US Dollar Index (DXY) seesaws around the December 2022 highs, making rounds to 105.60-65 during early Wednesday, as the greenback bulls take a breather after the biggest daily jump in five months.

SourceMoneyGuru-https://www.mgkx.com/3716.html

SourceMoneyGuru-https://www.mgkx.com/3716.html

The US Dollar’s gauge versus the six major currencies cheered hawkish comments from Federal Reserve (Fed) Chairman Jerome Powell, as well as the widest negative yield differentials between the 10-year and two-year US Treasury bonds, to please the bulls. However, the market’s reassessments of hawkish Fed concerns and a lack of major data/events join a cautious mood ahead of Fed Chair Powell’s second round of testimony, this time in front of the US House of Representatives Financial Services Committee, to probe the DXY buyers of late.SourceMoneyGuru-https://www.mgkx.com/3716.html

Fed’s Powell surprised markets by showing readiness for more rate hikes and bolstered the bets of a 50 bps Fed rate hike in March. The policymaker propelled the “higher for longer” Fed rate expectations and bolstered the US Treasury bond yields while weighing on the equities.SourceMoneyGuru-https://www.mgkx.com/3716.html

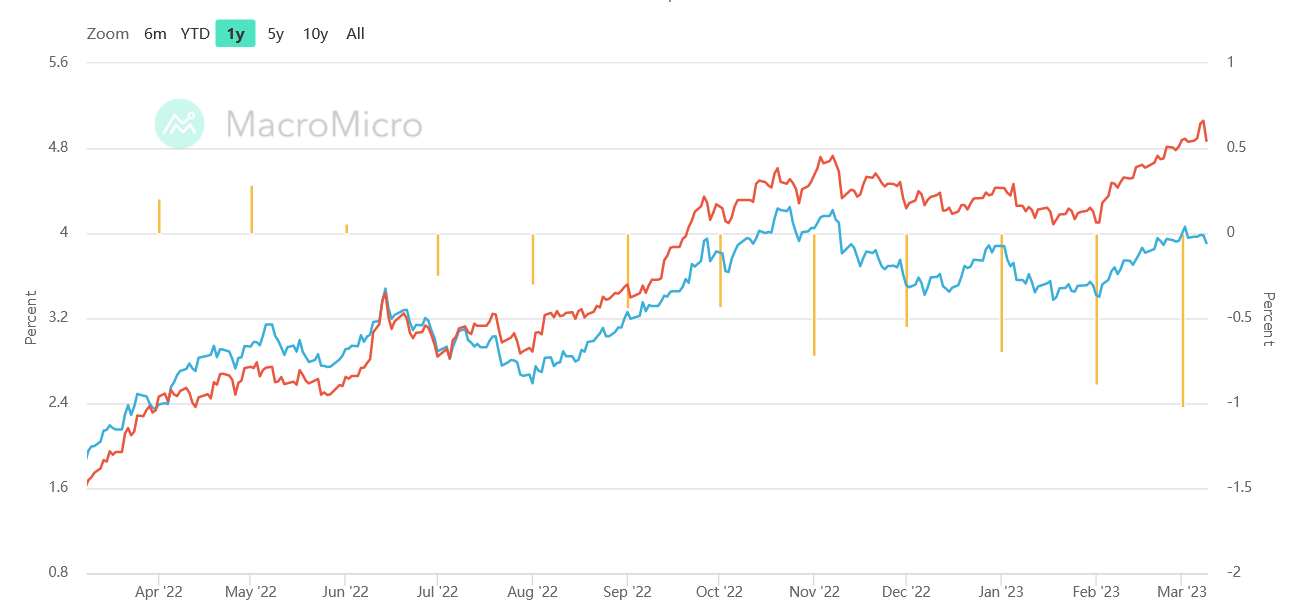

That said, the US 10-year Treasury bond yields rose 0.15% while closing around 3.97% on Tuesday but the two-year counterpart gained 2.60% on a day when poking the highest levels since 2007, to 5.02% at the latest. With this, the difference between the 10-year and two-year bond coupons marked the widest yield curve inversion in 40 years and portrays the recession, which in turn underpins the US Dollar’s safe-haven demand.SourceMoneyGuru-https://www.mgkx.com/3716.html

Apart from the Fed chatters and yields, the US-China tension and an uptick in the US Wholesale Trade in January also allowed the DXY to remain firmer.SourceMoneyGuru-https://www.mgkx.com/3716.html

It should be noted that the S&P 500 Futures remain indecisive while waiting for more signals to track Wall Street’s losses.SourceMoneyGuru-https://www.mgkx.com/3716.html

Moving on, Fed Chair Powell’s second round of testimony may not be too interesting but won’t be ignored whereas the US ADP Employment Change, the early signal for Friday’s US Nonfarm Payrolls (NFP), will be observed more closely for clear directions of the US Dollar Index.SourceMoneyGuru-https://www.mgkx.com/3716.html

Technical analysis

The first daily closing beyond the 100-DMA since early November 2022 directs the US Dollar Index toward the 200-DMA hurdle of 106.70.SourceMoneyGuru-https://www.mgkx.com/3716.html

Dollar Index SpotSourceMoneyGuru-https://www.mgkx.com/3716.html

| Overview | |

|---|---|

| Today last price | 105.66 |

| Today Daily Change | 0.03 |

| Today Daily Change % | 0.03 |

| Today daily open | 105.63 |

| Trends | |

|---|---|

| Daily SMA20 | 104.22 |

| Daily SMA50 | 103.4 |

| Daily SMA100 | 104.79 |

| Daily SMA200 | 106.83 |

| Levels | |

|---|---|

| Previous Daily High | 105.66 |

| Previous Daily Low | 104.12 |

| Previous Weekly High | 105.36 |

| Previous Weekly Low | 104.09 |

| Previous Monthly High | 105.36 |

| Previous Monthly Low | 100.81 |

| Daily Fibonacci 38.2% | 104.37 |

| Daily Fibonacci 61.8% | 104.49 |

| Daily Pivot Point S1 | 104.06 |

| Daily Pivot Point S2 | 103.85 |

| Daily Pivot Point S3 | 103.53 |

| Daily Pivot Point R1 | 104.59 |

| Daily Pivot Point R2 | 104.91 |

| Daily Pivot Point R3 | 105.12 |