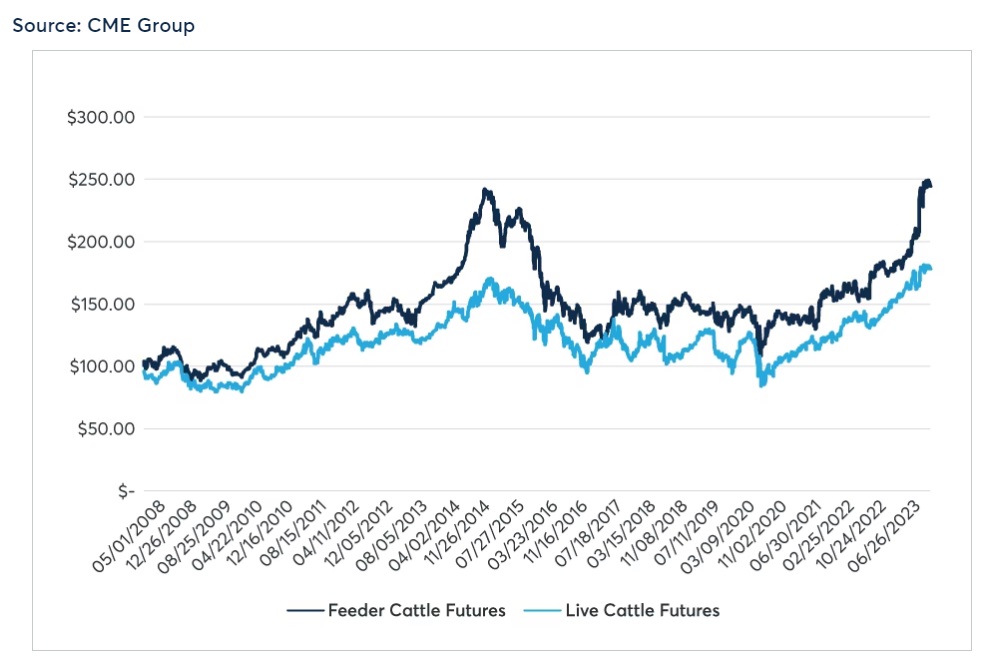

Front-month Live Cattle and Feeder Cattle futures daily settlement price, $/cwt

This decline is due to a perfect storm of factors. Severe drought in cattle country incentivized early herd liquidation and fewer heifer retentions for breeding. Cow slaughter hit an 11-year high in 2022. Heifer slaughter is also elevated, making up over 30% of total cattle slaughter. As long as heifer slaughter stays high, we likely haven’t reached the cycle bottom yet.SourceMoneyGuru-https://www.mgkx.com/5157.html

Eventually, the economics will favor herd rebuilding. Signs to watch for a turn include a significant drop in heifer slaughter as producers start retaining more females for breeding. It takes about 2-3 years from the start of rebuilding for supplies to rebound and prices to fall.SourceMoneyGuru-https://www.mgkx.com/5157.html

In the meantime, tight inventories will continue to support cattle prices at higher levels, especially for feeder cattle coming off pasture. However, high feeding costs due to elevated grain prices could limit calf prices and feedlot margins. Weather will remain a wild card, where drought restricts supply but higher grain costs weigh on demand.SourceMoneyGuru-https://www.mgkx.com/5157.html

While challenging, these boom and bust cycles have spurred efficiency gains in cattle feeding and genetics. Today’s average cattle reaches slaughter weight 30% faster than in the 1970s while yielding 28% more beef per animal. Technologies like gene editing may accelerate productivity further.SourceMoneyGuru-https://www.mgkx.com/5157.html

For cattle producers, being aware of cycle dynamics allows for better planning around breeding stock availability, grazing needs, and risk management. CME Group cattle futures and options can help hedge price volatility across the cattle lifecycle. From feeder cattle coming off pasture to live cattle ready for slaughter, our cattle contracts serve as global price benchmarks.SourceMoneyGuru-https://www.mgkx.com/5157.html

The cattle cycle has endured for over 130 years, and it will continue evolving with the industry. Staying informed on supply trends will be key for navigating the cycle’s ups and downs in the years ahead.SourceMoneyGuru-https://www.mgkx.com/5157.html SourceMoneyGuru-https://www.mgkx.com/5157.html