Are you tired of being confused about your finances and unsure where to start when it comes to managing your money? Look no further than Personal Capital (now Empower)! With their suite of financial management tools, you can take control of your investments, track your spending habits, and plan for long-term financial goals. In this comprehensive review, we'll dive into everything that Personal Capital has to offer and help you understand how to master your money once and for all. Say goodbye to financial stress and hello to a brighter financial future with Personal Capital!

SourceMoneyGuru-https://www.mgkx.com/4083.html

SourceMoneyGuru-https://www.mgkx.com/4083.html

Introduction to Personal Capital (Empower) and Its Features

Personal Capital is a financial management tool that allows you to see all of your accounts in one place and gives you insights into your spending, saving, and investing. The features of Personal Capital include:SourceMoneyGuru-https://www.mgkx.com/4083.html

- -A Dashboard that shows you a summary of your finances and where your money is going

- -Spending Tracker that shows you where you are spending your money and how much you are spending on each category

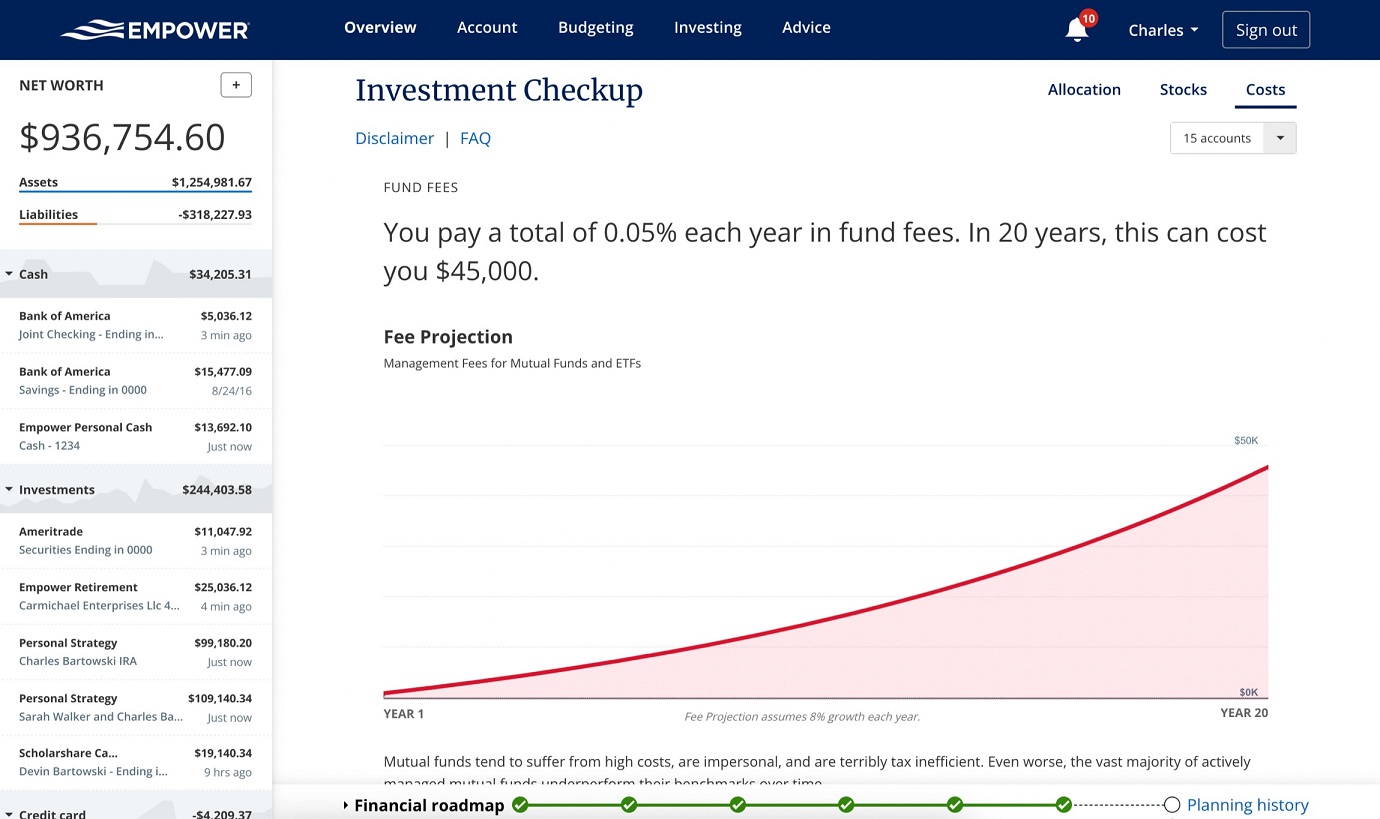

- -Investment Tracker that shows you your investment portfolio and performance

- -Retirement Planner that shows you how much you need to save for retirement and how to best invest your money to reach your goals

- -Financial Goals setting so you can track your progress towards specific financial goals

Overview of Personal Capital Services

Personal Capital is a financial management tool that allows users to see all of their financial accounts in one place. The service also offers a variety of features to help users manage their money, including budgeting, goal setting, and investment tracking.SourceMoneyGuru-https://www.mgkx.com/4083.html

- budgeting: Users can create a budget and track their progress towards meeting their financial goals.

- goal setting: Users can set financial goals and receive updates on their progress.

- investment tracking: Users can track their investments and see how they are performing.

SourceMoneyGuru-https://www.mgkx.com/4083.html

SourceMoneyGuru-https://www.mgkx.com/4083.html

Benefits of Using Personal Capital

There are many benefits to using Personal Capital’s financial management tools. One of the biggest advantages is that it can help you save time and money. With all of your financial information in one place, you can easily track your progress and see where you need to make adjustments.SourceMoneyGuru-https://www.mgkx.com/4083.html

Another great benefit is that Personal Capital can help you become more disciplined with your spending. By seeing all of your expenses in one place, you can more easily identify areas where you may be overspending. This can help you make changes to your budget and ultimately help you save money.SourceMoneyGuru-https://www.mgkx.com/4083.html

Finally, Personal Capital’s tools can also help you plan for the future. With the ability to see your net worth, investment portfolio, and retirement account balances all in one place, you can easily track your progress and make sure you are on track to reach your financial goals.SourceMoneyGuru-https://www.mgkx.com/4083.html

Budgeting Tools & Investment Advice in Personal Capital

If you're looking for budgeting tools and investment advice, Personal Capital is a great resource. With Personal Capital, you can track your spending, see where your money is going, and get advice on how to save and invest more effectively.SourceMoneyGuru-https://www.mgkx.com/4083.html

Personal Capital's budgeting tools are designed to help you understand your spending habits and make informed decisions about where to allocate yourmoney. You can see how much you're spending on necessary expenses like housing and groceries, as well as discretionary purchases like entertainment and travel. Personal Capital also allows you to set up budgets and track your progress over time.SourceMoneyGuru-https://www.mgkx.com/4083.html

In addition to budgeting tools, Personal Capital provides investment advice and guidance. They offer an extensive library of articles and resources on investing, including advice on choosing the right investments for your goals and risk tolerance. Personal Capital also has a team of experienced financial advisors who can provide one-on-one guidance if you're looking for more personalized assistance.SourceMoneyGuru-https://www.mgkx.com/4083.html

Retirement Planning with Personal Capital

When it comes to retirement planning, Personal Capital is a great option for those looking for comprehensive financial management tools. With Personal Capital, you can get a clear picture of your overall finances, including your investment portfolio, income and expenses, and net worth. You can also use the Retirement Planner tool to see how much you need to save to reach your retirement goals.SourceMoneyGuru-https://www.mgkx.com/4083.html

Personal Capital is a free financial management tool that gives you a clear picture of your overall finances. It includes your investment portfolio, income and expenses, and net worth. You can also use the Retirement Planner tool to see how much you need to save to reach your retirement goals.SourceMoneyGuru-https://www.mgkx.com/4083.html

Tax & Estate Planning with Personal Capital

Personal Capital is a wealth management company that provides individuals with a holistic view of their financial lives. The company's tax and estate planning services are designed to help individuals save money on taxes and maximize the value of their estates.SourceMoneyGuru-https://www.mgkx.com/4083.html

Individuals who use Personal Capital's tax and estate planning services can expect to receive comprehensive advice on how to reduce their tax liability and create an estate plan that maximizes the value of their assets. The company's team of certified public accountants and financial planners will work with each client to develop a personalized plan that meets their unique needs.SourceMoneyGuru-https://www.mgkx.com/4083.html

Clientele can rest assured that they are in good hands as Personal Capital has over $1.3 billion in AUM and serves over 1.5 million clients across the globe.SourceMoneyGuru-https://www.mgkx.com/4083.html

Review of Security Measures & Customer Support

At Personal Capital, we take the security of our clients' data and information very seriously. We have implemented a number of industry-leading security measures to protect our client's accounts and data from unauthorized access or theft. In addition, we offer 24/7 customer support to help our clients with any questions or concerns they may have about their account.SourceMoneyGuru-https://www.mgkx.com/4083.html

Personal Capital is committed to providing our clients with the best possible experience when it comes to managing their finances. We believe that by offering a comprehensive suite of financial management tools, along with world-class security and customer support, we can help our clients achieve their financial goals.SourceMoneyGuru-https://www.mgkx.com/4083.html

Alternatives to Personal Capital

There are a number of other financial management tools available on the market that offer similar features to Personal Capital. Some of these alternative options include:SourceMoneyGuru-https://www.mgkx.com/4083.html

Mint: Mint is a popular budgeting and tracking app that is free to use. It offers many of the same features as Personal Capital, including the ability to track your spending, income, investments, and debts in one place.SourceMoneyGuru-https://www.mgkx.com/4083.html

YNAB (You Need a Budget): YNAB is another budgeting app that can help you track your money and stay on top of your finances. like Personal Capital, it offers features such as goal setting, debt tracking, and investment monitoring. However, unlike Personal Capital, YNAB charges a monthly subscription fee.SourceMoneyGuru-https://www.mgkx.com/4083.html

FinancialForce: FinancialForce is an enterprise-level financial management tool that offers features similar to Personal Capital. However, it is geared towards businesses rather than individuals. As such, it may be more suitable for those with complex financial needs.

Clarity Money: Clarity Money is a personal finance app that helps you budget and save money. It offers many of the same features as Personal Capital, including the ability to track your spending, income, investments, and debts in one place. Unlike Personal Capital, however, Clarity Money also offers resources and advice to help you make better financial decisions.

Conclusion

Personal Capital’s financial management tools have been a game-changer for those looking to better master their money. Their user-friendly dashboard, in combination with their wide range of features, has made managing one's finances easier and more efficient than ever before. Whether you're trying to get a better handle on your investments or simply want to keep track of all your accounts in one place, Personal Capital can provide the solutions you need. With its suite of powerful tools and data-driven insights, it is no wonder why countless people turn to Personal Capital for help with handling their personal finances.

Trackbacks