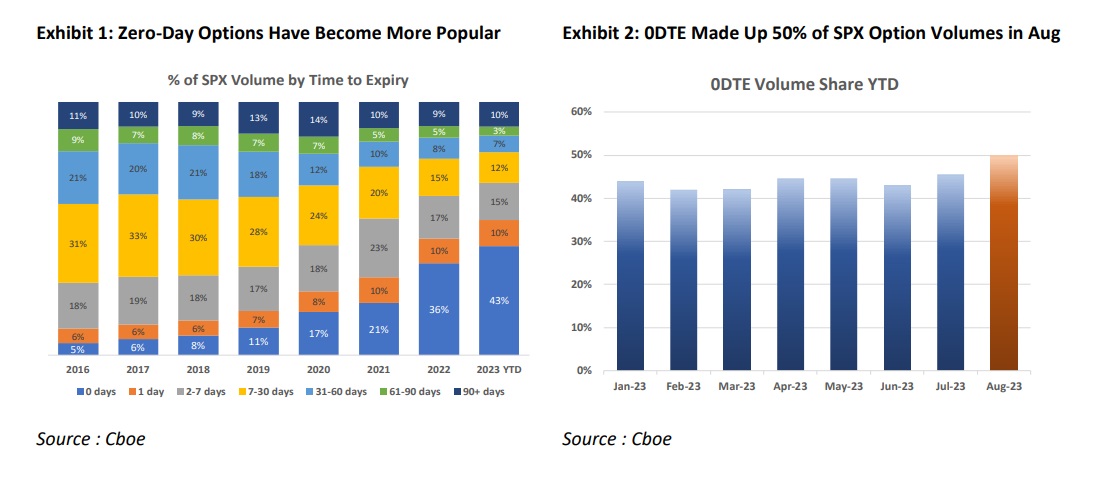

Trading in zero-days-to-expiry (0DTE) options has exploded in recent years, now accounting for over 50% of total volume in S&P 500 index (SPX) options. With this rapid growth has come increased scrutiny of 0DTEs' potential market impact. Specifically, fears that hedging of these options could move the overall market. In this post, I'll analyze the facts around 0DTEs and their true influence.

SourceMoneyGuru-https://www.mgkx.com/5209.html

SourceMoneyGuru-https://www.mgkx.com/5209.html

The main concern stems from the massive daily volume in these options, now averaging over 1.23 million contracts. Such eye-popping numbers lead some to believe market makers face huge risks in providing liquidity. Proponents of this view blame 0DTEs for everything from increasing intraday volatility to suppressing it.SourceMoneyGuru-https://www.mgkx.com/5209.html

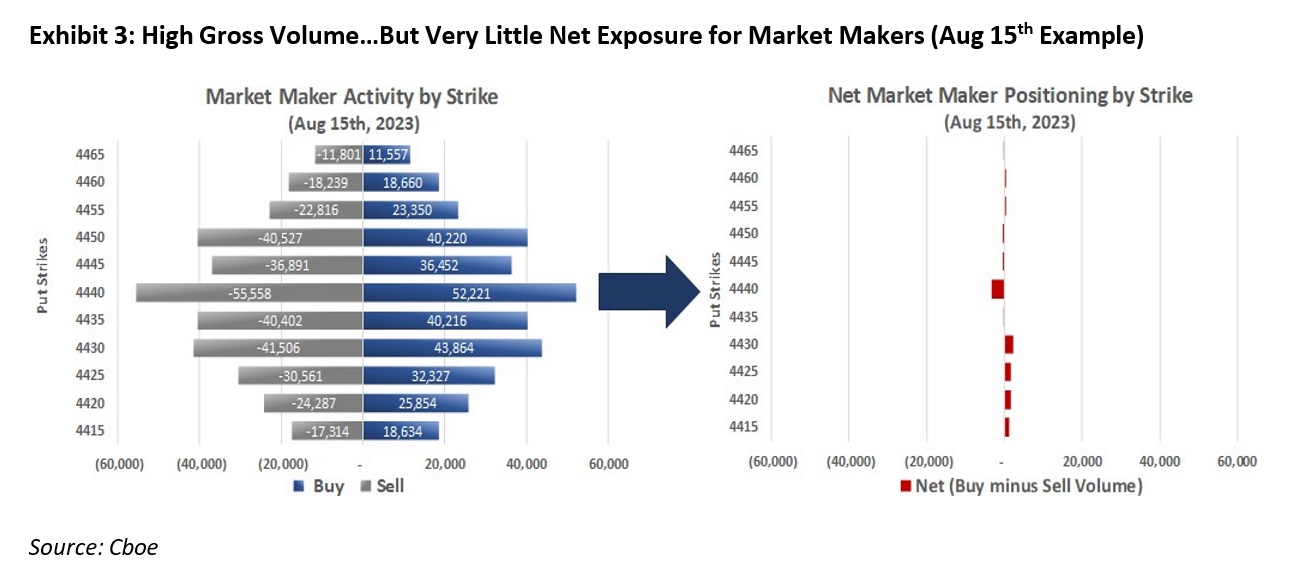

However, the data reveals a different story. While total volume is high, what matters most is the balance between buying and selling activity. As the exchange for all SPX options, Cboe has unique visibility into the nuances of 0DTE order flow. Their analysis shows the volume is remarkably balanced between the two sides.SourceMoneyGuru-https://www.mgkx.com/5209.html

For example, on 8/15 over 100,000 contracts traded on the 4440-strike put. Despite the huge notional value, net market maker exposure was just 3,000 contracts - a slim 3% of the total! This balanced flow leaves market makers with minimal directional exposure on average.SourceMoneyGuru-https://www.mgkx.com/5209.html

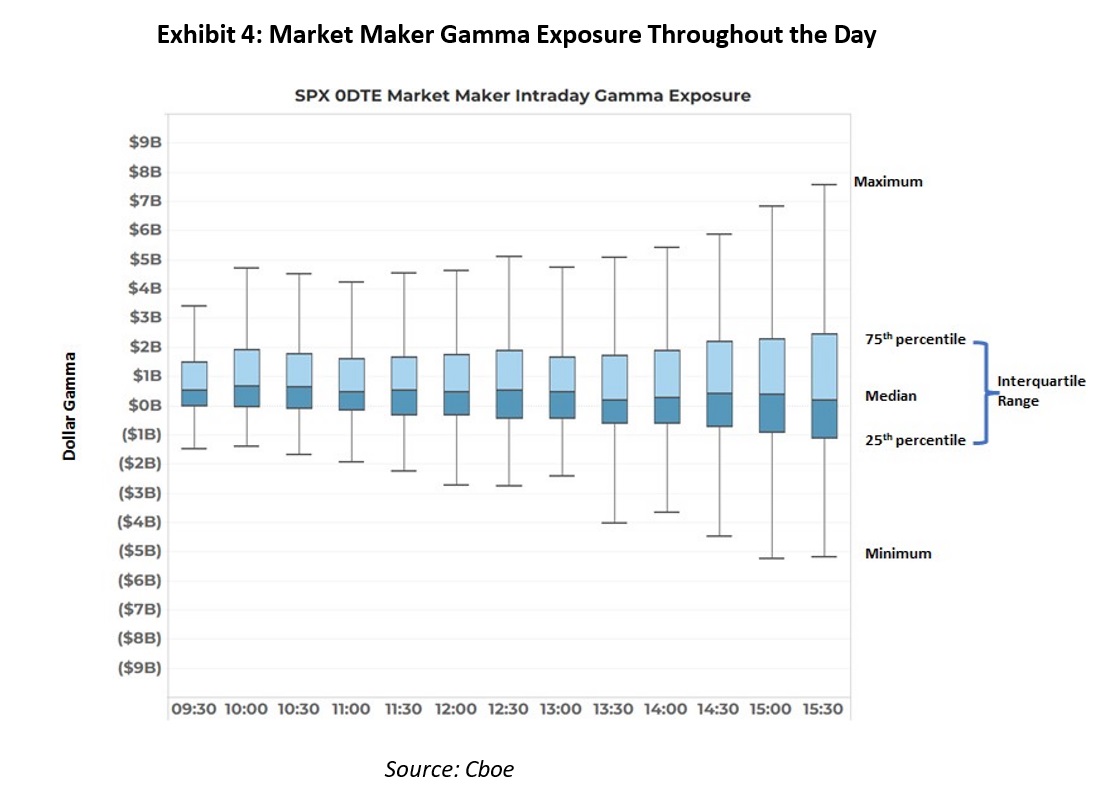

By tracking net gamma positioning over the past year, Cboe found typical market maker risk ranges from 0.04% to 0.17% of daily S&P futures volume. Hardly enough to disrupt markets. Midday readings have been between $170 million to $670 million - a drop in the bucket compared to the $400 billion in daily S&P futures volume.SourceMoneyGuru-https://www.mgkx.com/5209.html

There are logical reasons customer activity remains balanced. Investors use 0DTEs for diverse purposes like hedging, income generation, and tactical trading. This differs greatly from highly directional activity seen during meme stock mania.SourceMoneyGuru-https://www.mgkx.com/5209.html

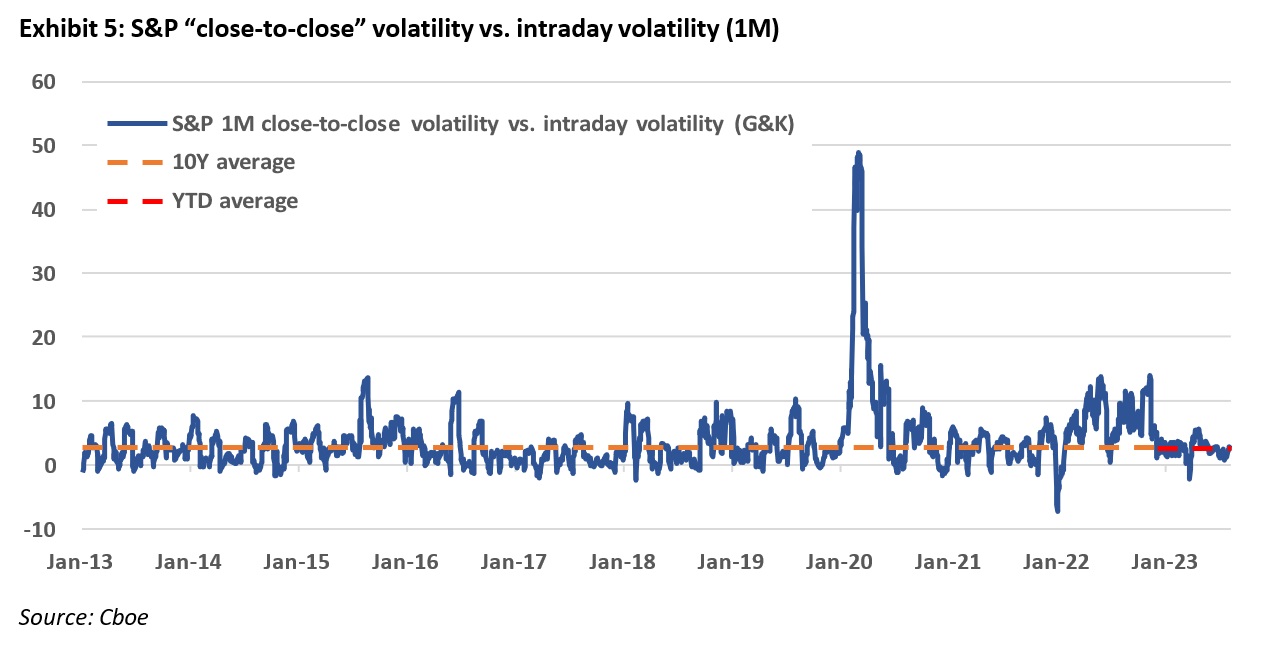

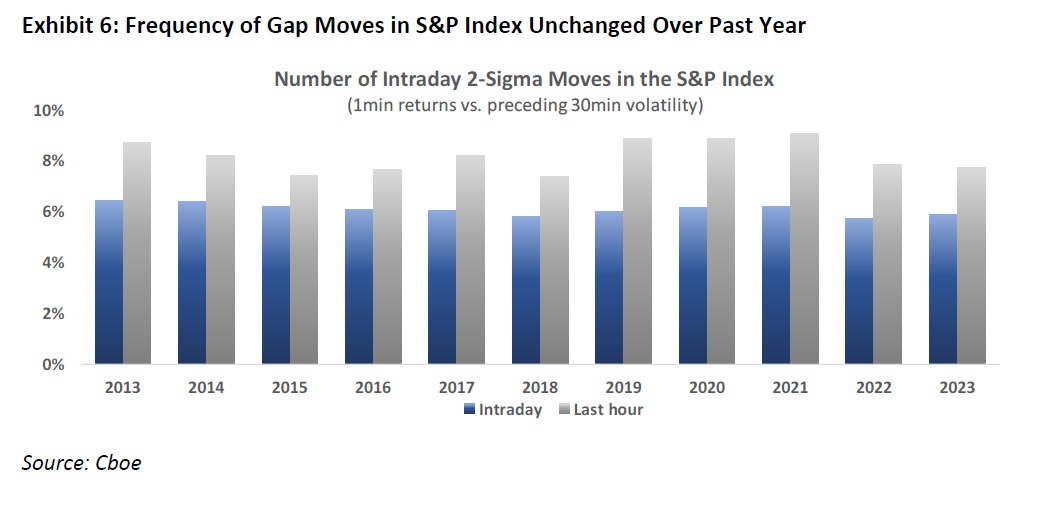

The data also shows no discernible impact on intraday S&P 500 volatility patterns since 0DTE trading grew. Key metrics like the spread between open-to-close and intraday realized volatility are right in line with historical averages. There has also been no uptick in intraday price gaps indicative of market maker hedging flows.SourceMoneyGuru-https://www.mgkx.com/5209.html

In summary, while 0DTE options generate massive nominal volume, true net exposures for market makers are minimal. There is simply no evidence these products are disproportionately moving markets. Much of the concern appears to be fear-driven speculation rather than data-supported facts. For now, it seems the tales of 0DTEs' market impact have been greatly exaggerated.SourceMoneyGuru-https://www.mgkx.com/5209.html SourceMoneyGuru-https://www.mgkx.com/5209.html