As the old saying goes, 'when America sneezes, the world catches a cold.' And with all eyes fixated on Wall Street's inverted yield curve, economists and investors alike are growing increasingly anxious about a possible recession. But is this foreboding trend really as dire as it seems? Join us as we explore whether the inverted yield curve is truly a harbinger of economic doom or merely an anomaly in our ever-fluctuating financial landscape.

SourceMoneyGuru-https://www.mgkx.com/3970.html

SourceMoneyGuru-https://www.mgkx.com/3970.html

Introduction to the Inverted Yield Curve

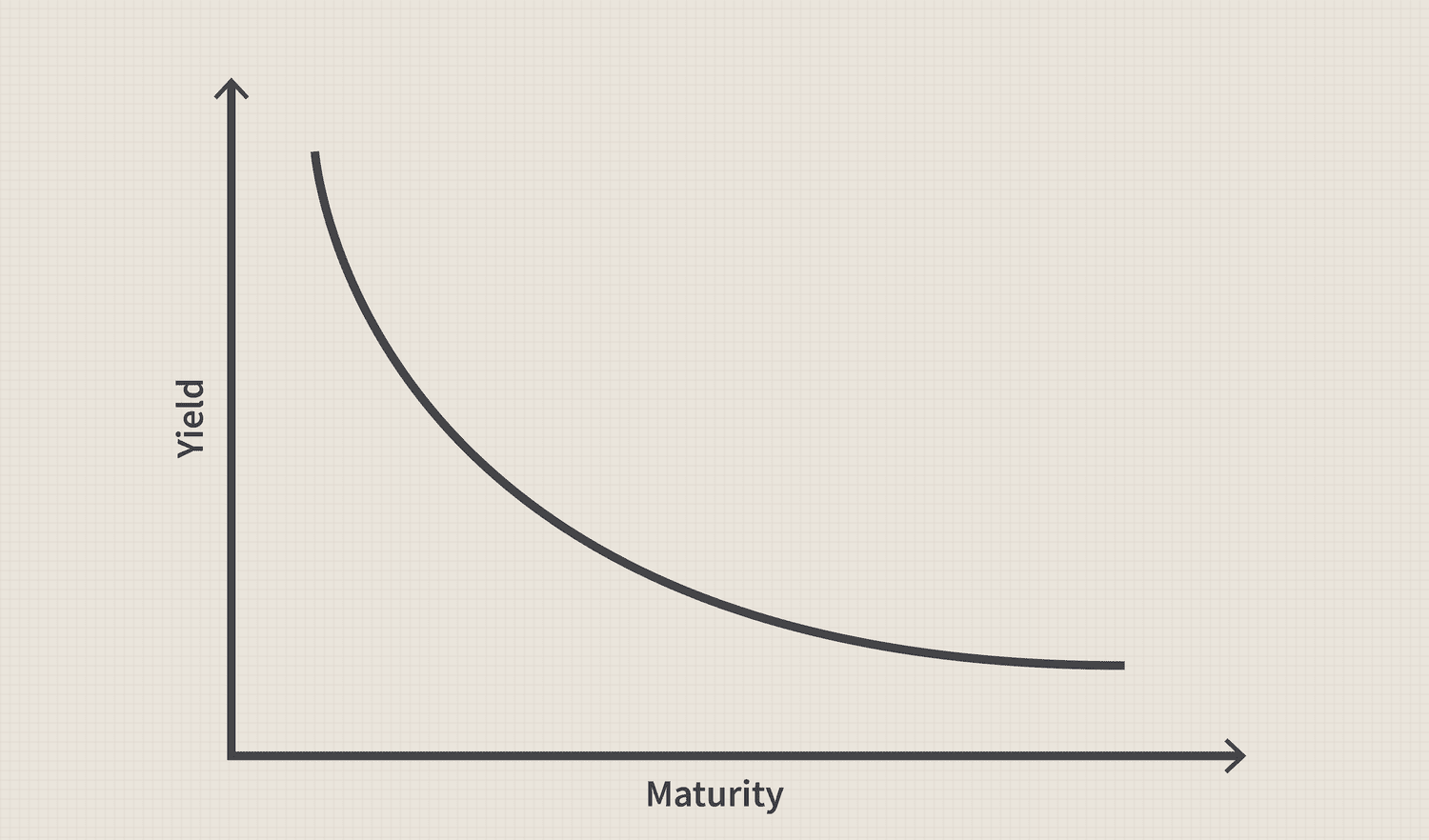

An inverted yield curve is when the short-term interest rates are higher than the long-term interest rates. This is usually a sign that the economy is about to enter a recession.SourceMoneyGuru-https://www.mgkx.com/3970.html

The inverted yield curve has been a reliable predictor of past recessions. It happens when investors become worried about the future and start moving their money from stocks into bonds. This shift causes the prices of bonds to go up and the yields to go down.SourceMoneyGuru-https://www.mgkx.com/3970.html

The yield curve normally slopes upwards because it costs more to borrow money for a longer period of time. An inverted yield curve means that this relationship has reversed and it's now cheaper to borrow for the long term than the short term.SourceMoneyGuru-https://www.mgkx.com/3970.html

There are a few theories as to why this happens, but it's generally accepted that it's due to investors' expectations about future economic growth. When investors believe that growth will slow in the future, they're more likely to buy bonds since they provide stability and income during periods of slower growth.SourceMoneyGuru-https://www.mgkx.com/3970.html

The most recent inversion of the yield curve happened in late 2018 and many experts believe that it's a sign that a recession could happen as soon as 2020. However, it's important to note that not all inversions lead to immediate recessions – there can be a lag of up to two years before a recession actually begins.SourceMoneyGuru-https://www.mgkx.com/3970.html

Whether or not an inverted yield curve is a cause for concern depends on your personal circumstances. If you're close to retirement, you may want to consider shifting some of your investments into more defensive strategies. However, if you're further away, then the inversion of the yield curve could represent an opportunity to buy stocks or bonds at a lower cost than usual.SourceMoneyGuru-https://www.mgkx.com/3970.html

What is an Inverted Yield Curve?

An inverted yield curve is a yield curve in which long-term debt instruments have a lower yield than short-term debt instruments of the same credit quality. An inverted yield curve is often seen as a precursor to an economic recession.SourceMoneyGuru-https://www.mgkx.com/3970.html

An inverted yield curve typically occurs when investors expect yields on long-term debt instruments to decline relative to short-term debt instruments. This typically occurs when they are expecting economic growth and inflation to slow down. When this happens, the long-term yields will be lower than the short-term yields, resulting in an inverted yield curve.SourceMoneyGuru-https://www.mgkx.com/3970.html

Historical Context of the Inverted Yield Curve

The inverted yield curve is often viewed as a strong indicator of an impending recession. Indeed, an inverted yield curve has preceded each of the last seven recessions dating back to 1955. However, some economists believe that the inverted yield curve may not be as accurate a predictor of recession as it once was. One reason for this is that the Federal Reserve has been more proactive in recent years in implementing policies to ward off recessionary pressures. Additionally, other economic indicators – such as employment numbers – currently do not point to a looming recession.SourceMoneyGuru-https://www.mgkx.com/3970.html

Still, the inverted yield curve should not be dismissed lightly. It remains one of the most closely watched economic indicators by both policymakers and market participants. And while it may not be an infallible predictor of recession, it still has the ability to provide valuable insights into the health of the economy.SourceMoneyGuru-https://www.mgkx.com/3970.html

How Does It Impact the Economy?

The inverted yield curve is often thought of as a harbinger of recession, but its impact on the economy is more complicated than that. While an inverted yield curve can indicate that a recession is coming, it can also be a symptom of other economic problems. For example, an inverted yield curve could be a sign that inflation is eroding the purchasing power of fixed-income investments. It could also reflect concerns about future interest rate hikes by the Federal Reserve.SourceMoneyGuru-https://www.mgkx.com/3970.html

Inverted yield curves have been associated with past recessions, but there is no guarantee that they will always precede economic downturns. Inverted yield curves can last for extended periods of time without leading to a recession. They can also occasionally appear in times of economic expansion.SourceMoneyGuru-https://www.mgkx.com/3970.html

The impact of an inverted yield curve on the economy depends on many factors, including the severity and duration of the inverting yields, as well as other economic conditions. In general, though, an inverted yield curve tends to increase borrowing costs and reduce lending activity, which can lead to slower economic growth.SourceMoneyGuru-https://www.mgkx.com/3970.html

The Relationship Between the Stock Market and an Inverted Yield Curve

It is no secret that the stock market and the bond market often move in opposite directions. The reason for this is that when bond prices are rising, yields are falling, and vice versa. This inverse relationship between bonds and stocks is due to the fact that they are competing for investor dollars. When bond yields fall, it becomes more expensive for companies to borrow money, which can lead to a decrease in corporate profits and share prices. Conversely, when bond yields rise, it becomes cheaper for companies to borrow money, which can lead to an increase in corporate profits and share prices.SourceMoneyGuru-https://www.mgkx.com/3970.html

One of the key indicators of whether or not the stock market is about to experience a downturn is an inverted yield curve. An inverted yield curve occurs when short-term interest rates are higher than long-term interest rates. This happens when investors believe that the Federal Reserve will raise interest rates in the future in order to combat inflation. As a result, they demand a higher yield (interest rate) on their investments in order to compensate for the risk of inflation eroding the value of their investment.SourceMoneyGuru-https://www.mgkx.com/3970.html

An inverted yield curve has preceded every recession since World War II. Inverted yield curves don't necessarily mean that a recession is imminent, but they are often seen as a leading indicator of economic trouble ahead.SourceMoneyGuru-https://www.mgkx.com/3970.html

Historical Examples of an Inverted Yield Curve and a Recession

An inverted yield curve has been a reliable predictor of recessions in the past. In fact, every recession since 1955 has been preceded by an inverted yield curve.SourceMoneyGuru-https://www.mgkx.com/3970.html

The most recent example of an inverted yield curve and a recession was the Great Recession of 2008. Prior to the onset of the recession, the yield on 10-year Treasury notes fell below the yield on 3-month Treasury bills. This signaled that investors were more concerned about short-term economic prospects than long-term prospects.SourceMoneyGuru-https://www.mgkx.com/3970.html

As it turned out, their concerns were well founded. The Great Recession was caused by a housing market bubble that burst, leading to widespread defaults and foreclosures. The resulting financial crisis plunged the economy into a deep recession from which it is only now beginning to recover.SourceMoneyGuru-https://www.mgkx.com/3970.html

Potential Causes for an Inverted Yield Curve Outside of a Recession

While an inverted yield curve is often seen as a sign of an impending recession, there are other potential causes for this anomaly. One such cause could be central bank intervention in the bond market. If the central bank buys bonds, it drives up prices and pushes down yields. This can lead to an inverted yield curve, even if the economy is not in a recessionary state.

Another potential cause for an inverted yield curve outside of a recession could be a flight to safety by investors. When investors are nervous about the stock market or the economy in general, they tend to move their money into safe-haven assets like bonds. This increases demand for bonds and drives down yields, again leading to an inverted yield curve.

So while an inverted yield curve is often seen as a sign of trouble ahead, it's not always indicative of a coming recession. There are other potential causes that should be considered before making any drastic decisions based on this economic indicator.

Conclusion

The inverted yield curve is often seen as a sign of an impending recession, but it's important to keep in mind that there could be other factors at play. It's critical to consider the full economic context and adhere to well-defined procedures when determining whether an inverted yield curve does or does not point towards a recession. By doing so, investors can feel better equipped for taking informed decisions with respect to their financial portfolio in order to face possible recessions with confidence.