Key takeaways

- The volatility among bank stocks was triggered by the rapid closure of 2 regional US banks, after customers began quickly withdrawing deposits.

- In the intervening weeks, investors have seemed to be scrutinizing the strength of financial institutions with new rigor and skepticism—leading to broader volatility.

- While near-term events can be challenging to predict, there may be ongoing impacts for the banking sector over the intermediate term.

- There could also be impacts to market share if some smaller banks are acquired or if customers choose to move their deposits.

As volatility in the banking sector continues, investors may be wondering what the future holds. Since the troubles began with Silicon Valley Bank two weeks ago, the Federal Reserve, regulators, and major banks have come in to help stabilize other at-risk institutions.

"The good news is the Fed and regulators acted quickly to backstop liquidity, and that should help stabilize the system," says Matthew Reed, manager of the Fidelity® Select Financial Services Portfolio (FIDSX). "The system is better capitalized, more liquid today, and improved on with these actions. I don't see this as a systemic issue."SourceMoneyGuru-https://www.mgkx.com/4036.html

Here's a look at what has happened, why it's happened, and what the broader and longer-lasting potential implications could be for banks.SourceMoneyGuru-https://www.mgkx.com/4036.html

Catalysts of the volatility

The volatility among banks was initially triggered by a rapid decline in the share price of Silicon Valley Bank (SVB), which culminated in regulators closing the bank on March 10.SourceMoneyGuru-https://www.mgkx.com/4036.html

SVB served a client base concentrated in the venture capital world. The bank had faced investor and customer worries over its bond portfolio, which had lost significant value due to the rapid rise in interest rates over the past year (bond prices fall when interest rates rise). Concerned customers—more than 90% of whom held amounts greater than the $250,000 covered by FDIC insurance—began withdrawing funds. The bank had to sell bonds at a loss in order to meet these withdrawals, which prompted more customer withdrawals, leading to the bank's closure.SourceMoneyGuru-https://www.mgkx.com/4036.html

As SVB was taking over news headlines, customers of another bank—New York-based Signature Bank—also began rapidly withdrawing deposits. Like customers of SVB, many Signature customers held amounts in excess of FDIC insurance limits. Also similar to SVB, Signature's stock had lost value in the previous 2 days. On March 12, New York regulators announced the closure of the regional bank, which served a mix of cryptocurrency, real estate, and other clients. (Note: On March 19, Flagstar Bank, a subsidiary of New York Community Bancorp, acquired the assets of Signature, with the exception of some digital assets.)SourceMoneyGuru-https://www.mgkx.com/4036.html

Soon after the 2 bank closures, the Treasury, Federal Reserve, and FDIC issued a joint statement announcing that all depositors of both closed institutions would be made whole (including depositors holding amounts in excess of FDIC insurance limits). The regulators also announced the creation of a new liquidity facility that will lend money to banks that need cash to meet withdrawal demands. Importantly, if banks pledge bonds as collateral, the bonds will be valued at "par" (or face value) even if their value is lower on the secondary market, helping to avert the need for banks to sell long-maturity bonds at loss, as SVB did.SourceMoneyGuru-https://www.mgkx.com/4036.html

Investor worries fuel continued uncertainty

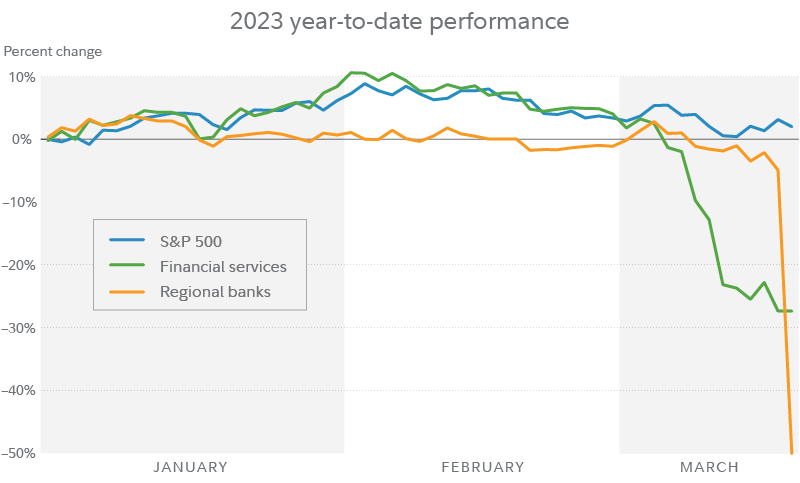

Financial stock indexes experienced volatility in the week that followed the 2 closures, as investors reassessed the strength of many financial institutions.SourceMoneyGuru-https://www.mgkx.com/4036.html

Source: FactSet, as of March 20, 2023. Blue line depicts S&P 500 index, green line represents S&P Composite 1500 Diversified Financial Services index, and orange line represents S&P Composite 1500 Regional Banks index. It is not possible to invest directly in an index.

In the US, investor concerns have largely focused on banks with similarities to SVB and Signature—namely, regional banks whose deposit bases are highly concentrated in a region or industry, or that include a large proportion of uninsured deposits. First Republic Bank, known for its strong franchise of high-net-worth customers, was also drawn into the fray last week. It received $30 billion in funding from 11 of the largest US banks. Investors have also shown concerns over international banks, as shown in the volatility of Switzerland-based Credit Suisse's stock. Switzerland's second-largest bank was vulnerable to a deteriorating customer base and a liquidity problem when its largest investor, Saudi National Bank, declined to invest more in the company. On March 19, it agreed to sell itself to rival UBS Group.SourceMoneyGuru-https://www.mgkx.com/4036.html

What’s different this time

It is never possible to forecast current events with any certainty. In financial markets the challenge can be even greater due to the influence of investor sentiment and psychology. That is why the Fed's moves to insure the safety of depositors and provide help to troubled banks has been so critical.SourceMoneyGuru-https://www.mgkx.com/4036.html

It is also worth noting how the current period bears many differences to the financial crisis of 2008 and accompanying bank failures. For one thing, bank balance sheets are generally much stronger than they were in that period, when many banks were sitting on large credit losses related to subprime mortgages. Banks have been subject to stricter capital requirements in the intervening years—with the largest, systematically significant institutions subject to rigorous stress tests. "Broadly speaking, the banking system has been structured to be stable and supportive," Reed says. Still, there are potential impacts that could affect the US banking sector over the intermediate term.SourceMoneyGuru-https://www.mgkx.com/4036.html

Potential impacts on bank profits

As interest rates have risen over the past year, some banks have increased the interest rates they pay on customer deposits, while others have not.SourceMoneyGuru-https://www.mgkx.com/4036.html

"This episode does bring to light the fact that banks have been paying depositors much less than competing short-term vehicles do," such as money market funds, says Jurrien Timmer, director of global macro at Fidelity.SourceMoneyGuru-https://www.mgkx.com/4036.html

In the wake of the closures, some banks may need to start offering higher rates in order to compete for deposits. And banks that make use of the new liquidity facility may need to pay a rate as high as about 5% to access funding. Both of these factors could pressure their net interest margins (and profits).SourceMoneyGuru-https://www.mgkx.com/4036.html

Potential impact on market share

It's important to note that SVB and Signature are outliers in terms of uninsured accounts. Other regional banks are not positioned in a similar way and are not likely to run into similar problems, says Pierre Sorel, a Fidelity financial sector portfolio manager. Additionally, the great majority of regional banks have strong local franchises and sticky customer relationships.SourceMoneyGuru-https://www.mgkx.com/4036.html

At the same time, it's an open question how recent bank closures may affect depositors' decisions about where they keep their money, particularly if depositors hold amounts that exceed FDIC limits and decide to move their cash.SourceMoneyGuru-https://www.mgkx.com/4036.html

Larger banks could potentially benefit from such moves if customers perceive greater safety at these banks, says Sorel. For example, the country's very biggest banks—which were deemed "too big to fail" in the wake of the 2008 financial crisis—have been subject to years of federal stress tests and requirements for increased loan loss reserves that have strengthened their balance sheets.SourceMoneyGuru-https://www.mgkx.com/4036.html

Generally speaking, larger banks tend to have a bigger share of insured deposits, and more geographically diversified deposits. The largest banks in the US include JPMorgan Chase (JPM), Bank of America (BAC), Citigroup (C), and Wells Fargo (WFC).SourceMoneyGuru-https://www.mgkx.com/4036.html

Similarly, so-called super regional banks are regularly stress tested for economic disruptions, and are in strong shape, Sorel says, and they could see potential benefits in the aftermath of the closures.SourceMoneyGuru-https://www.mgkx.com/4036.html

For example, they may be able to acquire smaller competitors at a discount and consolidate their market share. Super regionals generally have an asset base greater than $250 billion. Examples of such banks include PNC Financial Services Group (SourceMoneyGuru-https://www.mgkx.com/4036.html

), US Bancorp (

), and Truist Financial Corporation (

).

In general, consolidation in the banking sector has been an ongoing trend as banks benefit from scale, Reed says. However, the largest banks may be sidelined from any resulting merger and acquisition activity, as regulations restrict them from buying other institutions that might put them over a 10% cap for total national deposits, Sorel says. (They may exceed that cap as a result of organic growth, however.)

Potential impact on regulation and policy

Finally, given that the 2 closed US banks were both regional institutions with relatively concentrated business focuses, it's possible that regional banks could start to face more regulatory scrutiny, similar to what larger banks faced in the wake of the financial crisis.

That scrutiny could come in the form of increased capital and liquidity requirements for regional banks—as the large banks faced in the aftermath of 2008. And it could include more scrutiny of specialist business models like SVB, that basically catered to one industry.

Additional changes could include an increase on the $250,000 insurance cap per depositor, and some mid-sized banks have petitioned the FDIC to insure all deposits—insured and uninsured—for the next 24 months.

Yet the biggest question for banks of all sizes may be whether the episode prompts the Federal Reserve to slow or discontinue its aggressive interest rate hiking cycle, which could help improve net income and profitability for banks. "If SVB is actually a shot across the bow, then the Fed might have to choose between financial stability and containing inflation expectations," says Timmer.

Until there is clarity on that front, for banks of all sizes, that may mean continued volatility as they navigate more uncertainty and choppy waters.