Introduction to Gold Investing

Gold has been a symbol of wealth and prosperity for centuries. From ancient civilizations to modern times, this precious metal has held its value through wars, economic crises, and political turmoil. In today's uncertain times, investors are turning to gold as a safe haven asset that can protect their portfolios from the volatility of financial markets. But why buy gold now? In this blog post, we'll give you 5 compelling reasons why investing in gold could be one of the smartest decisions you make this year! So sit back, grab your favorite drink and let's dive into the world of gold investing!SourceMoneyGuru-https://www.mgkx.com/4310.html

Potential Fed Pause Could Signal Gold Breakout

The Federal Reserve's monetary policy decisions have a significant impact on the economy and financial markets. As such, any indication that the Fed may pause its rate hikes or even cut interest rates could signal a bullish outlook for gold.SourceMoneyGuru-https://www.mgkx.com/4310.html

In recent years, rising interest rates have been a headwind for gold prices as investors seek higher returns in other assets. However, if the Fed pauses its current tightening cycle due to concerns about economic growth or inflation, it could boost demand for safe-haven assets like gold.SourceMoneyGuru-https://www.mgkx.com/4310.html

Furthermore, a potential Fed pause could weaken the US dollar as lower interest rates make it less attractive to foreign investors. A weaker dollar typically supports higher gold prices since the yellow metal is priced in dollars and becomes cheaper for buyers using other currencies.SourceMoneyGuru-https://www.mgkx.com/4310.html

While there are no guarantees of what will happen with future monetary policy decisions by central banks around the world, a potential Fed pause is definitely one factor that could signal an upcoming breakout in gold prices.SourceMoneyGuru-https://www.mgkx.com/4310.html

Recent Bank Collapse Strengthens Gold’s Prospects

The recent collapse of several banks has raised concerns about the stability of financial institutions. Investors are now looking for alternative ways to preserve their wealth, and gold seems to be a viable option.SourceMoneyGuru-https://www.mgkx.com/4310.html

The collapse of banks can lead to a loss in confidence in the banking system, which could result in individuals withdrawing their funds. This can trigger a ripple effect that leads to more bank closures or even a financial crisis.SourceMoneyGuru-https://www.mgkx.com/4310.html

Gold is seen as a safe-haven asset during times of economic uncertainty, and its value tends to rise when other assets fall. As investors move away from stocks and bonds, they may turn towards gold as an investment option.SourceMoneyGuru-https://www.mgkx.com/4310.html

Furthermore, gold is not tied to any one currency or government, making it less vulnerable to fluctuations caused by geopolitical events or changes in monetary policy.SourceMoneyGuru-https://www.mgkx.com/4310.html

In short, recent bank collapses have strengthened the case for investing in gold as part of a diversified portfolio. It provides protection against financial instability and offers long-term growth potential.SourceMoneyGuru-https://www.mgkx.com/4310.html

Persistently high inflation

One of the key reasons to consider investing in gold now is due to persistently high inflation. Inflation measures the rate at which prices for goods and services increase over time, and it can have a significant impact on the value of money.SourceMoneyGuru-https://www.mgkx.com/4310.html

As governments around the world continue to print more money, there is a risk that inflation will accelerate even further. This means that holding cash or other traditional investments could become less valuable over time.SourceMoneyGuru-https://www.mgkx.com/4310.html

Gold has historically been seen as a reliable hedge against inflation because its value tends to rise during times of economic uncertainty. Unlike paper currency, gold cannot be printed or created out of thin air, making it a finite resource with intrinsic value.SourceMoneyGuru-https://www.mgkx.com/4310.html

Investing in gold can help protect your portfolio from the damaging effects of high inflation by providing a stable store of wealth that retains its purchasing power over time.SourceMoneyGuru-https://www.mgkx.com/4310.html

If you're concerned about rising inflation rates and want to safeguard your investments against potential economic instability, investing in gold could be an excellent strategy worth considering.SourceMoneyGuru-https://www.mgkx.com/4310.html

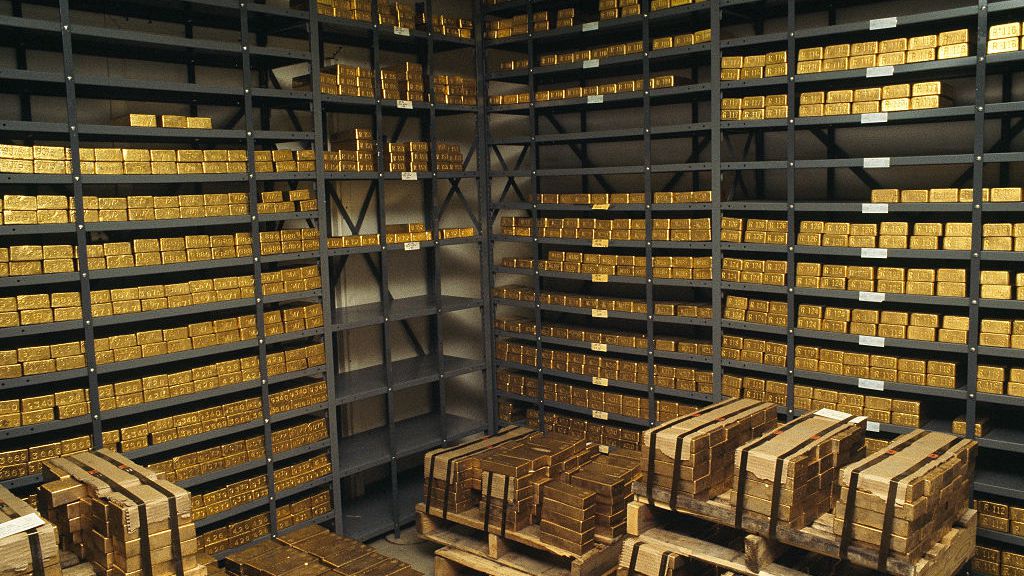

Central banks around the world are aggressively buying gold

Central banks around the world have been buying gold at an unprecedented pace over the past few years. According to data from the World Gold Council, central banks bought 651.5 tonnes of gold in 2018, marking a 74% increase from the previous year and its highest level since 1971 when President Nixon ended convertibility between US dollars and gold.SourceMoneyGuru-https://www.mgkx.com/4310.html

There are several reasons why central banks are aggressively stockpiling gold. One reason is that gold serves as a hedge against inflation and currency devaluation. With many countries facing persistent inflation pressures, particularly emerging markets, central bankers may be turning to gold as a way to protect their currencies' purchasing power.SourceMoneyGuru-https://www.mgkx.com/4310.html

Another reason is geopolitical uncertainty. Central bankers may be worried about potential risks stemming from trade tensions, Brexit or other political developments and view gold as a safe haven asset in times of turmoil.SourceMoneyGuru-https://www.mgkx.com/4310.html

Moreover, some analysts argue that central bank purchases could also reflect efforts to diversify away from US dollar holdings amid concerns over rising debt levels and a potential decline in America's global economic dominance.SourceMoneyGuru-https://www.mgkx.com/4310.html

Regardless of their motivations for accumulating more bullion reserves, this trend highlights growing recognition among policymakers of the unique attributes of physical gold and its value as part of national foreign exchange reserves portfolios.SourceMoneyGuru-https://www.mgkx.com/4310.html

The value of gold is significantly underestimated

Despite its long history as a valuable commodity, the true worth of gold is often underestimated. While many people know that it's a precious metal with inherent value, few really understand just how important and essential this metal is to our global economy. In fact, there are numerous reasons why experts believe that the true value of gold has yet to be realized.

One reason for this undervaluation is simply due to the fact that not enough people invest in gold. Despite its proven track record as a reliable store of wealth during times of economic turmoil or high inflation rates, many investors still overlook it as an asset class. As such, demand remains low and prices can remain stagnant.

Another factor contributing to the underestimation of gold's value is its current price point relative to other assets like stocks and bonds. Because these investments have been performing well in recent years, investors may feel less inclined to allocate funds towards buying physical gold. However, if market conditions were to change suddenly - say through an unexpected recession or geopolitical event - then those who had invested in gold beforehand would likely see significant returns on their investment.

Ultimately though, what makes gold truly invaluable isn't just its rarity or physical properties but rather its universal appeal across cultures and time periods alike; something no other currency or asset can claim.

Conclusion

Investing in gold can be a wise decision for any investor looking to diversify their portfolio. The potential for a Fed pause, recent bank collapses, persistently high inflation, and aggressive central bank buying are all reasons to consider buying gold now.

Moreover, the value of gold is significantly underestimated which means that it still has room to grow in price. By adding some amount of gold investments into your portfolio, you can reduce risk and increase returns.

So why not take advantage of these factors? Gold has been around since ancient times and its worth will never die out. As Warren Buffet once said “Gold gets dug out of the ground in Africa or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it”. So make the most out of this opportunity before someone else does!