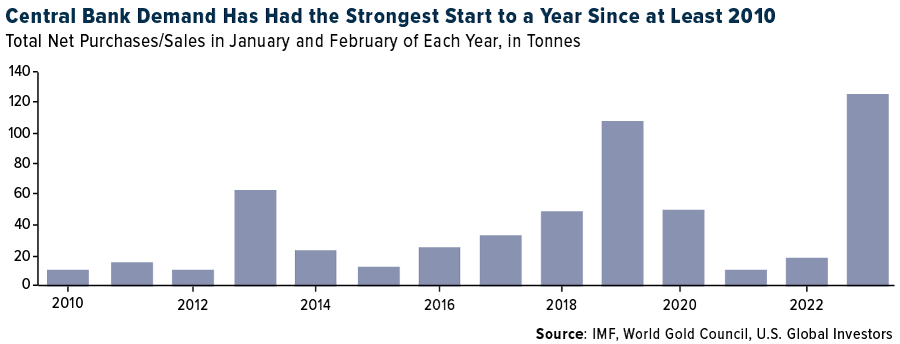

Central banks accumulated gold at the fastest pace on record in the first two months of 2023, according to a report by the World Gold Council’s (WGC) Krishan Gopaul. In January and February, central banks collectively bought a net 125 tonnes of the metal, the highest amount for the year-to-date period since banks became net buyers in 2010.

SourceMoneyGuru-https://www.mgkx.com/4336.html

SourceMoneyGuru-https://www.mgkx.com/4336.html

The countries reporting the largest purchases in the first two months were Singapore (51.4 tonnes), Turkey (45.5 tonnes), China (39.8 tonnes), Russia (31.1 tonnes) and India (2.8 tonnes). The Central Bank of Russia published an update on its gold reserves for the first time in about a year, so the 31.1 tonnes were likely accumulated over the course of several months instead of in January and February.SourceMoneyGuru-https://www.mgkx.com/4336.html

Meanwhile, very few countries’ central banks shrank their gold reserves. Net sellers were Kazakhstan, Uzbekistan, Croatia and the United Arab Emirates (UAE), though year-to-date purchases far outweighed sales.SourceMoneyGuru-https://www.mgkx.com/4336.html

BRICS Countries Will Continue To Be Huge Buyers

If you look back at the list of net buyers, you’ll notice that three are members of the BRICS countries (Brazil, Russia, India, China and South Africa). I point this out because, as I’ve been sharing with you for a couple of weeks now, we may be seeing the emergence of a multipolar world, with a U.S.-centric world on one side and a China-centric world on the other. For the first time ever, BRICS countries’ share of the global economy has surpassed that of the G7 nations (Canada, France, Germany, Italy, Japan, the U.K. and U.S.), on a purchasing parity basis.SourceMoneyGuru-https://www.mgkx.com/4336.html

Gold plays an important role in this multi-polarization. The BRICS need the precious metal to support their currencies and shift away from the U.S. dollar, which has served as the global foreign reserve currency for about a century. More and more global trade is now being conducted in the Chinese yuan, and there are reports that the BRICS—which could eventually include other important emerging economies such as Saudi Arabia, Iran and more—are developing their own medium for payments.SourceMoneyGuru-https://www.mgkx.com/4336.html

If this is indeed the case, the implication is clear to me that investors should be increasing their exposure to gold and gold miners. Gold is a finite resource. It’s expensive and time-consuming to produce more of it. At the same time, BRICS countries will continue to be net buyers as they seek to diversify away from the dollar.SourceMoneyGuru-https://www.mgkx.com/4336.html

Net Inflows Into Gold-Backed ETFs Turn Positive

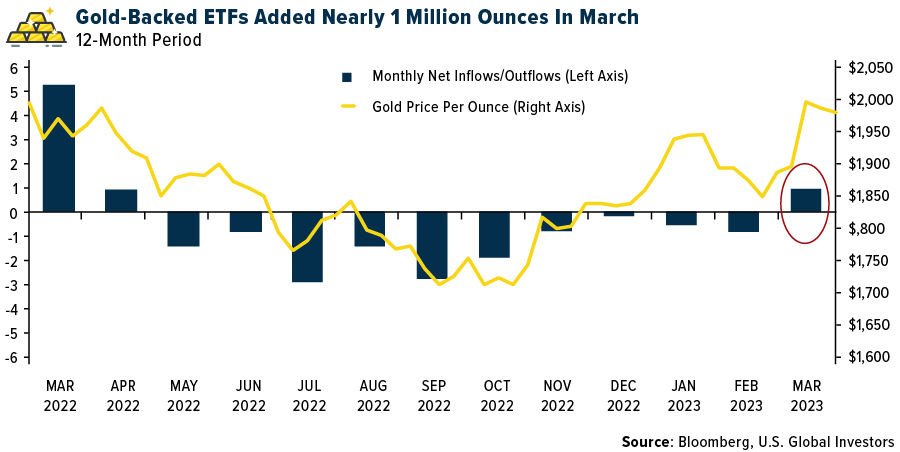

Net inflows into gold-backed ETFs turned positive in March after 10 straight months of outflows as the metal’s price flirts with a new record high. Investors added nearly 1 million ounces to all known physical gold ETFs in March, the highest monthly increase since March 2022, when investors added 1.4 million ounces. As of March 31, total gold holdings stood at 93.2 million ounces, according to Bloomberg.SourceMoneyGuru-https://www.mgkx.com/4336.html

SourceMoneyGuru-https://www.mgkx.com/4336.html

SourceMoneyGuru-https://www.mgkx.com/4336.html

In light of weak economic news, ongoing inflation, rising rates, a shaky banking sector and geopolitical tension, gold is catching a strong bid as it seeks to make a new all-time high. On Thursday, the metal touched $2,032 an ounce, just $43 off its record high, set in August 2020.SourceMoneyGuru-https://www.mgkx.com/4336.html

Weak Manufacturing Data Points To Potential Trouble Ahead. Do You Have Your 10%?

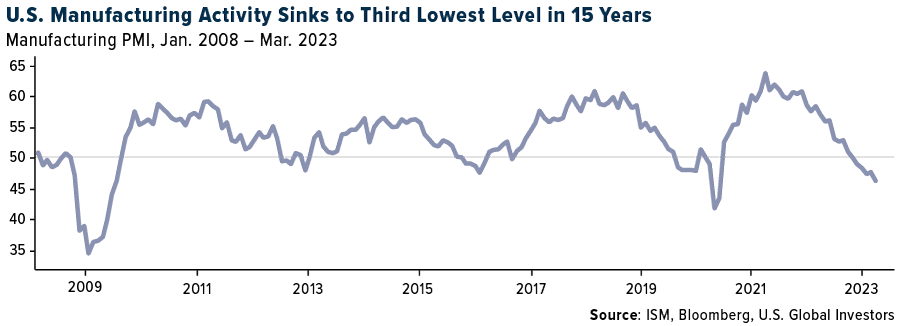

I believe accumulating gold and gold stocks is prudent and wise at this time, especially as recession signals are starting to flash. U.S. manufacturing activity contracted at a faster rate for the fourth straight month, with ISM’s Manufacturing PMI sinking to 46.3 in March. That’s the third-lowest reading in 15 years, following the financial crisis and pandemic lockdowns. What’s more, every category—from new orders to production to inventories—was in contraction mode.SourceMoneyGuru-https://www.mgkx.com/4336.html

SourceMoneyGuru-https://www.mgkx.com/4336.html

SourceMoneyGuru-https://www.mgkx.com/4336.html

The Federal Reserve’s actions to slow economic growth appear to be having the desired effect. We may be looking at the end of the most aggressive rate hike cycle in two generations, and this carries risks that investors should be aware of.SourceMoneyGuru-https://www.mgkx.com/4336.html

Over the past 70 years, a Fed pause was followed by an economic recession 75% of the time, with an average lag of six months, according to CLSA’s Alexander Redman and Della Chen. The two analysts believe the Fed has just one more hike to go before it pauses and begins to reverse course. The cycle should be complete by July, Redman and Chen estimate.SourceMoneyGuru-https://www.mgkx.com/4336.html

If their estimates are correct, we may be looking at a recession late in the fourth quarter.SourceMoneyGuru-https://www.mgkx.com/4336.html

The time to buy equities, they say, is when the Manufacturing PMI bottoms after the start of the recession. Doing so resulted in positive 12-month returns seven out of eight times, for an average return of 26%.SourceMoneyGuru-https://www.mgkx.com/4336.html

Timing these things is always tricky, and we’re talking about events that could be months in the future. If a recession is in the cards, it may make sense to ride it out with the help of gold. As always, I recommend a 10% weighting, with 5% in physical gold and the other 5% in high-quality gold mining stocks, mutual funds and ETFs.SourceMoneyGuru-https://www.mgkx.com/4336.html SourceMoneyGuru-https://www.mgkx.com/4336.html