In 2011, the United States experienced a political showdown that brought the country to the brink of financial disaster – all over a debate about raising the debt ceiling. Now, with another debt ceiling fight looming in Congress, it's time to revisit what happened before and consider what could happen now. As we face this critical moment in our nation's history, let’s reflect on past mistakes and determine how we can move forward as a country. So fasten your seat belts – we’re about to take a wild ride through one of the most contentious debates in recent US history!

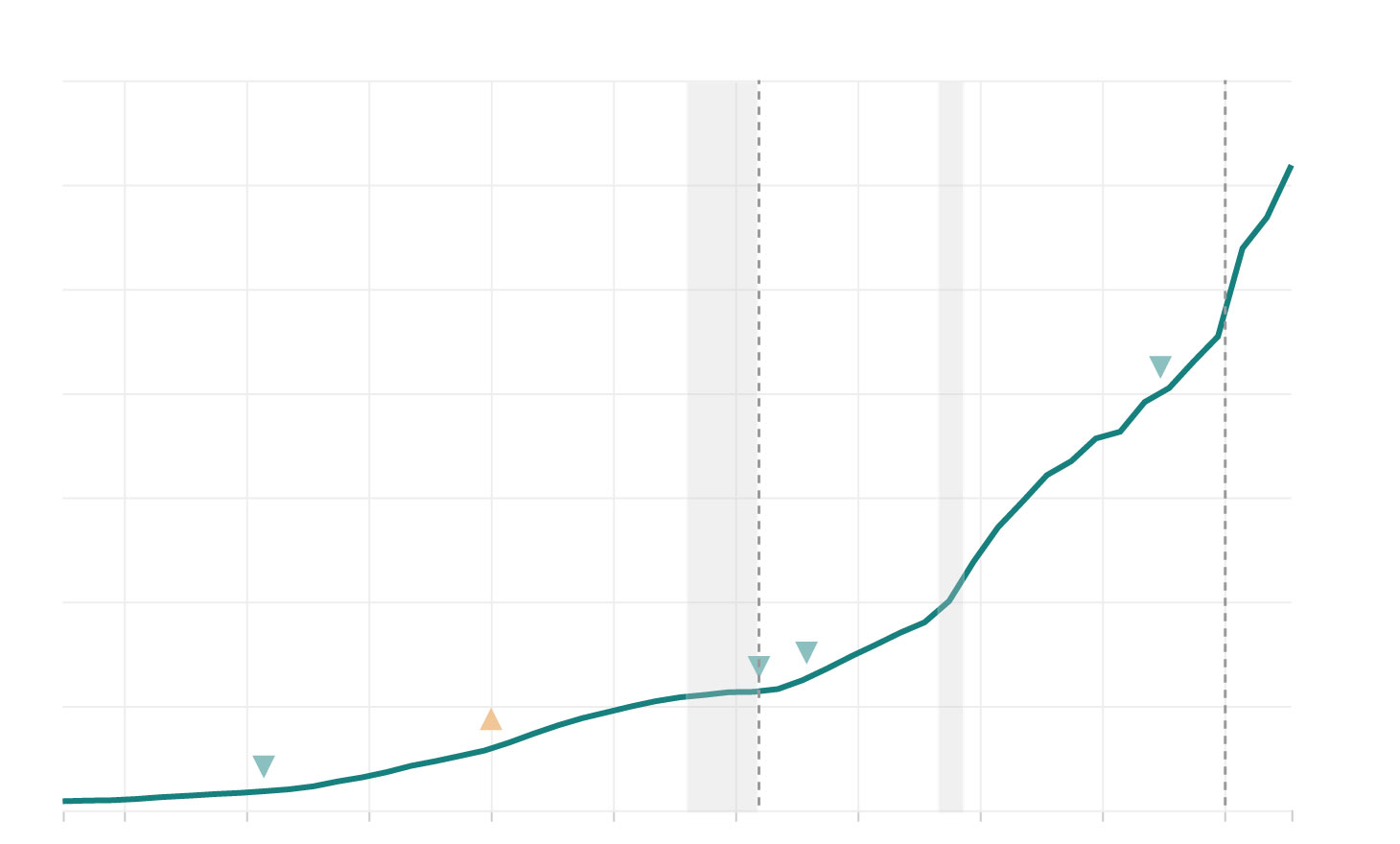

U.S. debt rose nearly 400% in the last 20 years

U.S. government’s total outstanding debt at the end of each fiscal year from 1972 to 2022.

Introduction to the Debt Ceiling and its History

The debt ceiling is a limit on the amount of money that the federal government can borrow. The current debt ceiling is $18.1 trillion, and it was set by Congress in 2015. The debt ceiling has been raised 78 times since 1960, and 10 times since 2001.SourceMoneyGuru-https://www.mgkx.com/4411.html

When the government reaches the debt ceiling, it can no longer borrow money to pay its bills. This could lead to a government shutdown, as happened in 2013. It could also lead to a default on the national debt, which would be catastrophic for the economy.SourceMoneyGuru-https://www.mgkx.com/4411.html

Congress has routinely raised the debt ceiling when necessary, but some lawmakers have threatened to withhold their support unless spending cuts are made. This led to the 2013 government shutdown when Congress failed to agree on a budget.SourceMoneyGuru-https://www.mgkx.com/4411.html

The debt ceiling will need to be raised again in 2018, and it's possible that lawmakers will once again use this opportunity to try to force spending cuts. This could lead to another government shutdown or even default on the national debt if Congress cannot reach an agreement.SourceMoneyGuru-https://www.mgkx.com/4411.html

What Happened in 2011 with the Debt Ceiling?

2011 was a difficult year for the debt ceiling. In August 2011, Congress passed the Budget Control Act of 2011 in an attempt to control spending and reduce the deficit. Part of this act included raising the debt ceiling by $2.1 trillion. This increase allowed the government to borrow money to pay its bills and avoid defaulting on its debts.SourceMoneyGuru-https://www.mgkx.com/4411.html

However, even with this increase, the government still struggled to make ends meet. In November 2011, Congress had to pass another law to temporarily suspend the debt ceiling so that the government could continue borrowing money. This suspension was set to expire on December 31, 2012.SourceMoneyGuru-https://www.mgkx.com/4411.html

With the expiration of this suspension, the debt ceiling will once again be raised. It is unclear how high it will be raised, but it is possible that it could be increased by as much as $1.2 trillion. This would allow the government to continue borrowing money and avoid defaulting on its debts for at least another year.SourceMoneyGuru-https://www.mgkx.com/4411.html

How Has the Debt Ceiling Situation Changed Since 2011?

In 2011, Congress and the White House were at an impasse over how to raise the debt ceiling. Republicans demanded spending cuts as a condition for raising the debt ceiling, while Democrats insisted on revenue increases. Ultimately, a deal was reached to raise the debt ceiling and avoid default, but it came at the cost of significant spending cuts.SourceMoneyGuru-https://www.mgkx.com/4411.html

Now, in 2019, the situation is eerily similar. Once again, Congress and the White House are at an impasse over how to raise the debt ceiling. This time around, however, Democrats are demanding spending cuts as a condition for raising the debt ceiling, while Republicans push for revenue increases. It remains to be seen whether or not a compromise can be reached this time around, but one thing is certain: the debt ceiling saga is far from over.SourceMoneyGuru-https://www.mgkx.com/4411.html

Potential Consequences of Not Raising the Debt Ceiling Now

Bankers and business leaders have warned that failing to raise the debt ceiling could trigger a financial crisis and lead to defaults on government obligations and a plunging value for the dollar.SourceMoneyGuru-https://www.mgkx.com/4411.html

In previous standoffs over the debt limit, the Treasury Department has taken extraordinary measures to avoid default, but those options would be exhausted if the limit is not raised by early November.SourceMoneyGuru-https://www.mgkx.com/4411.html

If Congress does not act, the United States could face an unprecedented default on its debts, which could roil global markets and lead to a new recession. The country's credit rating could also be downgraded, making it more difficult and expensive for the government to borrow money.SourceMoneyGuru-https://www.mgkx.com/4411.html

Benefits of a Balanced Budget Amendment

A balanced budget amendment (BBA) to the U.S. Constitution would require that the federal government not spend more money in any fiscal year than it collects in revenue. Proponents argue that this would force the government to make tough choices on spending and curb excessive deficit spending.BBAs typically contain exceptions for times of war or recession, and many also include a debt limit provision limiting the amount of outstanding debt the federal government can incur.SourceMoneyGuru-https://www.mgkx.com/4411.html

Some economists believe that a BBA would help reduce deficits and stabilize the national debt over the long term. They argue that if the government is required to balance its budget, it will be forced to make tough decisions on spending and revenues, which could lead to more efficient and effective government. Others contend that a BBA could adversely affect the economy by constraining government spending during recessions, when increased government spending is often needed to stimulate economic growth.SourceMoneyGuru-https://www.mgkx.com/4411.html

Alternatives to Raising the Debt Ceiling

Debt ceiling crises have occurred several times in American history, most recently in 2011 when Congress nearly failed to raise the debt ceiling in time to avoid default. The debt ceiling is a limit on how much money the US government can borrow, and it must be raised periodically in order to allow the government to keep borrowing money and paying its debts. If the debt ceiling is not raised, the government will default on its debts, which could have catastrophic consequences for the economy.SourceMoneyGuru-https://www.mgkx.com/4411.html

There are a few alternatives to raising the debt ceiling that could avoid default and help to reduce the national debt. One option is for Congress to pass a balanced budget amendment, which would require that the government only spend as much money as it takes in each year. This would prevent the need to ever raise the debt ceiling again, but it would also likely require deep cuts to government spending, which could be difficult to implement.SourceMoneyGuru-https://www.mgkx.com/4411.html

Another option is for Congress to pass legislation that would automatically raise the debt ceiling whenever the national debt reaches a certain level. This would take away Congress' ability to use the debt ceiling as a bargaining chip, but it could also lead to even higher levels of government borrowing and debt.SourceMoneyGuru-https://www.mgkx.com/4411.html

Ultimately, whether or not to raise the debt ceiling is a political decision that depends on Congress' willingness to compromise and work together for the good of the country. If Congress can't reach an agreement on how to deal with the national debt, then raising the debt ceiling may be necessary in order to avoid default and maintain financial stability.SourceMoneyGuru-https://www.mgkx.com/4411.html

Solutions to Avoid Reoccurrence of National Default

As the saying goes, 'Those who cannot remember the past are condemned to repeat it.' This is certainly the case when it comes to the debt ceiling and the potential for national default. Here are some solutions that would help avoid a repeat of this disastrous event:SourceMoneyGuru-https://www.mgkx.com/4411.html

1. Congress should pass a balanced budget amendment to the Constitution. This would go a long way in avoiding another debt ceiling crisis, as it would force Congress to live within its means.SourceMoneyGuru-https://www.mgkx.com/4411.html

2. Congress should pass legislation that would automatically raise the debt ceiling whenever necessary, without needing approval from Congress. This would take the politics out of the equation and prevent brinksmanship from happening again.

3. The president should use his authority to unilaterally raise the debt ceiling if Congress fails to do so. While this option may be controversial, it would provide much-needed stability in times of crisis.

4. Both parties should come together and agree on a long-term solution to avoid another debt ceiling showdown. This could involve raising taxes, cutting spending, or a combination of both.

Conclusion

Ultimately, the term 'debt ceiling' can be contentious. We must remember that in 2011 the government was able to find a solution to the debt crisis, however difficult it may have been at first - and we must also remember that any compromise reached should be one that prioritizes American economic stability over politics. If Congress is willing to work together with this goal in mind, then there is every chance that history will not repeat itself come August –and our national debt crisis will emerge unscathed once again.