My favorite investment going into 2023 was silver, with the ETF (NYSEARCA:SLV) being a solid choice due to its ample liquidity. Silver declined during the first months of the year but rose around 22% over the past month and is now positive YTD. Both silver and gold have benefited from the recent wave of tumult across the banking and broader monetary systems. Fiat currencies are facing increased volatility again, and major central banks slow rate-hike expectations due to concerns regarding financial stability. At the same time, US and EU inflation remains relatively high despite indications of an economic slowdown. Further, with OPEC taking aggressive steps to constrain oil supplies, the inflation outlook may increase even if the global economy slows.

Fundamentally, silver and gold benefit from high inflation compared to interest rates. If inflation is high, but interest rates are higher, then precious metals are inferior to bank deposits or short-term bonds due to their higher real yields. Of course, that excludes the possibility of liquidity and security issues in fiat currency "cash." If bank deposits continue to decline at the expense of bank liquidity, precious metals may rise due to the "counterparty risk" in depositing fiat currencies; however, the FDIC's expansion mitigates this pressure for now. Further, while I like "paper" metal ETFs like SLV in most instances, it is not necessarily secure in a widespread banking crisis due to their lack of physical coverage.SourceMoneyGuru-https://www.mgkx.com/4312.html

The "spread" between silver spot prices, which SLV is linked to, and physical silver bullion coin prices has risen tremendously since 2020. Silver's "spot" price is around $24.5/oz today, while silver eagle coins are currently around $45/oz on most markets. To me, this fact indicates that there is a lack of physical silver compared to demand. Secondly, it implies that retail demand for silver is exceptionally high and growing, opening the door to higher silver spot prices as the more significant market catches up. Barring extreme monetary and financial turbulence, but expecting ample volatility, I believe SLV may rise much higher by year-end as it breaks to a new high.SourceMoneyGuru-https://www.mgkx.com/4312.html

Silver Bracing for a New Breakout

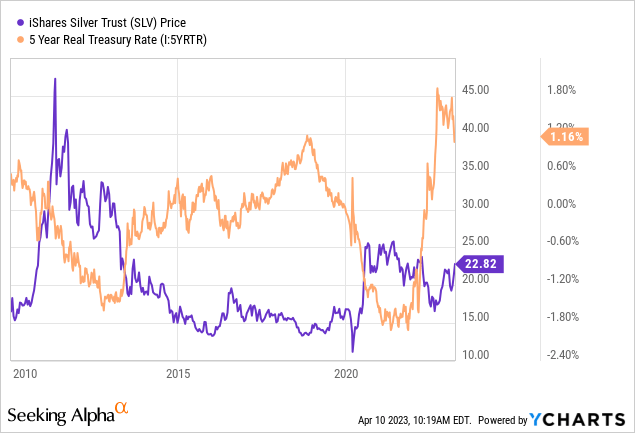

Silver prices rose rapidly in 2020 as the Federal Reserve pursued interest rate cuts and QE amid a surge in financial instability. As real interest rates plummeted, precious metals rose dramatically in value. However, the opposite has been true since mid-2021 as the Federal Reserve rapidly switched toward a hawkish outlook to halt the massive inflation its policies created in 2020. Real interest rates are very high today by historical standards, weighing on the value of silver. However, due to the slowing economy and bank instabilities, the monetary policy outlook will likely need to become less hawkish, signaling lower real interest rates. Historically, sharp declines in real interest rates push silver prices up dramatically. See below:SourceMoneyGuru-https://www.mgkx.com/4312.html

SourceMoneyGuru-https://www.mgkx.com/4312.html

SourceMoneyGuru-https://www.mgkx.com/4312.html

Silver is relatively cheap today compared to its prices in 2010-2013 when QE began. Silver was in a speculative bubble then, so it's not necessarily "cheap" compared to its 2011 price today. That said, I believe silver may be dramatically undervalued if we expect a sharp decline in real interest rates by year-end. As real interest rates decline, the investment value of fiat currencies falls, comparatively boosting the investment value of silver and gold.SourceMoneyGuru-https://www.mgkx.com/4312.html

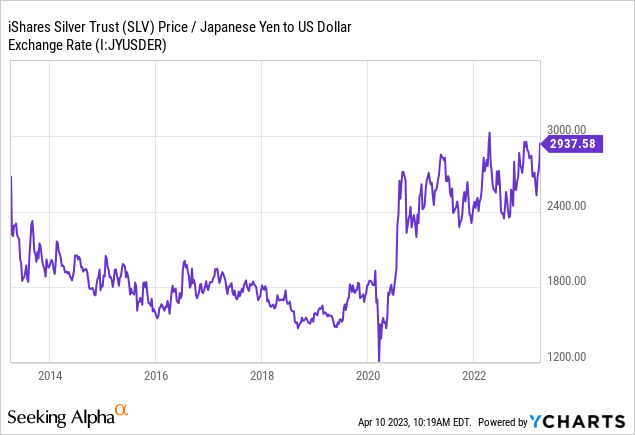

Silver is a global asset with different prices in each country. I believe Japan is a solid potential leading indicator because the Japanese economy is plagued by the same core issues as the US and Europe; however, Japan's are somewhat larger. Even more than the US, Japan highly imports price sensitive and dependent on foreign commodities (particularly energy). Its population pyramid is also more inverted, limiting economic output capacity compared to demand - thereby exacerbating inflation sensitivities. Japan also has tremendous public and private debt to GDP, and many "zombie banks" (and others) primarily depend on dovish government policies. Thus, the Japanese central bank cannot afford to raise interest rates despite growing inflation pressures or the risk of creating a financial crisis. However, that may be unavoidable as the Japanese Yen's value has collapsed, requiring the BOJ to pursue direct currency intervention (which drains its FX reserves).SourceMoneyGuru-https://www.mgkx.com/4312.html

Due to the country's challenging monetary and economic position, silver is trending higher faster in Japanese Yen terms. See below:SourceMoneyGuru-https://www.mgkx.com/4312.html

SourceMoneyGuru-https://www.mgkx.com/4312.html

SourceMoneyGuru-https://www.mgkx.com/4312.html

The US and Europe have the same core issues as Japan. However, Japan may be a clearer microcosm of those issues, implying other Western countries will inevitably follow Japan's trends - an economic concept known as "Japanification." While silver has not "broken out" against the Yen, it appears to be at a high probability of doing so over the next month as it retests is a cyclical peak with its "support level" rising consistently. Notably, the Yen is no longer depreciating against the US dollar as the Federal Reserve begins to be forced to pursue a similar dovish shift due to financial constraints despite remaining inflation pressures. To me, this indicates that the core issues in the Japanese market are now spreading to all other fiat currencies (excluding EM's with higher interest rates and exports - mainly BRICS).SourceMoneyGuru-https://www.mgkx.com/4312.html

BRICS Currency Deals Exacerbate Dollar Instability

US investors may benefit from paying attention to the growing monetary alliances forming among "BRICS" nations. This includes not only Brazil, Russia, India, China, and South Africa but also Saudi Arabia, Iran, and other Latin American countries. Russia and China have combined efforts to de-throne the US dollar from trade dominance, with ample support from other BRICS countries. Latin American countries are also looking at creating their own currency union. These countries are huge net exporters and have much higher deposit interest rates. Despite that, "BRICS+" countries generally suffer much greater monetary instability, mainly due to a lack of FDI and associated "exorbitant privileges" the dollar and Euro have due to global currency pegs. Regardless of one's personal opinions on these countries, it is a fact that they would economically benefit from creating a new currency union that threatens the US dollar's position.SourceMoneyGuru-https://www.mgkx.com/4312.html

Since 2020, growing instability in the US dollar, Euro, Yen, Pound, and others due to immense money-creation have created a massive window of opportunity for these countries to accomplish this. As efforts expand in 2023, relying extensively on Saudi support (due to oil), I believe there is a relatively high potential for the US dollar (and Western peers) to experience significant volatility over the coming year as the trade balance could rapidly shift against the dollar. An economic recession in Western countries would likely accelerate this change, mainly if more QE or rate cuts are pursued, opening the door to higher inflation even with an economic slowdown.SourceMoneyGuru-https://www.mgkx.com/4312.html

Silver is a Hedge Against CBDCs

SLV is likely the best hedge against this risk factor. While digital currencies like Bitcoin could be a hedge, silver has maintained its value for thousands of years and can operate without the energy infrastructure needed for cryptocurrencies. Put simply, if you're bullish on Bitcoin due to fiat currency risks, there's no reason not to be bullish on silver as well. If inflation rises above 10%+, both may perform well, but silver most definitely will (based on vast historical precedents).SourceMoneyGuru-https://www.mgkx.com/4312.html

A recent accidental conversation with the ECB's Christine Lagarde (Powell's European counterpart) implied the ECB has direct efforts to roll out a central bank digital currency CBDC that will have no private oversight. Lagarde also noted that the ECB would lower the threshold for payment control to the 300-400 Euro range, indicating a plan for increased direct government oversight of small private transactions. As the ECB states, there are "two" forms of money, "private money" and "central bank money," that falls under the central bank's jurisdiction of control instead of private banks.SourceMoneyGuru-https://www.mgkx.com/4312.html

To me, the fact that the US Fed and ECB are working so diligently on digital currency plans also implies they're well aware of the growing fiat currency instability issue and are making plans for an alternative. I believe this factor is another reason investors should consider precious metals to hedge against fiat currency risks and uncertainties regarding digital currency alternatives. As the ECB website states, the core "benefit" of digital currency is that it "provides resilience" against unregulated forms of money such as cryptocurrencies and alternative payment solutions (including precious metals). While some investors may welcome more direct oversight from unelected central bank leaders, I believe such control structures may erode tangible wealth stability.SourceMoneyGuru-https://www.mgkx.com/4312.html

SLV is not a perfect protection against this risk since it operates within financial institutions that central banks oversee. However, I think it offers a "middle ground" with some protection against central bank efforts, mixed with ample liquidity, accessibility, and stability not found in bullion and (most) cryptocurrencies.SourceMoneyGuru-https://www.mgkx.com/4312.html

Silver is the Oldest Currency Hedge

Copper, silver, and gold price ratios have maintained relatively tight ranges for thousands of years. They are the oldest forms of money and have maintained stability against other prices despite the general end to precious metals pegs in the 1970s. In my view, there is a solid argument to be made that the world has never stopped using silver as a core currency due to gold and silver's strong correlation with real interest rates. Instead, the end to metal-backing merely allowed fiat currencies to depreciate against precious metals to create an "inflation wealth tax" that slowly transfers wealth away from savers toward institutions.SourceMoneyGuru-https://www.mgkx.com/4312.html

I believe the recent peak in real interest rates and a wave of instability in US and European banks strongly signal an immediate bullish catalyst for silver. This catalyst's potential grows as the Federal Reserve's balance sheet shifts back toward "expansion mode" (putting new money into the financial system) through discount window borrowings. These recent events, and the central bank's reaction to them, signal ample efforts to provide liquidity to ensure the banking system remains relatively stable; however, all of these efforts jeopardize the value of fiat currencies by creating new liquidity amid inflation, potentially exacerbating the issues started in 2020. With BRICS countries making many new currency and trade deals, I believe there is a high potential for the US dollar (and its Western peers) to lose its dominant position since the colonial era. While it would seem this change should take time, I believe a recession will accelerate that timeline.SourceMoneyGuru-https://www.mgkx.com/4312.html

Overall, I am very bullish on SLV and believe it has strong potential for a significant breakout over the coming months. The same factors that benefit silver also benefit gold; however, silver has greater "leverage" to these changes and may rise faster due to the historically low silver-to-gold price ratio. In most instances, I believe SLV is superior to physical bullion due to its accessibility. However, if financial institutions face more pressure, physical bullion may offer tangible protection against counterparty risks. Planned potentials for central bank digital currencies may also increase the need for physical metals due to government control concerns (which were recently confirmed by Lagarde).SourceMoneyGuru-https://www.mgkx.com/4312.html SourceMoneyGuru-https://www.mgkx.com/4312.html