Key takeaways

- Inflation and a rocky stock market may be wearing on Americans' saving stamina. America's retirement score dropped slightly from the last reading in 2020, according to recent research from Fidelity.

- There are steps investors can take to boost their personal retirement scores, no matter how close or far away retirement may be.

- 3 ways to help supercharge your savings: Saving 15% of your income (including any match from your employer), reevaluating your retirement plan, and investing in an age-appropriate mix of investments that consider your risk tolerance and time horizon.

Many people find the word retirement to be stress-inducing. It’s easy to see why: Saving a significant amount of money consistently for decades through everything that life throws at you is hard—and sometimes even impossible. Add to that high inflation and a rocky stock market and it’s no wonder people are saving a little less for retirement these days and investing more conservatively.

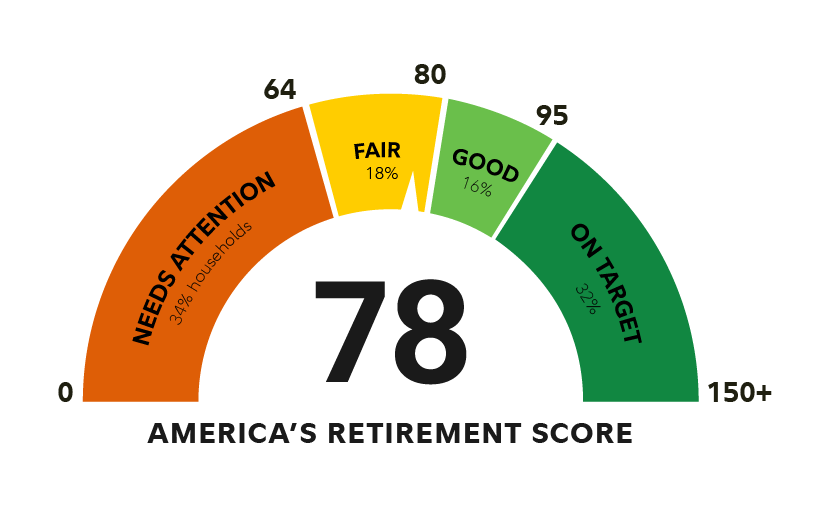

Every 2 years, Fidelity surveys thousands of Americans who have already started saving for retirement. The results are calculated to give the country a score that shows generally how prepared Americans may be in retirement. In 2023, America’s retirement score is 78, down from 83 in 2020. That means that the median person who is saving for retirement is on track to cover 78% of their expenses in retirement.SourceMoneyGuru-https://www.mgkx.com/4039.html

On a generational basis, baby boomers landed a score of 87. Gen X scored 79 and millennials 72. How do you compare? Find out with the Fidelity Retirement Score.SourceMoneyGuru-https://www.mgkx.com/4039.html

The drop in Americans’ retirement preparedness is not surprising given global economic uncertainties, rising prices, and the recent bear market. In this environment, saving anything for retirement should be celebrated and considered a win. Still, there are steps you can take, no matter your age or situation, to improve your readiness to retire on your terms when the time is right.SourceMoneyGuru-https://www.mgkx.com/4039.html

SourceMoneyGuru-https://www.mgkx.com/4039.html

SourceMoneyGuru-https://www.mgkx.com/4039.html

There are 4 categories on Fidelity's retirement preparedness scale. They measure your ability to cover estimated retirement expenses particularly in a down market.3SourceMoneyGuru-https://www.mgkx.com/4039.html

- Dark green: Very good (96 or over). On target to cover 96% or more of total estimated expenses.

- Green: Good (81–95). On target to cover essential expenses, but not discretionary expenses like travel, entertainment, etc.

- Yellow: Fair (65–80). Not on target to cover all essential retirement expenses without modest adjustments to planned lifestyle.

- Red: Needs attention (less than 65). Not on target to cover all essential retirement expenses without significant adjustments to planned lifestyle.

If you have 5, 10, 20, or 30 years until retirement, you have plenty of time to ride out pullbacks in the market. Saving and investing consistently during down markets can actually help supercharge retirement savings once the market rebounds. If you’re closer to retirement, working just 1 or 2 years longer than planned—if it’s a possibility—can have a significant impact on your retirement savings because that’s one extra year your savings and investments can potentially grow, and one less year you’ll need to withdraw from your savings.SourceMoneyGuru-https://www.mgkx.com/4039.html

Looking for ways to catch up on your retirement savings? Here are the 3 biggest steps you can take.SourceMoneyGuru-https://www.mgkx.com/4039.html

3 tips to help prepare for retirement

1. Try to save as much as you can.SourceMoneyGuru-https://www.mgkx.com/4039.html

Your savings rate is the amount of your income that you're able to save, stated as a percentage. If you earn $100,000 and save $10,000 per year—your savings rate would be 10%.SourceMoneyGuru-https://www.mgkx.com/4039.html

The median savings rate for all ages and incomes was 10% in Fidelity's Retirement Savings Assessment (RSA) survey. That's not too far from Fidelity's retirement savings guideline which suggests saving 15% of your income for retirement—including any match you may get from your employer.SourceMoneyGuru-https://www.mgkx.com/4039.html

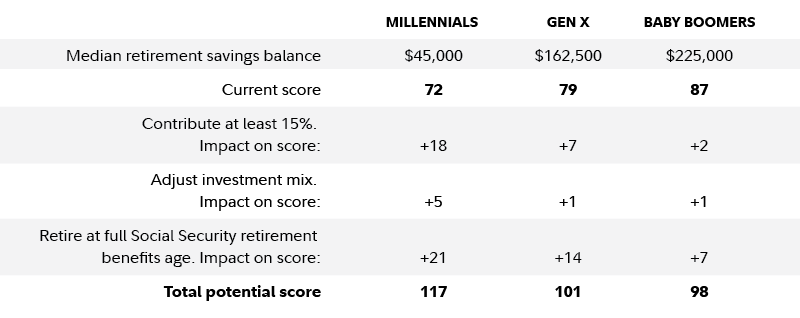

Boosting America's savings rate to 15% could bump up the national average 10 points to 88, solidly in the green.SourceMoneyGuru-https://www.mgkx.com/4039.html

How can you get to 15%? Small steps can help get you there.SourceMoneyGuru-https://www.mgkx.com/4039.html

Make your savings automatic. If you're contributing to a workplace savings plan, your contributions may be made by payroll deduction so the money you contribute never hits your bank account. Since you don't see it come in or go out, you may not think about it or miss it too much.SourceMoneyGuru-https://www.mgkx.com/4039.html

If you're contributing to your own retirement account, like an IRA, you can make those savings automatic as well by setting up direct deposit or establishing recurring transfers from your bank.SourceMoneyGuru-https://www.mgkx.com/4039.html

Look for spending trade-offs. Being aware of your spending and the trade-offs between pleasure now and pleasure later can help identify times when a potential purchase isn’t worth it. A trade-off could also be called an opportunity cost—the choice you don’t make can be a missed opportunity to potentially make more money. Sometimes spending may be worth it but other times, that could be a few extra dollars you could save and invest for your future.SourceMoneyGuru-https://www.mgkx.com/4039.html

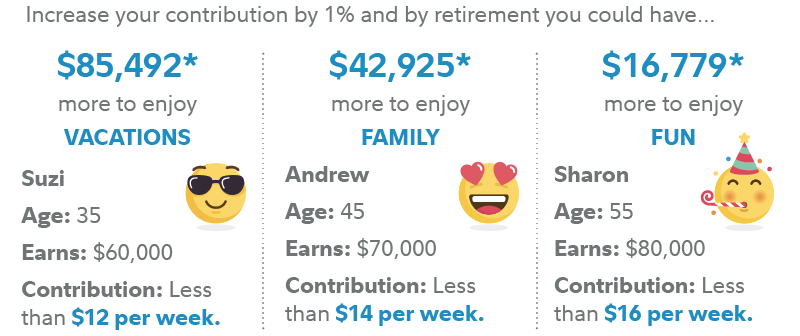

A mindful approach can help you work your way up to saving 15% of your income annually. You could even aim to increase your contribution rate by 1% each year until you get there. 1% more may be less cash to give up than you fear—and even small increases in savings can make a big difference.SourceMoneyGuru-https://www.mgkx.com/4039.html

SourceMoneyGuru-https://www.mgkx.com/4039.html

SourceMoneyGuru-https://www.mgkx.com/4039.html

2. Work a little longerSourceMoneyGuru-https://www.mgkx.com/4039.html

Tacking on a few extra years to the tail end of your career may be a great way to improve your retirement prospects. But it's often not that easy. Health issues may prevent people from working as long as they would like and ageism in the workplace can make it difficult and discouraging for experienced workers. That being said, if you feel behind on your savings and have the opportunity to continue working, it could give your savings a significant boost.SourceMoneyGuru-https://www.mgkx.com/4039.html

The people surveyed by Fidelity reported that they plan to retire, on average, around age 65. For the median American represented by the national RSA score, retiring at their full Social Security retirement benefits age (around age 67) could improve the score by 17 points.SourceMoneyGuru-https://www.mgkx.com/4039.html

Waiting to claim Social Security at age 70 instead of age 65 is another strong step—it could increase your payments by 43%.

3. Consider an age-appropriate investment mix

Most people who are saving for retirement are invested appropriately for their age,6 goals, and time frame. Still, making some adjustments to an investment mix has the potential to improve your readiness for retirement.

In general, we believe younger people should be invested in stocks for long-term growth potential, while people closer to retirement are better off in a more balanced stock/bond portfolio. By adjusting portfolios appearing to be either too conservative (not enough stocks) or too aggressive (too heavy in stocks) with age-appropriate mixes, the national median score improves 2 points.

Taken together, saving more, working until full retirement age or beyond, and tweaking the investment mix brings America's retirement score up to 108—enough to cover 100% of estimated expenses in retirement with more to spare.

Opportunities for improvement in retirement savings by age

Here's where each generation stands in their retirement planning and how they can improve their savings.

How to plan for retirement by age

As boomers get closer to retirement, being clear on your goals and having a plan in place can make a big difference in ensuring your savings last.

Key questions to ask yourself:

- Can I delay claiming Social Security?

- What will my income sources in retirement be?

- What will my strategy be for taking income from my retirement accounts?

Close to retirement?

- Answer a few questions and get help prioritizing retirement decisions like when to claim Social Security and planning for health insurance: Retirement Decision Guide.

- Explore how much money you could have every month: Retirement Income Calculator.

People in Gen X are in their prime earning years and may still have a long time before retirement to save and invest. With years to stay invested, there's plenty of time for your investments to potentially grow so funneling extra money toward retirement now can make good sense. People over age 50 can even take advantage of catch-up contributions to boost savings.

Key questions to ask yourself:

- How much income will I need in retirement?

- How can I save more?

- Do I have the right mix of investments?

Millennials have time on their side so staying invested and making steady contributions can help your retirement savings grow long term and likely recover from any downturns.

Key questions to ask yourself:

- How can I improve my investment mix?

- What tax-advantaged accounts should I be investing in? Examples of tax-advantaged accounts include health savings accounts (HSAs), workplace savings plans like 401(k)s, and IRAs.

Keep up the great work!

The road to retirement is a long one with unexpected twists and turns. Don't despair if you can't save 15% of your income right now. Save what you can consistently while keeping the rest of your financial life in order. Try to invest for growth potential even when things look bleakest in the stock market. Trust that doing your best at these things now can pay off in the future. It's not always easy but it will be worth it.