As a result of nearly two weeks of financial turmoil, the Federal Reserve raised its target federal funds rate by a modest 0.25 percentage point on Wednesday.

Nevertheless, this marks the ninth consecutive increase since the central bank began its current rate-raising cycle to combat rising prices one year ago.SourceMoneyGuru-https://www.mgkx.com/4008.html

Inflation spiked to a 40-year high over the last 12 months and then started to ease, but all of that tightening has been tied to banking issues.SourceMoneyGuru-https://www.mgkx.com/4008.html

During this time, consumers must borrow at higher interest rates while facing a persistently high cost of living - all while suffering from a crisis of confidence when it comes to saving.SourceMoneyGuru-https://www.mgkx.com/4008.html

What the federal funds rate means to you

A former chief economist at the Department of Labor and an economics professor at George Washington University, Diana Furchtgott-Roth said that the bank problems are likely making people think twice. Whenever people feel less well off than they did before, they spend less, according to the wealth effect, she said.SourceMoneyGuru-https://www.mgkx.com/4008.html

As part of its efforts to contain inflation, the Federal Reserve has raised its benchmark interest rate.SourceMoneyGuru-https://www.mgkx.com/4008.html

Banks borrow and lend overnight at the federal funds rate, which also influences credit card, mortgage, and auto loan rates for consumers, either directly or indirectly.SourceMoneyGuru-https://www.mgkx.com/4008.html

Your wallet can be affected by higher rates

Credit cards

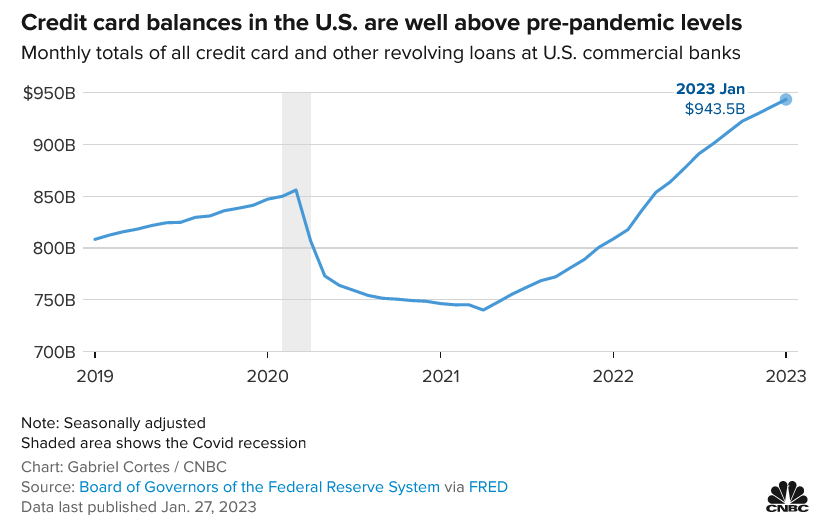

Most credit cards offer variable rates, so their rates follow the Fed's benchmark. As the federal funds rate rises, so does the prime rate, and so does your credit card rate.SourceMoneyGuru-https://www.mgkx.com/4008.html

On average, credit card interest rates are now over 20%, up from 16.3% a year ago, according to Bankrate. At the same time, Americans, in general, feel less financially secure.SourceMoneyGuru-https://www.mgkx.com/4008.html

SourceMoneyGuru-https://www.mgkx.com/4008.html

SourceMoneyGuru-https://www.mgkx.com/4008.html

For those with credit card debt, a 0% balance transfer credit card may be the best option, according to Matt Schulz, chief credit analyst for LendingTree. Otherwise, a lower-interest personal loan can be used to consolidate and pay off a high-interest revolving balance.SourceMoneyGuru-https://www.mgkx.com/4008.html

LendingTree recently found that consolidating $10,000 of credit card debt into a personal loan could save borrowers up to $3,000, even if monthly payments remain the same.SourceMoneyGuru-https://www.mgkx.com/4008.html

Home Loans

Anyone shopping for a new home has lost considerable purchasing power, partly because of inflation and the Fed's policies, even though 15-year and 30-year mortgage rates are fixed.SourceMoneyGuru-https://www.mgkx.com/4008.html

When the Fed started raising rates last March, the average rate for a 30-year, fixed-rate mortgage was 4.40%.SourceMoneyGuru-https://www.mgkx.com/4008.html

In contrast, many home loans are closely tied to Fed actions. Adjustable-rate mortgages, or ARMs, and home equity lines of credit, or HELOCs, are pegged to prime rates. ARMs adjust once a year after an initial fixed-rate period, while HELOCs adjust right away. In just one year, the average HELOC rate has increased from 3.96% to 7.76%.SourceMoneyGuru-https://www.mgkx.com/4008.html

According to Sam Khater, Freddie Mac's chief economist, homebuyers can greatly benefit from shopping around for additional rate quotes.SourceMoneyGuru-https://www.mgkx.com/4008.html

By shopping around among multiple lenders, homebuyers can potentially save $600 to $1,200 annually.SourceMoneyGuru-https://www.mgkx.com/4008.html

Auto loans

The price of cars is rising along with interest rates on new loans, so if you plan to buy a car in the months ahead, you'll have to spend more even though auto loans are fixed.SourceMoneyGuru-https://www.mgkx.com/4008.html

A five-year new car loan now carries an average interest rate of 6.48%, up from 4% a year ago.SourceMoneyGuru-https://www.mgkx.com/4008.html

With the Fed's latest move, the average interest rate could rise even higher at a time when borrowers are already struggling to keep up with higher monthly payments.SourceMoneyGuru-https://www.mgkx.com/4008.html

Consumers with high credit scores may be able to secure better loan terms or find better deals on used cars.SourceMoneyGuru-https://www.mgkx.com/4008.html

Another recent study found that car buyers could save an average of $5,198 by choosing the offer with the lowest APR over the one with the highest.

Student loans

Moreover, federal student loan rates are fixed, so a rate hike won't affect most borrowers immediately. Federal student loans taken out for the 2022-23 academic year already have an interest rate of 4.99%, up from 3.73% last year, and those disbursed after July 1 will likely have even higher interest rates.

The interest rate on a private loan may be fixed or variable, based on Libor, prime or T-bill rates, which means that as the central bank raises rates, borrowers will likely pay more, although the amount will vary depending on the benchmark.

The Education Department expects the payment pause to end sometime this year, so those with existing federal education debt can benefit from 0% rates for the time being.

CDs and savings accounts

Savings account rates at some of the largest retail banks, which were near rock-bottom for years, are now up to 0.35%, on average, due to changes in the Federal Funds Rate.

According to Bankrate, top-yielding online savings account rates can reach 5.02%, much higher than last year's 0.75% and significantly higher than the average rate from a traditional brick-and-mortar bank.

DepositAccounts.com reports that rates on one-year certificates of deposit at online banks have also risen over 5%.

The returns on savings accounts and CDs are the highest in 15 years, according to Greg McBride, chief financial analyst at Bankrate.com.

While most savers don't need to worry about their cash at the bank since FDIC-insured funds cannot be lost due to a bank failure, money that earns less than inflation still loses purchasing power over time.