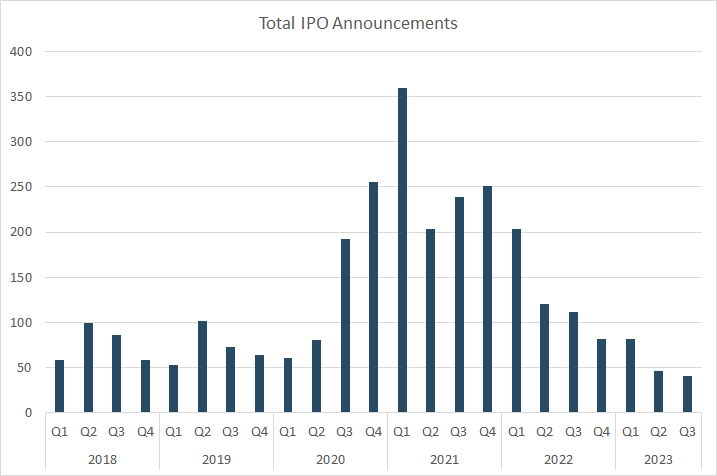

The IPO market has been ice cold in 2022. Q2 2023 marked the sixth straight quarter of declining year-over-year IPO activity, the longest such streak since the 2008-2009 financial crisis. But some high profile upcoming deals have given investors hope for a thaw.

The most anticipated IPO of the second half of 2023 is Arm Holdings, the semiconductor technology company that designs processor architectures used in most smartphones. Arm is set to begin trading this Thursday, September 14th, at an expected valuation of $54.5 billion.SourceMoneyGuru-https://www.mgkx.com/5216.html

Another major offering investors are keenly watching is grocery delivery app Instacart, which just filed its IPO paperwork earlier this week. Instacart plans to raise over $600 million at a $9.3 billion valuation when it goes public next Wednesday, September 20th.SourceMoneyGuru-https://www.mgkx.com/5216.html

SourceMoneyGuru-https://www.mgkx.com/5216.html

SourceMoneyGuru-https://www.mgkx.com/5216.html

These prominent deals have sparked optimism that the IPO pipeline may be reopening after an extremely slow first half of 2023. Only 46 companies went public globally in Q2, the lowest tally since early 2016. But Q3 is currently on pace for at least 41, and momentum seems to be building.SourceMoneyGuru-https://www.mgkx.com/5216.html

Other tech IPOs to watch include marketing automation platform Klaviyo, expected to raise nearly $500 million starting September 19th.SourceMoneyGuru-https://www.mgkx.com/5216.html

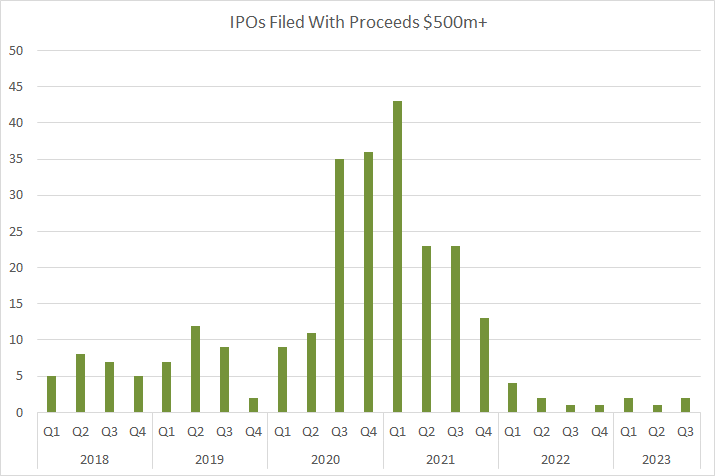

However, massive, billion-dollar-plus IPOs have become a rarity in the current market environment. While Arm and Instacart will be substantial offerings, they pale in size compared to the blockbuster deals of 2020-2021.SourceMoneyGuru-https://www.mgkx.com/5216.html

Some private tech giants still waiting in the wings for the right time to go public include data analytics firm Databricks, payments processor Stripe, and digital bank Chime. But their IPOs likely won't materialize until market conditions improve.SourceMoneyGuru-https://www.mgkx.com/5216.html

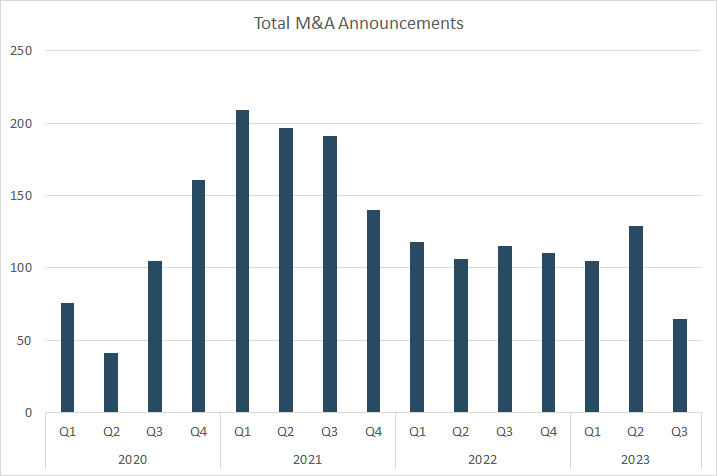

The revival of M&A activity is another positive sign for markets after a slow start to 2023. Global M&A deal value jumped in Q2 but has since stagnated in Q3 so far. Notable recent deals include Campbell Soup's $2.33 billion purchase of pasta sauce maker Sovos Brands and J.M. Smucker's $5.6 billion acquisition of Hostess Brands.SourceMoneyGuru-https://www.mgkx.com/5216.html

In summary, while the IPO market remains challenging, there are finally some concrete reasons for optimism. If high-profile listings from Arm, Instacart and others go smoothly over the next few weeks, it could entice more private companies to test the public waters. But economic uncertainty still abounds, so a broader IPO rebound is far from guaranteed. Investors should closely monitor upcoming new issues for signs of spring in the markets.SourceMoneyGuru-https://www.mgkx.com/5216.html SourceMoneyGuru-https://www.mgkx.com/5216.html