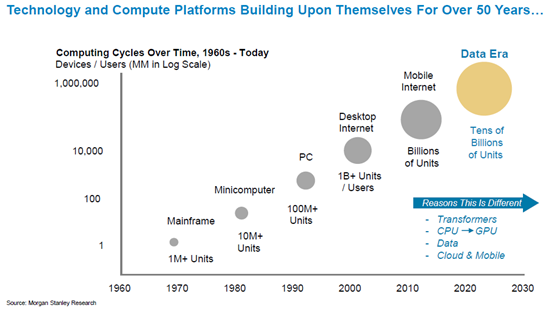

Artificial intelligence (AI) has captured the attention of investors in 2023, fueling a strong rally in large-cap technology stocks. While the full impact may take time to materialize in the small-cap universe, we believe AI has the potential to be one of the most disruptive secular growth trends ever.

After a tough 2022 for growth stocks, the success of ChatGPT and other generative AI models has triggered renewed enthusiasm. Leading technology companies like Apple, Google, Meta, Microsoft, and Nvidia have been aggressively investing in AI, with Microsoft emerging as an early winner through its partnership with OpenAI. But we believe the real value of AI lies in its broad applicability as a foundational technology that will enable new products, services, and business models across industries.SourceMoneyGuru-https://www.mgkx.com/5194.html

AI is still early in its development, so forecasts remain speculative. But AI pioneer DeepMind aims to "solve intelligence and then use that to solve everything else." Bill Gates similarly sees AI as a fundamental breakthrough on par with the microprocessor and internet. Github Copilot can already boost developer productivity by 55%, proving AI's power to transform workflows.SourceMoneyGuru-https://www.mgkx.com/5194.html

SourceMoneyGuru-https://www.mgkx.com/5194.html

SourceMoneyGuru-https://www.mgkx.com/5194.html

The possibilities span from manufacturing and logistics to healthcare and education. Recommendation engines, personalized medicine, optimized operations - AI can analyze data at scale to tailor experiences and inform decisions. As with past computing revolutions, it may take time for startups to emerge as winners. But AI's potential to drive productivity growth makes it a crucial technology trend.SourceMoneyGuru-https://www.mgkx.com/5194.html

As investors, we are focused on several considerations:SourceMoneyGuru-https://www.mgkx.com/5194.html

Avoid companies at risk of disruption by AI, as seen with Chegg's recent growth struggles. Identify potential long-term winners beyond today's giants like Nvidia. Semiconductor equipment companies enabling AI chip production warrant attention. Seek real technology adoption vs. hype - progressive revenue and profit milestones matter most.SourceMoneyGuru-https://www.mgkx.com/5194.html

AI will bring setbacks amid the excitement. But it appears poised to define a new computing era, much like personal computers, the internet, and mobile phones before it. While hype comes and goes, category-defining companies with durable advantages stand to create tremendous value. With patience and diligence, emerging leaders harnessing AI's seismic potential can be found. We will watch developments closely as investors excited by the promise of technology-driven change.SourceMoneyGuru-https://www.mgkx.com/5194.html SourceMoneyGuru-https://www.mgkx.com/5194.html