As the second quarter draws to a close, we stand on the precipice of anticipation, fueled by a surge of late window dressing, and naturally find ourselves reflecting on the central theme of the past three months. Is it too simplistic to point at the burst of "AI Mania" and call it a day? While AI's influence is undeniable, the narrative of the quarter is far richer and more complex than one sector's performance.

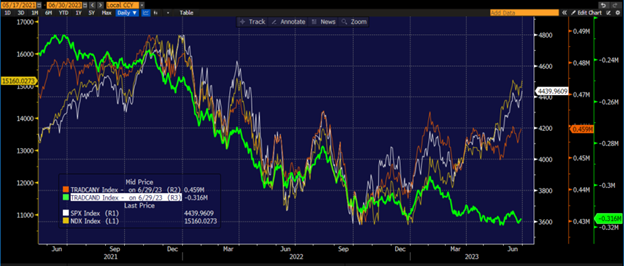

It's all too easy to gaze at the stellar 12+% gain for the NASDAQ 100 (NDX), observe its propulsion by market-leading mega-cap techs, and conclude our analysis there. But this would be painting an incomplete picture. The S&P 500 Index has seen an impressive rise of over 8%, and while the mega-caps undoubtedly played a critical role in that rally, they were not the sole contributors.SourceMoneyGuru-https://www.mgkx.com/4905.html

SourceMoneyGuru-https://www.mgkx.com/4905.html

SourceMoneyGuru-https://www.mgkx.com/4905.html

This quarter, we started to witness the early signs of rotation with other sectors beginning to participate in the rally. The Russell 2000’s quarter-to-date gains are approaching a respectable 5%. The story abroad is equally fascinating. European stocks, having posted double-digit gains in Q1, remained modestly higher on balance, whereas the Nikkei 225's 20% gain was nothing short of astonishing. However, the much-anticipated reopening of China failed to live up to the early hype, and both Mainland Chinese and Hong Kong indices fell.SourceMoneyGuru-https://www.mgkx.com/4905.html

As the below chart suggests, the rotation is still a work in progress. Although advance/decline lines have shown some recovery, they are far from fully confirming the recent moves.SourceMoneyGuru-https://www.mgkx.com/4905.html

Interestingly, the most significant catalyst for this quarter’s run, at least in the US, was the banking crises that peaked last quarter. It's tempting to revert to the axiom that "whatever doesn't kill you makes you stronger," but such a saying, while valid in this context, doesn't provide the full picture. A crucial catalyst was the Federal Reserve's balance sheet expansion by $300 billion as a result of loans to the banking sector.SourceMoneyGuru-https://www.mgkx.com/4905.html

Monetary policy transmission has always been characterized by a striking asymmetry. Markets react swiftly—within weeks—to any form of monetary accommodation, while the impact of rate hikes and quantitative tightening (QT) unfolds over a much longer and less predictable time frame. In this case, the accommodation wasn't specifically targeted at markets, but the balance sheet expansion quickly trickled into already buoyant markets. The rapid undoing of several months’ worth of QT gave a caffeine-like boost to markets that were primed for take-off. Despite QT bringing the balance sheet back to prior levels, the equity market's enthusiasm, or inertia, remains firmly in place, even if it has waned somewhat in the bond market.SourceMoneyGuru-https://www.mgkx.com/4905.html

As we peer into the future, equities are about to face a stern test with the onset of the second-quarter earnings season in roughly two weeks. A significant chunk of the current rally, particularly in the tech sector, has been fueled by multiple expansion. If we examine P/E ratios, we see that price (P) has outpaced earnings (E), implicitly suggesting that earnings expectations have increased, regardless of whether the published estimates reflect this. A key factor driving this quarter's rally was a solid response to Q1 earnings in April. Most companies met or slightly exceeded expectations, while others, like Nvidia (NVDA), soared based on positive guidance. The question now is whether expectations have been set too high, at least in the near term.SourceMoneyGuru-https://www.mgkx.com/4905.html

Turning to the near term, I was recently asked whether investors should consider taking profits after the remarkable rally and ahead of the earnings season. My suggestion was to buy insurance instead. With the VIX at around 13, volatility is at its lowest since February 2020, an interesting point of reference to say the least. The VIX offers the market's best estimate of volatility over the coming 30 days, which now includes the heart of the earnings season. The current low level of volatility suggests that traders are rather calm about the upcoming earnings releases.SourceMoneyGuru-https://www.mgkx.com/4905.html

However, if we consider volatility protection akin to insurance, it is not about making a profit but rather about safeguarding our investments. Just as we don't desire a fire at our home but still buy fire insurance, similarly, when the value of our financial assets has appreciated significantly, it is prudent to buy insurance to protect against potential downturns. And when the cost of this insurance is low, as it is now, it becomes an even more compelling proposition.SourceMoneyGuru-https://www.mgkx.com/4905.html

In conclusion, the second quarter has been a dynamic period marked by a fascinating dance of sector rotation and resilience against external shocks. Tech and AI have been standout performers, but the gains have been more widespread, with other sectors also participating in the rally. Meanwhile, the global markets have painted a mixed picture, with impressive gains in some regions contrasted by underwhelming performance in others.SourceMoneyGuru-https://www.mgkx.com/4905.html

Central to this quarter's theme has been the Federal Reserve's accommodating monetary policy, which provided a significant boost to the markets. As we look ahead, the focus will be on the upcoming earnings season and whether the market's high expectations will be met or potentially result in a correction. In these times of low volatility, investors should consider safeguarding their gains by buying insurance, allowing for a peaceful night's sleep regardless of the market's ups and downs.SourceMoneyGuru-https://www.mgkx.com/4905.html

This quarter has taught us the importance of looking beyond the obvious, beyond the mega-cap techs and AI, and appreciating the more nuanced narrative of market dynamics. As we prepare to step into the next quarter, let us carry this lesson forward: the markets are an intricate ballet of myriad factors, and understanding them requires us to appreciate the entire performance, not just the prima ballerinas. The curtain has closed on 2Q, but the stage is set for an exciting 3Q – let's watch the performance unfold.SourceMoneyGuru-https://www.mgkx.com/4905.html SourceMoneyGuru-https://www.mgkx.com/4905.html