A handful of earnings releases today from large banks exceeded expectations, but any resulting optimism is being tempered by retail sales data pointing to tapped out consumers against the backdrop of an economy that is running on fumes. While the earnings releases are a positive sign for the largest banks, upcoming results from regional banks will provide valuable insight into the health of smaller financial institutions and loan availability following several recent failures. In the meantime, this morning’s retail sales data is an ominous sign as we kick off the first-quarter earnings season.

Biggest Banks’ Earnings Soar

The 25 biggest banks attracted approximately $120 billion in deposits during the week ended March 15, while deposits at smaller banks fell by $108 billion during the period. The deposits were driven by several banking failures as investors sought the safety of larger financial institutions. This big uptick in deposits occurred as the tailwind of higher interest rates resulted in JPMorgan Chase, Citigroup, and Wells Fargo posting earnings this morning that easily exceeded analyst expectations. Highlights include the following:SourceMoneyGuru-https://www.mgkx.com/4345.html

- JPMorgan generated a profit of $12.6 billion or $4.10 per share, up from $8.3 billion or $2.63 per share generated in the first quarter of 2022. Its revenues of $38.35 billion climbed 25% from the $30.7 billion posted a year ago. The recent results sailed past the $3.41 of earnings per share (eps) and the $36.1 billion in revenue forecast by a consensus of analysts.

- Citigroup generated a profit of $4.6 billion or $2.19 a share compared to the year ago quarter profit of $4.3 billion or $2.02 of eps. Its revenues climbed to $21.4 billion compared to $19.2 billion in the first quarter of last year. For the most recent quarter, analysts expected eps of $1.67 and revenue of $19.19 billion.

- Wells Fargo reported first-quarter earnings of $4.9 billion or eps of $1.23 compared to $3.7 billion or $0.88 per share in the first quarter of 2022. Its revenues totaled $20.7 billion compared to the $17.6 billion in revenues for the year ago quarter. For the first quarter of this year, analysts expected $3.8 billion in earnings and $20.1 billion in revenues.

Equity markets appear to be at a sticking point as they hover around a valuation ceiling of 19 times forward earnings estimates. This morning was similar to Wednesday as a strong morning rally backtracked into losses a few minutes past 10:00 am Eastern Time. The S&P 500 Index is down 0.3% while the tech-heavy Nasdaq Index is down 0.4%. The cyclical Dow Jones Industrial Index is leading the losses in the aftermath of contracting retail sales and production issues related to the 737 Max aircraft at Boeing’s factory. The index is down 0.7% in large part due to Boeing shares declining 6%. Yields are higher following hawkish Fed speakers who are generally maintaining discipline regarding the “higher for longer” mantra. The 2-year and 10-year Treasury yields are up 12 and 6 basis points, respectively, propelled by 83% odds of a hike at the May 3rd meeting. Yields are pushing the dollar higher as well, with the Dollar Index rising 0.6% to 101.6. Crude oil is fighting to conquer recent highs as the summer driving season approaches, with WTI crude gaining 0.7% to $82.76 per barrel supported by favorable supply and demand dynamics.SourceMoneyGuru-https://www.mgkx.com/4345.html

Retail Sales contracted 1% in March, much worse than expectations of a 0.4% decline and the previous month’s 0.2% loss. On a year-over-year basis, sales rose 2.9%, bringing both the monthly and yearly numbers well below the inflation rate and pointing to a continued downward drift in economic momentum. Or in other words, real retail sales are negative by both y/y and m/m measures. The following were the most significant detractors from results.SourceMoneyGuru-https://www.mgkx.com/4345.html

- Gasoline stations, with a 5.5% decline

- General merchandise and department stores, with a 3% decline.

- Building materials stores, with a 2.1% decline.

- Electronics and appliance stores, with a 2.1% decline

- Clothing stores, with a 1.7% decline.

Ecommerce offset some of the losses and was the largest and only meaningful gainer. It gained 1.9% on the month.SourceMoneyGuru-https://www.mgkx.com/4345.html

Earnings Season Will Illustrate Economy’s Health

Big banks are largely immune to the issues that drove Silicon Valley Bank and Signature Bank into the columbarium of failed financial institutions. Unlike regional banks, the money centers have low cost of funds, especially with the recent failures of smaller banks causing investors to flock to the safety of the biggest financial companies. Larger banks have also maintained conservative loan underwriting standards and have diversified revenues streams.SourceMoneyGuru-https://www.mgkx.com/4345.html

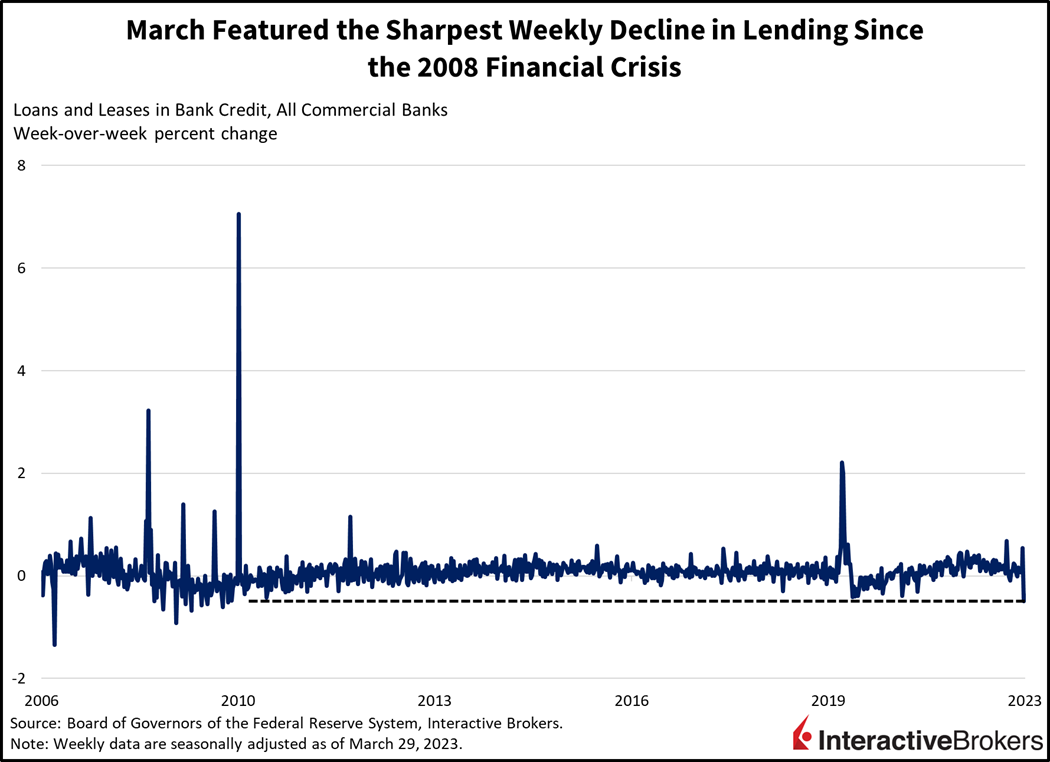

Already, March has featured the sharpest weekly declines in lending and deposits since the 2008 financial crisis.SourceMoneyGuru-https://www.mgkx.com/4345.html

Upcoming earnings reports from regional banks are likely to shed light on the potential for a recession to start during the second half of this year. These future reports will provide important insights into the overall health of the financial system by disclosing if smaller banks have been forced to sell longer duration bonds and/or assets like commercial real estate at unfavorable market prices to meet redemptions and if these institutions have had to increase marketing expenses and interest rates to attract depositors. Moreover, earnings reports will disclose if regional banks have curtailed financing for sectors of the economy, such as inherently more risky commercial loans and retail and office mortgages, that large banks maintain a smaller share of. Such a decline in lending at a time of tight monetary policy and consumers struggling with rising gasoline prices and constraining debt burdens point to risks on the horizon. Already, March has featured the sharpest weekly declines in lending and deposits since the 2008 financial crisis.

Visit Traders’ Academy to Learn More about Retail Sales and Other Economic Indicators.SourceMoneyGuru-https://www.mgkx.com/4345.html

SourceMoneyGuru-https://www.mgkx.com/4345.html