Do you often find yourself anxiously waiting for your tax refund each year, dreaming of all the things you'll buy with that extra cash? What if we told you there is a better way to use that money - one that could unlock a pathway towards financial freedom? In this beginner's guide, we will explore practical tips and tools to help you make the most out of your tax refund and start building long-term wealth. No matter where you stand in your financial journey, it's never too late to take control of your finances and achieve true financial independence. So let's dive in!

SourceMoneyGuru-https://www.mgkx.com/4466.html

SourceMoneyGuru-https://www.mgkx.com/4466.html

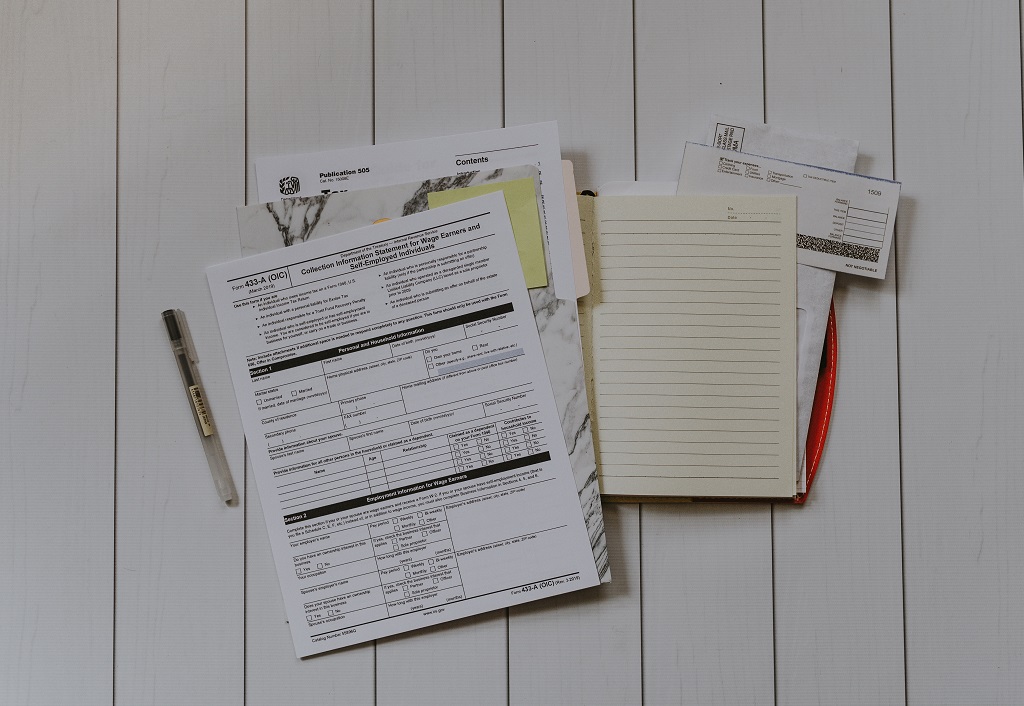

Introduction to Tax Refunds

When it comes to tax refunds, there are a lot of misconceptions out there. A lot of people think that they're entitled to a refund simply because they've overpaid their taxes throughout the year. However, that's not always the case.SourceMoneyGuru-https://www.mgkx.com/4466.html

In order to get a refund, you have to have paid more taxes than you owe. If you've paid exactly what you owe, then you won't receive a refund. While it may seem like you're due a refund simply because you've been paying taxes all year, it doesn't work like that.SourceMoneyGuru-https://www.mgkx.com/4466.html

There are a few exceptions to this rule, however. If you've made any mistakes on your tax return, such as overstating your deductions, then you may be entitled to a refund. Additionally, if you've had any changes in your tax situation during the year (such as getting married or having a baby), then you may also be due a refund.SourceMoneyGuru-https://www.mgkx.com/4466.html

If you think you might be due a refund, the best thing to do is file your tax return as soon as possible. The sooner you file, the sooner you'll get your money back - and who doesn't want that?SourceMoneyGuru-https://www.mgkx.com/4466.html

How to Use Your Tax Refund Wisely

When it comes to your tax refund, there are a few key things to keep in mind in order to make the most of it. First and foremost, be sure to set aside some money for any unexpected expenses that may come up. It’s also important to remember that your refund is not “free money” – it’s simply money that you overpaid to the government throughout the year. With that in mind, here are a few suggestions for using your refund wisely:SourceMoneyGuru-https://www.mgkx.com/4466.html

1. Invest in yourself – Use your refund to cover the costs of taking a financial literacy course or investing in other resources that can help you get ahead financially.SourceMoneyGuru-https://www.mgkx.com/4466.html

2. Invest in your home – Use your refund to make much-needed repairs around the house or put it towards a down payment on a new home.SourceMoneyGuru-https://www.mgkx.com/4466.html

3. Invest in your future – Use your refund to contribute to a retirement account or start saving for your child’s college education.SourceMoneyGuru-https://www.mgkx.com/4466.html

4. Pay off debt – Use your refund to pay down high-interest debt, such as credit card debt or student loans. This will free up more of your income each month and put you on the path to financial freedom!SourceMoneyGuru-https://www.mgkx.com/4466.html

Strategies for Properly Managing Your Tax Refund Money

If you are one of the many people who receive a tax refund each year, it is important to know how to properly manage that money. A tax refund can be a great way to jumpstart your savings or pay down debt, but only if you use it wisely. Here are a few strategies for properly managing your tax refund money:SourceMoneyGuru-https://www.mgkx.com/4466.html

1. Save it. A tax refund is like found money, so it makes sense to sock it away in savings. This will give you a nice cushion to fall back on in case of an unexpected expense or emergency.SourceMoneyGuru-https://www.mgkx.com/4466.html

2. Pay down debt. If you have high-interest debt, such as credit card debt, using your tax refund to pay it down can save you a lot of money in interest charges over time.SourceMoneyGuru-https://www.mgkx.com/4466.html

3. Invest it. If you have been wanting to invest in stocks or mutual funds, using your tax refund to do so can be a smart move. Just be sure to research any investments carefully before putting your money in them.SourceMoneyGuru-https://www.mgkx.com/4466.html

4. Use it for home improvements. If there are repairs or updates you have been wanting to make around your home, using your tax refund could be a good way to fund them. Just be sure not to go overboard and spend more than you can afford just because you have the extra money available.SourceMoneyGuru-https://www.mgkx.com/4466.html

5. Give some away. If you are fortunate enough to have more money than you need, consider giving some of your tax refund away to charity or someone in need. It will make you feel good to help others and it can be a great way to pay it forward.SourceMoneyGuru-https://www.mgkx.com/4466.html

No matter what you do with your tax refund money, the most important thing is to make sure you are doing something financially responsible with it. This will give you peace of mind knowing that your hard-earned money is being used for something positive.SourceMoneyGuru-https://www.mgkx.com/4466.html

What Factors Can Affect Tax Refund Amounts?

When it comes to tax refunds, there are a lot of factors that can affect the amount you receive. The most common factor is your income. If you make more money, you're likely to get a bigger refund. Other factors include your filing status, your deductions, and whether or not you have any credits.SourceMoneyGuru-https://www.mgkx.com/4466.html

If you want to get the biggest refund possible, it's important to understand all of the factors that can affect it. That way, you can make sure you're taking advantage of all the deductions and credits you're entitled to.SourceMoneyGuru-https://www.mgkx.com/4466.html

Pros and Cons of Investing in Tax Refund Money

When it comes to your tax refund, you may be wondering if it’s worth investing the money. After all, a refund can be a significant amount of money, and you may be eager to make the most of it.SourceMoneyGuru-https://www.mgkx.com/4466.html

However, there are both pros and cons to investing your tax refund. On the plus side, investing can help you grow your money over time. This can be especially helpful if you invest in something that has the potential to appreciate in value, such as real estate or stocks.

On the downside, however, investments can also come with risk. There’s always the chance that you could lose money on an investment, so it’s important to weigh the potential risks and rewards before making any decisions.

Ultimately, whether or not you choose to invest your tax refund is up to you. But if you do decide to invest, it’s important to do your research and make sure you understand all of the risks involved.

Common Mistakes & How to Avoid Them

When it comes to taxes, there are a lot of things that can trip you up and result in a smaller refund – or even owing money to the government. Here are some of the most common mistakes people make, and how you can avoid them:

• Not Keeping Good Records: Throughout the year, you should keep records of all your income and expenses so that come tax time, you’re not scrambling to try and remember everything. This will also help if you get audited.

• overestimating Deductions: It’s tempting to try and deduct everything possible, but beware of doing this. The IRS has specific guidelines on what can be deducted, so make sure you know what these are before claiming anything on your return. Otherwise, you could end up owing money or getting penalized.

• Filing Incorrectly: There are a lot of forms and instructions involved in filing your taxes, so it’s easy to make a mistake. Before you file, double check that everything is filled out correctly and that you’re using the right forms for your situation.

• Not Filing at All: Some people think they can just ignore their taxes altogether, but this is definitely not advisable. If you don’t file, you could face penalties and interest charges – not to mention the stress of dealing with the IRS down the road.

By following these tips, you can help ensure that you get the maximum refund possible – and avoid any unpleasant surprises from the IRS.

Different Types of Investments & Where To Find Them

There are many different types of investments, and each has its own benefits and risks. You can invest in stocks, bonds, mutual funds, ETFs, and more. Some investments are better for short-term goals, while others are better for long-term goals.

You can find investments through online brokerages, financial advisors, and more. Each has its own fees and rules, so be sure to do your research before choosing one.

When you're ready to start investing, be sure to diversify your portfolio. This means investing in a variety of assets to reduce your overall risk. Diversification is one of the most important things you can do to protect your finances.

Conclusion

Unlocking your tax refund is a great way to build financial freedom and achieve greater success in life. With little effort, you can easily unlock money back from the IRS and start building towards a better future. Being aware of the different strategies you can use to maximize your refunds will help you gain control over your finances and become more financially secure today! Don't miss out on this opportunity - get started now!