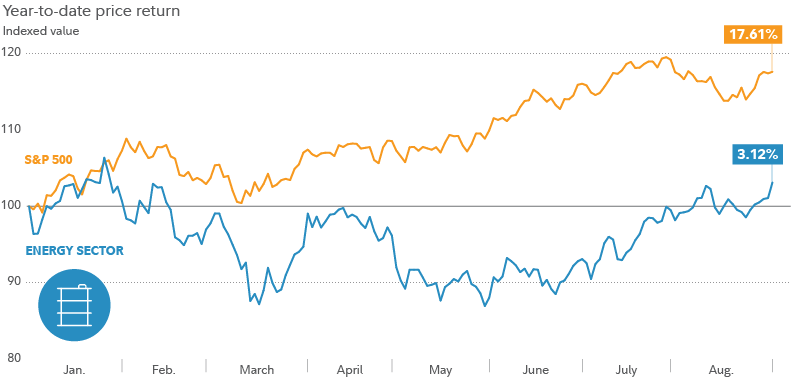

After a stellar 2022, energy stocks have cooled off a bit this year as oil prices softened on economic concerns. But constrained supply, recovering demand, and a ramp-up in production investment could support prices and boost certain segments like equipment/services stocks.

Supply Tightness to Keep Prices Elevated

Oil prices surged with Russia's invasion of Ukraine, but worries about potential recession recently dampened the oil rally. However, with spare capacity limited and OPEC curtailing output, prices could stay lofty. OPEC is likely to maintain $80-$100/barrel to ensure strong profits without hurting demand.SourceMoneyGuru-https://www.mgkx.com/5231.html

Meanwhile, demand is recovering with China reopening and air travel expanding. Longer-term, emerging market growth should further boost demand. With supply limited, the environment looks positive for commodities like oil.SourceMoneyGuru-https://www.mgkx.com/5231.html

Services/Equipment Stocks: Early Innings of Growth Cycle

One area with especially compelling valuations is energy services/equipment. After years of underinvestment, especially offshore and internationally, the industry is starting to boost spending on production.SourceMoneyGuru-https://www.mgkx.com/5231.html

With oil companies eyeing output growth, their equipment and services spending should rise too. We're still early in the cycle, with offshore/international investment recovering over years as new projects ramp up. Recent price resurgence could also spur more domestic shale drilling.SourceMoneyGuru-https://www.mgkx.com/5231.html

SourceMoneyGuru-https://www.mgkx.com/5231.html

SourceMoneyGuru-https://www.mgkx.com/5231.html

For investors, an old maxim says to sell picks and shovels during a gold rush. Similarly, surging energy investment requires equipment and services to extract it. This segment looks poised to benefit.SourceMoneyGuru-https://www.mgkx.com/5231.html

In summary, constrained supply and recovering demand could keep oil prices lofty. While energy stocks have moderated, certain areas like equipment/services have room for gains. After years of underinvestment, a new production growth cycle is underway. The backdrop looks promising for energy stocks and commodities.SourceMoneyGuru-https://www.mgkx.com/5231.html SourceMoneyGuru-https://www.mgkx.com/5231.html