Hawkish comments by Federal Reserve Chairman Jerome Powell about efforts to tame inflation have deepened the inversion of the bond yield curve for U.S. Treasury securities, which many on Wall Street have come to view as a leading indicator of an upcoming recession.

Powell delivered the Fed’s semi-annual update to Congress on monetary policy this week and told lawmakers that the central bank will need to raise interest rates higher than previously expected because inflation has remained persistently high despite a series of rate hikes amid strong economic growth.SourceMoneyGuru-https://www.mgkx.com/3707.html

One of the most closely watched spreads on the yield curve is that between the two-year and 10-year Treasury notes, which is referred to as the "2/10 spread" as shorthand. The 2/10 spread has been inverted in July 2022 – just four months after the Fed began to raise rates last March.SourceMoneyGuru-https://www.mgkx.com/3707.html

The 2/10 spread reached negative 103.1 basis points on Tuesday – the largest inversion between those securities since September 1981 when the economy was in a recession as the Fed was raising interest rates to tamp down rampant inflation – and widened to about 107 basis points Wednesday.SourceMoneyGuru-https://www.mgkx.com/3707.html

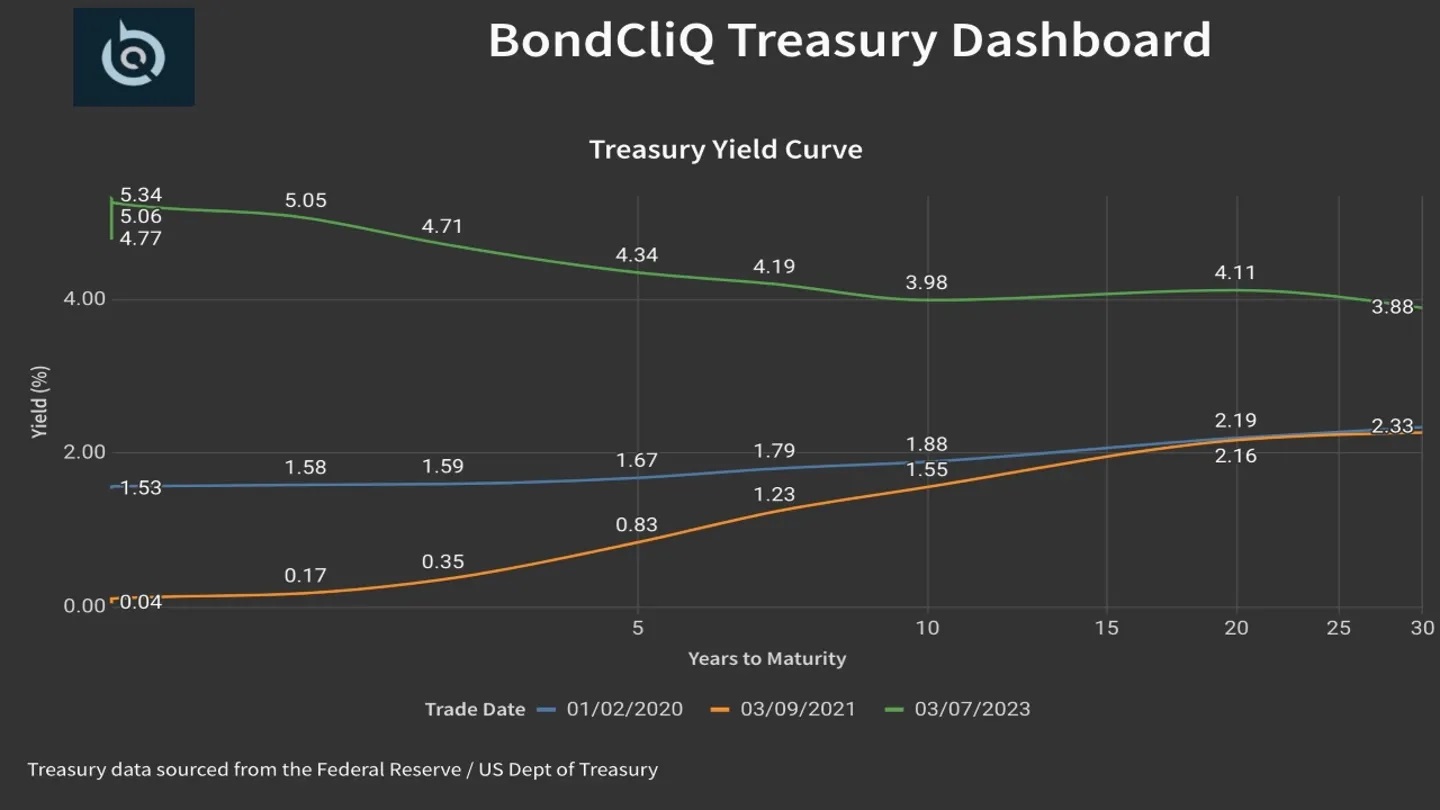

This chart shows the current inversion of the Treasury yield curve (green) as compared to more typical yield curves from before the pandemic in January 2020 (blue) and about one year into the pandemic in March 2021 (orange). (Courtesy of BondCliQ)

For context, the 2/10 spread averaged about 84 basis points in recent decades. The 2/10 spread was at its steepest in March 2010 when it reached 280 basis points as the economy began to slowly recover from the financial crisis. The deepest inversion of the 2/10 yield curve occurred in March 1980 when it reached negative 199 basis points.SourceMoneyGuru-https://www.mgkx.com/3707.html

Paul Faust, the co-head of strategic accounts at BondCliQ, told FOX Business, "The current inversion of the U.S. Treasury curve is signaling the market’s concern of near-term inflationary pressures and the need for the Fed to act coupled with their concern of recession or weakness in longer-term economic expansion."SourceMoneyGuru-https://www.mgkx.com/3707.html

Powell said that the Fed hasn’t made a decision yet on the size of the next round of rate hikes that will be announced after the central bank’s March meeting. The Fed eased the pace of rate hikes following its last two meetings, opting for a 25-basis-point hike at its February meeting, which raised the benchmark federal funds rate to a range of 4.5% to 4.75%. That followed a 50-basis-point hike in December that had been preceded by four consecutive 75-basis-point increases.SourceMoneyGuru-https://www.mgkx.com/3707.html

Rising interest rates on Treasurys mean that rates for auto loans, credit cards and mortgages will all tend to rise as well, raising costs for borrowers and consumers. They also create an incentive for investors to move out of equity markets and into Treasurys as they offer more attractive interest rates.SourceMoneyGuru-https://www.mgkx.com/3707.html

"Investors have historically compared 10-year Treasury yields to the dividend yield of the S&P when making investment decisions," Faust said. "The dividend yield on the S&P is still close to historical lows at about 1.3% versus 10-year yields of almost 4%, a 15-year-high. Given recessionary concerns indicated by the Treasury market, the equity market looks to be the most at risk of a correction."SourceMoneyGuru-https://www.mgkx.com/3707.html

Yield curves and their relation to recessions

Typically, longer-term Treasurys carry higher interest rates than short-term securities because there is greater uncertainty about the economy over a longer period of time, so Treasurys with maturities 10 or more years into the future command a risk premium in the form of higher interest rates. This means that ordinarily, the yield curve gradually slopes upward in tandem with the duration of a given Treasury security.SourceMoneyGuru-https://www.mgkx.com/3707.html

Yield curve inversions occur rarely but are viewed as a predictor of an upcoming recession because they suggest that investors believe that economic growth will slow in the short term and that over a more extended period of time, the Fed will have to return to cutting interest rates to stimulate growth.SourceMoneyGuru-https://www.mgkx.com/3707.html

The Federal Reserve Bank of San Francisco published research in 2018 that found every recession since 1955 has been preceded by an inversion of the 2/10 spread that occurred six to 24 months prior to the recession, and it only delivered one false signal in that time frame.SourceMoneyGuru-https://www.mgkx.com/3707.html

Anu Gagger, a global investment strategist for Commonwealth Financial Network, found 28 inversions of the 2/10 spread dating back to 1900, and recessions followed in 22 of those instances. She said in June that the last six recessions began an average of six to 36 months after the curve inverted.SourceMoneyGuru-https://www.mgkx.com/3707.html

Fox Business’ Megan Henney and Reuters contributed to this report.SourceMoneyGuru-https://www.mgkx.com/3707.html SourceMoneyGuru-https://www.mgkx.com/3707.html