Financial institutions took billions in short-term loans this week from the Federal Reserve as the industry copes with a serious crisis of confidence and liquidity, the central bank reported Thursday.SourceMoneyGuru-https://www.mgkx.com/3899.html

Utilizing tools the Fed rolled out Sunday, banks looking for cash infusions borrowed $11.9 billion from the Bank Term Funding Program. Under that facility, banks can take one-year loans under favorable terms in exchange for high-quality collateral.SourceMoneyGuru-https://www.mgkx.com/3899.html

Most banks took the more traditional route, using the Fed’s discount window under terms slightly less favorable, with borrowing totaling nearly $153 billion. The discount window provides loans of up to just 90 days, while the BTFP term is for one year. However, the Fed eased conditions at the discount window to make it more attractive for borrowers in need of operating funds.SourceMoneyGuru-https://www.mgkx.com/3899.html

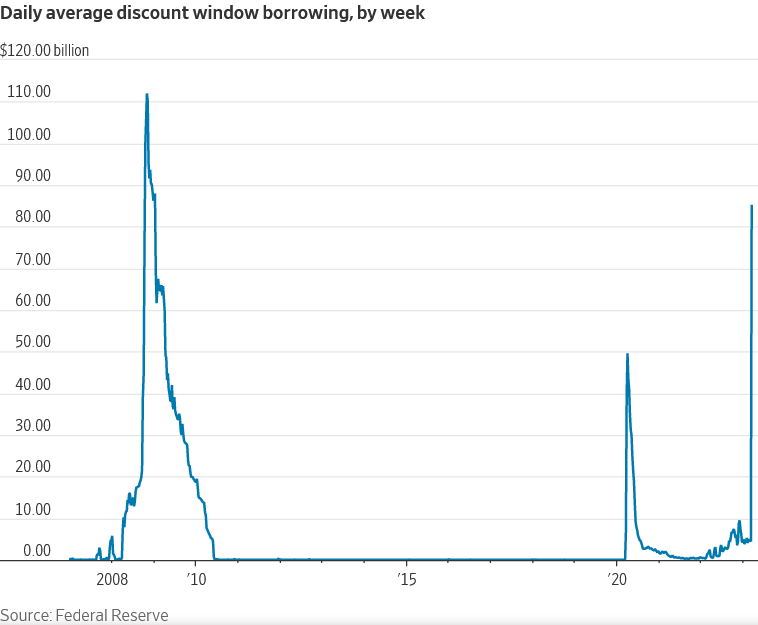

Federal Home Loan Bank Borrowing Spikes After SVB Failed, As of Wednesday, banks had $153 billion in loans at the "discount window," a longstanding tool through which the Fed provides cash to banks in need of liquidity by lending against solid collateral. The previous record for discount window borrowing was $111 billion in 2008.

There also was a large uptick in offered bridge loans, also done over short terms, totaling $142.8 billion, made primarily to now-shuttered institutions so they could meet obligations regarding depositors and other expenses.SourceMoneyGuru-https://www.mgkx.com/3899.html

The data comes just days after regulators shut Silicon Valley Bank and Signature Bank, two institutions favored by the high-tech community.SourceMoneyGuru-https://www.mgkx.com/3899.html

With fears high that customers who exceeded the $250,000 Federal Deposit Insurance Corp. guarantee could lose their money, regulators stepped in to back all deposits.SourceMoneyGuru-https://www.mgkx.com/3899.html

The programs ramped up the totals on the Fed balance sheet, escalating the total by some $297 billion.SourceMoneyGuru-https://www.mgkx.com/3899.html SourceMoneyGuru-https://www.mgkx.com/3899.html