Are you curious about the inverted yield curve and its impacts on the economy? If so, you've come to the right place. In this blog post, we'll be decoding the mysterious phenomenon of an inverted yield curve - a situation where short-term interest rates are higher than long-term rates - and analyzing its relationship with economic recessions. We'll delve into what causes it, how it works, and why we should care. Join us as we unravel this complex yet intriguing topic that has been making headlines across financial news platforms around the world.

SourceMoneyGuru-https://www.mgkx.com/3968.html

SourceMoneyGuru-https://www.mgkx.com/3968.html

Introduction

When it comes to economic recessions, there’s no shortage of theories out there. One popular theory is the inverted yield curve, which states that an inverted yield curve (where short-term interest rates are higher than long-term interest rates) is a predictor of an impending recession.SourceMoneyGuru-https://www.mgkx.com/3968.html

In this article, we’ll take a closer look at the inverted yield curve and its relationship with economic recessions. We’ll also dispel some common myths about this theory and explain why it’s not always accurate.SourceMoneyGuru-https://www.mgkx.com/3968.html

So what exactly is the inverted yield curve? And how strong is its relationship with economic recessions? Keep reading to find out.SourceMoneyGuru-https://www.mgkx.com/3968.html

What is an Inverted Yield Curve?

An inverted yield curve is an interest rate environment in which long-term debt instruments have a lower yield than short-term debt instruments of the same credit quality. This type of yield curve is often considered a predictor of economic recession because it typically occurs when investor confidence is low and the demand for safe, long-term investments is high.SourceMoneyGuru-https://www.mgkx.com/3968.html Inverted yield curves have been associated with numerous past economic downturns, including the Great Recession of 2008-2009. While an inverted yield curve is not a guaranteed indicator of an impending recession, it has been a reliable predictor in the past and therefore warrants close attention from investors and policymakers alike.SourceMoneyGuru-https://www.mgkx.com/3968.html

How Does An Inverted Yield Curve Impact the Economy?

The inverted yield curve is a relatively rare occurrence in which long-term interest rates fall below short-term rates. This happens when bond investors are expecting economic growth to slow in the future, causing them to demand higher yields for longer-term bonds.SourceMoneyGuru-https://www.mgkx.com/3968.html

An inverted yield curve can be a leading indicator of an economic recession, as it reflects bond market expectations for lower growth. When the yield curve inverts, it often signals that a recession may occur within the next year or two.SourceMoneyGuru-https://www.mgkx.com/3968.html

While an inverted yield curve is not a perfect predictor of recessions, it has been accurate in the past. For example, an inverted yield curve preceded each of the last seven US recessions.SourceMoneyGuru-https://www.mgkx.com/3968.html

The impact of an inverted yield curve on the economy can be significant. A recessionary environment typically leads to reduced lending and investment, slower economic growth, and increased unemployment.SourceMoneyGuru-https://www.mgkx.com/3968.html

What Leads to an Inverted Yield Curve?

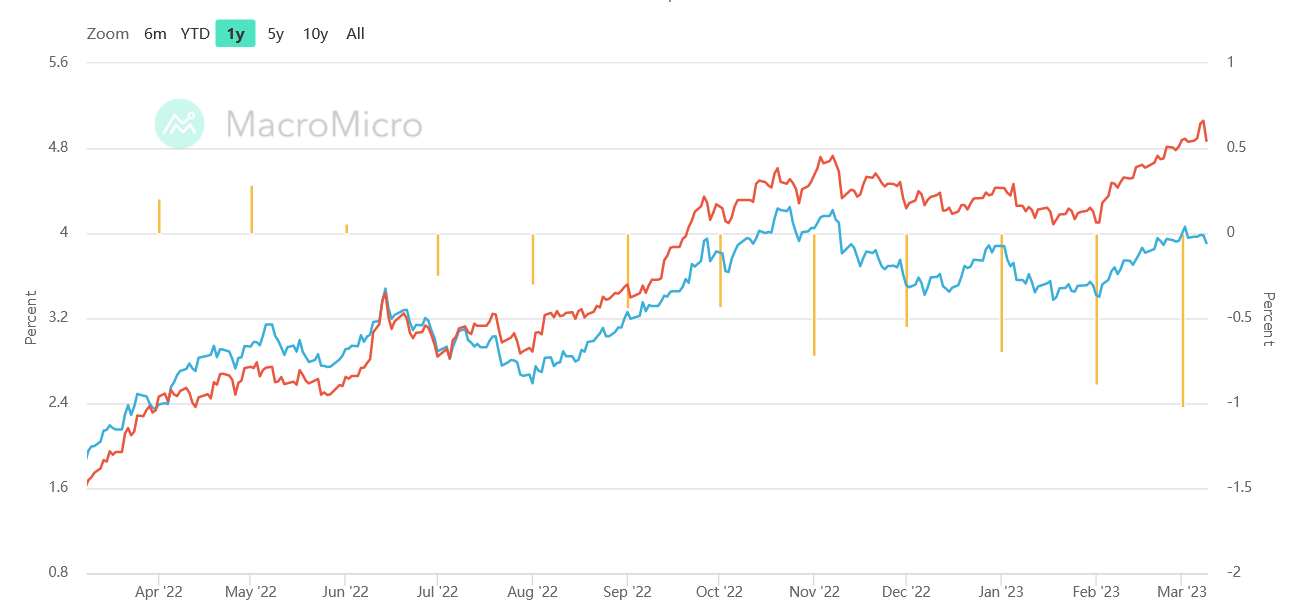

An inverted yield curve is an important indicator of future economic activity, and has been found to precede every recession in the United States since the 1970s. While there are a variety of ways to measure an inverted yield curve, the most common is to compare the yields on 10-year and 2-year Treasury notes. When the yield on the 10-year notes is lower than the yield on the 2-year notes, this is generally indicative of an inverted yield curve.SourceMoneyGuru-https://www.mgkx.com/3968.html

There are a number of factors that can lead to an inverted yield curve. One of the most important is Federal Reserve policy. When the Fed raises interest rates, as it has done in recent years, this can lead to an inverted yield curve. Other factors that can lead to an inverted yield curve include a weakening economy and rising inflation expectations.SourceMoneyGuru-https://www.mgkx.com/3968.html

An inverted yield curve is often seen as a sign that a recession may be on the horizon. This is because when investors believe that economic growth will slow in the future, they are less likely to want to hold long-term debt instruments like 10-year Treasury notes. As a result, yields on these instruments fall relative to other investments like 2-year Treasury notes. While an inverted yield curve is not a guaranteed predictor of a recession, it is closely watched by economists and market participants for clues about future economic activity.SourceMoneyGuru-https://www.mgkx.com/3968.html

History of the Relationship Between Recession and the Inverted Yield Curve

The inverted yield curve has been a reliable predictor of economic recessions for over 50 years. The yield curve is a plot of short-term interest rates (typically 3-month Treasury bills) against long-term interest rates (10-year Treasury bonds). An inverted yield curve occurs when short-term rates are higher than long-term rates.SourceMoneyGuru-https://www.mgkx.com/3968.html

Historically, an inverted yield curve has preceded each of the last seven US recessions. Inversion is thought to indicate that market participants expect future short-term rates to fall relative to long-term rates. This expectation is often driven by fear of an impending recession, as investors seek the safety of long-term assets in anticipation of lower returns in the future.SourceMoneyGuru-https://www.mgkx.com/3968.html

There are several key mechanisms through which an inverted yield curve can contribute to an economic recession. Firstly, higher short-term rates make it more expensive for businesses to borrow for investment and expansion. This can lead to cutbacks in investment spending, which can act as a drag on overall economic growth. Secondly, higher short-term rates also make it more difficult for households to borrow for big purchases like homes and cars. This can lead to a slowdown in consumer spending, which is another key driver of economic growth. Finally, an inverted yield curve can cause financial stress for banks and other financial institutions that rely heavily on borrowing at short-term rates to fund their activities. This can lead to a tightening of credit conditions and further slowing of economic activity.SourceMoneyGuru-https://www.mgkx.com/3968.html

While the inverted yield curve has had a strong track record of predicting recessions, it is important to remember that this predictor can sometimes give false alarms. In recent years, the inverted yield curve has been an early warning of both the 2007-09 global financial crisis and the 2020 COVID-19 recession. But it also briefly inverted in late 1998, when an economic slowdown was averted. As such, while the inverted yield curve can be an indicator of potential economic slowdowns, it should not be used as a sole predictor of recessions.SourceMoneyGuru-https://www.mgkx.com/3968.html

Examples of Recent Recessions Related to the Inverted Yield Curve

The inverted yield curve has been a reliable predictor of economic recessions in the past. In fact, every recession since 1970 has been preceded by an inverted yield curve. Here are some examples of recent recessions that have been related to the inverted yield curve:SourceMoneyGuru-https://www.mgkx.com/3968.html

-The 2001 dot-com bubble burst was preceded by an inverted yield curve.SourceMoneyGuru-https://www.mgkx.com/3968.html

-The 2008 financial crisis was preceded by an inverted yield curve.SourceMoneyGuru-https://www.mgkx.com/3968.html

-The 2020 coronavirus pandemic has also been preceded by an inverted yield curve.

In each of these cases, economic growth slowed and unemployment rose significantly, indicating a recession.

Strategies for Responding to an Inverted Yield Curve

An inverted yield curve occurs when long-term interest rates are lower than short-term interest rates. This is usually a sign that the economy is about to enter a recession.

If you're wondering how to respond to an inverted yield curve, there are a few strategies you can use:

1. Increase your focus on cash flow: An inverted yield curve can be a good time to focus on increasing your company's cash flow. This will help you weather any potential economic downturn and keep your business afloat.

2. Build up your cash reserves: Another strategy is to build up your company's cash reserves. This will give you a cushion to fall back on if the economy does enter a recession.

3. Review your borrowing costs: An inverted yield curve can also be a good time to review your company's borrowing costs. This is because they are likely to increase in an economic downturn.

4. Cut back on non-essential expenditure: In an economic downturn, it's important to cut back on non-essential expenditure in order to conserve cash flow. Review your budget and look for areas where you can make cuts.

Conclusion

The inverted yield curve has been a reliable predictor of economic recessions for over 50 years. We hope that this article has helped you decode the mystery behind it and gain a better understanding of its relationship with future economic conditions. Though predicting the direction of the economy is not an exact science, the inverted yield curve gives us valuable insight into what may be coming in the near-term future. With all this in mind, it’s important to understand how to use this information when making financial decisions—especially those related to investing—in order to maximize your returns and reduce risk during difficult periods in time.